Bart and Elizabeth Forrest are married and have no dependents. They have asked you to advise them

Question:

Bart and Elizabeth Forrest are married and have no dependents.

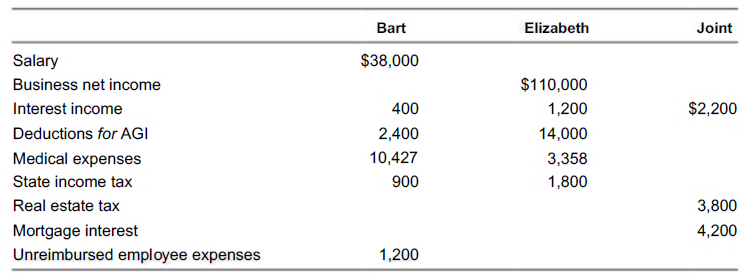

They have asked you to advise them whether they should file jointly or separately in 2018. They present you with the following information: If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2018. Bart and Elizabeth reside at 2003 Highland Drive, Durham, NC 27707.

If they file separately, Bart and Elizabeth will split the real estate tax and mortgage interest deductions equally. Write Bart and Elizabeth a letter in which you make and explain a recommendation on filing status for 2018. Bart and Elizabeth reside at 2003 Highland Drive, Durham, NC 27707.

Transcribed Image Text:

Elizabeth Joint Bart Salary Business net income Interest income Deductions for AGI Medical expenses State income tax Real estate tax Mortgage interest Unreimbursed employee expenses $38,000 $110,000 400 1,200 $2,200 2,400 10,427 14,000 3,358 1,800 900 3,800 4,200 1,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Maloney Raabe Hoffman Young CPAs 5191 Natorp Boulevard Mason O...View the full answer

Answered By

Muhammad Salman Alvi

Well, I am a student of Electrical Engineeing from Information Technology University of Punjab. Just getting into my final year. I have always been good at doing Mathematics, Physics, hardware and technical subjects. Teaching profession requires a alot of responsibilities and challenges.

My teaching experience started as an home tutor a year ago. When I started teaching mathematics and physic subjects to an O Level student. He was about 14 years old. His name was Ibrahim and I used to teach him for about 2 hours daily. Teaching him required a lot of patience but I had to be polite with him. I used to give him a 5 min break after 1 hour session. He was quite weak in basic maths and calculation. He used to do quite a lot of mistakes in his homework which I gave him weekly. So I decided to teach him basics from scratch. He used to say that he got the concept even if he didn't. So I had to ask him again and again. I worked on his basics for a month and after that I started taking a weekly test sesions. After few months he started to improve gradually. Now after teaching him for about a year I can proudly say that he has improved alot. The most important thing was he managed to communicate all the difficullties he was facing. He was quite capable and patient. I had a sincere desire to help him reach to its full potential. So I managed to do that. We had a very good honest relationship of a student and a teacher. I loved teaching him as a tutor. Now having an experience of one year teaching I can read students quite well. I look forward to work as an online tutor who could help students in solving their all sort of difficulties, problems and queries.

4.90+

29+ Reviews

43+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

Evan is single and has AGI of $277,300 in 2018. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: Medical expenses (before the AGI...

-

Dorothy acquired a 100% interest in two passive activities: Activity A in January 2013 and Activity B in 2014. Through 2016, Activity A was profitable, but it produced losses of $200,000 in 2017 and...

-

Simon owns stock that has declined in value since acquired. He has decided either to give the stock to his nephew, Fred, or to sell it and give Fred the proceeds. If Fred receives the stock, he will...

-

In Problems 4352, graph each system of linear inequalities. State whether the graph is bounded or unbounded, and label the corner points. 0 x y 0 x + y = 1 x + y 7 2x + y 10

-

Let n Z+, n odd. Can a palindrome of n have an even number of summands?

-

Factor the given expressions completely. 3 2x 5x 2

-

Define communication.

-

A common arrangement for heating a large surface area is to move warm air through rectangular ducts below the surface. The ducts are square and located midway between the top and bottom surfaces that...

-

Conlon Chemicals manufactures paint thinner. Information on the work in process follows: Beginning inventory, 36,000 partially complete gallons. Transferred out, 206,000 gallons. Ending inventory...

-

Netflix is arguably the most popular and successful streaming company. However, in the last years, the company has started to crumble under pressure due to not only fierce competition but also its...

-

On December 27, 2018, Roberta purchased four tickets to a charity ball sponsored by the city of San Diego for the benefit of underprivileged children. Each ticket cost $200 and had a fair market...

-

Linda, who files as a single taxpayer, had AGI of $280,000 for 2018. She incurred the following expenses and losses during the year: Medical expenses (before the 75%-of-AGI limitation)...

-

How is the amount of accrual entry for the portion of a weekly payroll that is accrued at the end of an accounting period determined?

-

Small town Diners has a policy of treating dividends as a passive residual. It forecasts that net earnings after taxes in the coming year will be $500,000. The firm has earned the same $500,000 for...

-

Part 1-Chi-Square Goodness-of-Fit Tests A health psychologist was interested in women's workout preferences. Of the 56 participants surveyed, 22 preferred running, 8 preferred swimming, 15 preferred...

-

The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,070,000, and it would cost another $21,000 to install it. The machine falls...

-

Problem 1. (10 points) Consider the space X = R22 and the map L XX defined as traceX -traceX L:X X = X 0 0 1. Show that L is a linear map; 2. Find the matrix representation M = mat L in the canonical...

-

Suppose that the exchange rate is 1.25 = 1.00. Options (calls and puts) are available on the Philadelphia exchangein units of10,000 with strike prices of $1.60/1.00. Options (calls and puts) are...

-

In Exercises complete parts (a), (b), and (c) for the piecewise defined function. (a) Draw the graph of . (b) Determine lim xc+ (x) and lim xc - (x). (c) Does lim xc (x ) exist? If so, what is it? If...

-

Use the information given about the angles and to find the exact value of: (a) sin( + ) (b) cos( + ) (c) sin( - ) (d) tan ( + ) (e) sin(2) (f) cos (2) (g) sin /2 (h) cos/2 cos = 4/5, 0 < < /2; cos =...

-

During the current year, Swallow Corporation, a calendar year C corporation, has the following transactions: Income from operations $660,000 Expenses from operations 720,000 Dividends received from...

-

During the current year, Swallow Corporation, a calendar year C corporation, has the following transactions: Income from operations $660,000 Expenses from operations 720,000 Dividends received from...

-

During the current year, Swallow Corporation, a calendar year C corporation, has the following transactions: Income from operations $660,000 Expenses from operations 720,000 Dividends received from...

-

As a Financial Analyst in the Finance Department of Zeta Auto Corporation they are seeking to expand production. The CFO asks you to help decide whether the firm should set up a new plant to...

-

Chapter 4 When an Auditor finds misstatements in entities financial statements which may be the result of fraudulent act, what should be the role of an auditor under that situation? (2 Points)

-

Suppose the following input prices are provided for each year: Required: $

Study smarter with the SolutionInn App