Christopher died in 2015 and is survived by his wife, Chloe, and their 18-year-old son, Dylan. Chloe

Question:

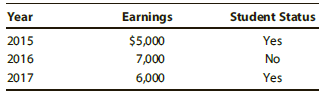

Christopher died in 2015 and is survived by his wife, Chloe, and their 18-year-old son, Dylan. Chloe is the executor of Christopher’s estate and maintains the household in which she and Dylan live. All of their support is furnished by Chloe while Dylan saves his earnings. Dylan’s status for 2015 to 2017 is as follows:

What is Chloe’s filing status for:

a. 2015?

b. 2016?

c. 2017?

Transcribed Image Text:

Earnings Student Status Year 2015 2016 Yes $5,000 7,000 No Yes 2017 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 78% (14 reviews)

a For 2015 Chloe should file a joint return Because she is the executor ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Christopher died in 2012 and is survived by his wife, Chloe, and their 18-yearold son, Dylan. Chloe is the executor of Christopher's estate and maintains the household in which she and Dylan live....

-

Nadia died in 2015 and is survived by her husband, Jerold (age 44); her married son, Travis (age 22); and her daughter-in-law, Macy (age 18). Jerold is the executor of his wife's estate. He maintains...

-

Roy dies and is survived by his wife, Marge. Under Roy's will, all of his otherwise uncommitted assets pass to Marge. Based on the property interests listed below, determine the marital deduction...

-

In 2013, Natural Selection, a nationwide computer dating service, had $500 million of assets and $200 million of liabilities. Earnings be-fore interest and taxes was $120 million, interest expense...

-

Let U = {1, 2, 3, 4, 5, 6}. Determine the truth value of p(x) = [(x is even) or (x is divisible by 3)] for the given values of x. (a) x = 1 (b) x = 4 (c) x = 3 (d) x = 6 (e) x = 5

-

Calculate the nuclear binding energy per nucleon for cobalt-59, the only stable isotope of cobalt. The mass of cobalt-59 is 58.933198 amu. a) 517.3 MeV b) 8.768 MeV c) 19.16 MeV d) 1.011 * 10 -5 MeV

-

What are the implications for company strategy and performance of business process outsourcing? LO.1

-

Parker is a 100% shareholder of Johnson Corp. (an S corporation). At the beginning of 2010, Parkers basis in his Johnson Corp. stock was $14,000. During 2010, Parker loaned $20,000 to Johnson Corp....

-

$46.98 per share is the current price for Foster Farms' stock. The dividend is projected to increase at a constant rate of 5.19% per year. The required rate of return on the stock, rs, is 9.00%. What...

-

Stickley Furniture is a manufacturer of fine hand-crafted furniture. During the next production period, management is considering producing dining room tables, dining room chairs, and/or bookcases....

-

In each of the following independent situations, determine Winstons filing status for 2017. Winston is not married. a. Winston lives alone, but he maintains a household in which his parents live. The...

-

Nadia died in 2016 and is survived by her husband, Jerold (age 44); her married son, Travis (age 22); and her daughter-in-law, Macy (age 18). Jerold is the executor of his wifes estate. He maintains...

-

How does the existence of asymmetric information lead to market inefficiencies?

-

Give an example of a program that will cause a branch penalty in the three-segment pipeline of Sec. 9-5. Example: Three-Segment Instruction Pipeline A typical set of instructions for a RISC processor...

-

Are Google, Microsoft, and Apple acting ethically? Are they being socially responsible? Eager to benefit from the economic growth and the job creation that foreign direct investments generate, many...

-

On May 1, 2011, Lenny's Sandwich Shop loaned \$20,000 to Joe Lopez for one year at 6 percent interest. Required Answer the following questions: a. What is Lenny's interest income for 2011? b. What is...

-

Tipton Corporations balance sheet indicates that the company has \($300,000\) invested in operating as sets. During 2006, Tipton earned operating income of \($45,000\) on \($600,000\) of sales....

-

Norton Car Wash Co. is considering the purchase of a new facility. It would allow Norton to increase its net income by \($90,000\) per year. Other information about this proposed project follows:...

-

Find the absolute maximum and minimum values of the following functions over the given regions R. Use Lagrange multipliers to check for extreme points on the boundary. f(x, y) = - (x 1) + (y + 1); R...

-

An environmentalist wants to determine if the median amount of potassium (mg/L) in rainwater in Lincoln County, Nebraska, is different from that in the rainwater in Clarendon County, South Carolina....

-

Yancy's personal residence is condemned as part of an urban renewal project. His adjusted basis for the residence is $480,000. He receives condemnation proceeds of $460,000 and invests the proceeds...

-

Nicky receives a car from Sam as a gift. Sam paid $48,000 for the car. He had used it for business purposes and had deducted $10,000 for depreciation up to the time he gave the car to Nicky. The fair...

-

An individual taxpayer sells some used assets at a garage sale. Why are none of the proceeds taxable in most situations?

-

Your company produces a health magazine. Its sales data for 1 - year subscriptions are as follows: Year of Operation Subscriptions Sold % Expired at Year End 2 0 2 0 $ 3 0 0 , 0 0 0 5 2 0 2 1 $ 6 4 7...

-

Problem 3 - 2 0 ( Static ) Calculate profitability and liquidity measures LO 3 - 3 , 3 - 4 , 3 - 6 Presented here are the comparative balance sheets of Hames Incorporated at December 3 1 , 2 0 2 3...

-

3 Required information [The following information applies to the questions displayed below) John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter. Samantha. In 2020,...

Study smarter with the SolutionInn App