Calculate the taxpayers 2022 qualified business income deduction for a qualified trade or business: a. $5,000 b.

Question:

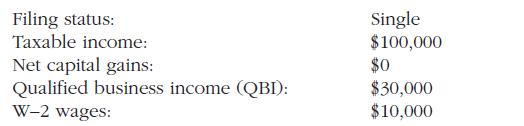

Calculate the taxpayer’s 2022 qualified business income deduction for a qualified trade or business:

a. $5,000

b. $70,000

c. $20,000

d. $6,000

Transcribed Image Text:

Filing status: Taxable income: Net capital gains: Qualified business income (QBI): W-2 wages: Single $100,000 $0. $30,000 $10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

Choice d is correct 30000 QBI 20 6000 W2 wage and p...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Calculate the taxpayers 2022 qualified business income deduction for a qualified trade or business: a. $16,000 b. $10,000 c. $2,700 d. $14,188 Filing status: Taxable income: Net capital gains:...

-

In the novel, we can see a big difference between the powers of black and white people. The white people in the novel have the power of money, status, control, and influence. They also manipulate...

-

At what points are the function. y = x tan x 2 x + 1

-

Assume that RMO will use a relational database, as shown in Figure (a). Assume further that a new catalog group located in Milan, Italy, will now create and maintain the catalog. To minimize...

-

Assume that we are auditing a company for the first time. Our audit procedures for petty cash require a surprise audit of the petty cash fund. We approach the petty cash custodian to conduct the...

-

From the following information extracted from the books of Modern Hotel, you are required to prepare the Income Statement for the year ended 31st December 2005 in accordance with the Uniform System...

-

Walnut Park Senior Center has a weekly payroll of $7,500. December 31 falls on Wednesday, and Walnut Park Senior Center will pay its employees the following Monday (January 5) for the previous full...

-

M5-1 Matching Circumstances to the Fraud Triangle [LO 5-1) Match each of the following Circumstances to the corresponding element of the fraud triangle by selecting the appropriate Fraud Triangle...

-

Phoenix Management helps rental property owners find renters and charges the owners one-half of the first months rent for this service. For August 2010, Phoenix expects to find renters for 100...

-

Jane and Ben are married and usually file a joint return. They live in a separate property state (rather than a community property state). Jane is a partner in a law firm and typically generates...

-

Why did Congress decide to provide a deduction for qualified business income?

-

Develop the appropriate primary research question to be associated with this design. Develop a hypothetical research scenario that would necessitate the use of a 3-Factor Crossover Design. The...

-

Aircraft \(B\) has a constant speed of \(150 \mathrm{~m} / \mathrm{s}\) as it passes the bottom of a circular loop of 400-m radius. Aircraft \(A\) flying horizontally in the plane of the loop passes...

-

A small inspection car with a mass of \(200 \mathrm{~kg}\) runs along the fixed overhead cable and is controlled by the attached cable at \(A\). Determine the acceleration of the car when the control...

-

An aircraft \(P\) takes off at \(A\) with a velocity \(v_{0}\) of \(250 \mathrm{~km} / \mathrm{h}\) and climbs in the vertical \(y^{\prime}-z^{\prime}\) plane at the constant \(15^{\circ}\) angle...

-

If each resistor in Figure P31.75 has resistance \(R=5.0 \Omega\), what is the equivalent resistance of the combination? Data from Figure P31.75 wwwwww wwwww www www wwwww

-

Identify the proper point to recognize expense for each of the following transactions. a. Kat Inc. purchases on credit six custom sofas for \(\$ 800\) each in June. Two of the sofas are sold for \(\$...

-

Sally's Sweet Shop's August 31 bank balance was $11,135. The company's cash balance at August 31 was $10,805. Other information follows: 1. Outstanding cheques were #421 for $165, #485 for $265, #492...

-

In Problems, solve each system of equations. x + 2y + 3z = 5 y + 11z = 21 5y + 9z = 13

-

Quinn Corporation is subject to tax in States G, H, and I. Quinns compensation expense includes the following. Officers' salaries are included in the payroll factor for G and I, but not for H....

-

Quinn Corporation is subject to tax in States G, H, and I. Quinns compensation expense includes the following. Officers' salaries are included in the payroll factor for G and I, but not for H....

-

Josie is a sales representative for Talk2Me, a communications retailer based in Fort Smith, Arkansas. Josie's sales territory is Oklahoma, and she regularly takes day trips to Tulsa to meet with...

-

Sociology

-

I am unsure how to answer question e as there are two variable changes. In each of the following, you are given two options with selected parameters. In each case, assume the risk-free rate is 6% and...

-

On January 1, Interworks paid a contractor to construct a new cell tower at a cost of $850,000. The tower had an estimated useful life of ten years and a salvage value of $100,000. Interworks...

Study smarter with the SolutionInn App