Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them

Question:

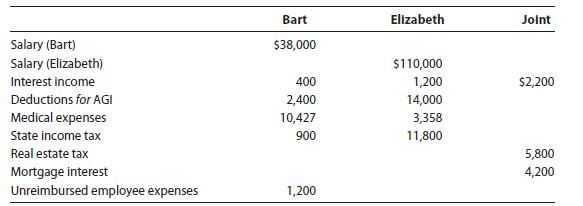

Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them whether they should file jointly or separately in 2022. Bart incurred some significant medical expenses during the year related to an unexpected surgery. They present you with the following information:

If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2022. Bart and Elizabeth reside at 2003 Highland Drive, Durham, NC 27707.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted: