Coline has the following capital gain and loss transactions for 2022. After the capital gain and loss

Question:

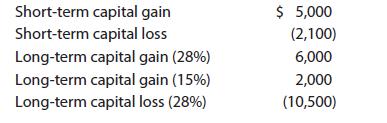

Coline has the following capital gain and loss transactions for 2022.

After the capital gain and loss netting process, what is the amount and character of Coline’s gain or loss?

Transcribed Image Text:

Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (15%) Long-term capital loss (28%) $ 5,000 (2,100) 6,000 2,000 (10,500)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

Coline first nets the shortterm gains and losses against ea...View the full answer

Answered By

Larlyu mosoti

I am a professional writer willing to do several tasks free from plagiarism, grammatical errors and submit them in time. I love to do academic writing and client satisfaction is my priority. I am skilled in writing formats APA, MLA, Chicago, and Harvard I am a statistics scientist and I can help out in analyzing your data. I am okay with SPSS, EVIEWS, MS excel, and STATA data analyzing tools.

Statistical techniques: I can do linear regression, time series analysis, logistic regression, and some basic statistical calculations like probability distributions. . I'm ready for your working projects!

Services I would offer:

• Academic writing.

• Article writing.

• Data entry.

• PDF conversion.

• Word conversion

• Proofreading.

• Rewriting.

• Data analyzing.

The best reason to hire me:

- Professional and Unique work in writing.

- 100% satisfaction Guaranteed

- within required time Express delivery

- My work is plagiarism Free

- Great communication

My passion is to write vibrantly with dedication. I am loyal and confident to give my support to every client. Because Client satisfaction is much more important to me than the payment amount. A healthy client-contractor relationship benefits in the longer term. Simply inbox me if you want clean work.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Coline has the following capital gain and loss transactions for 2015. Short-term capital gain ......................................... $ 5,000 Short-term capital loss...

-

Coline has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Colines gain or loss? Short-term capital...

-

Coline has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 5,000 Short-term capital loss ......................................

-

A cardboard tube is wrapped with two windings of a insulated wire wound in opposite directions, as shown in Fig. 29.34. Terminals a and b of winding A may be connected to a battery through a...

-

Peugeot S.A. reports the following financial information for the year ended December 31, 2008 (euros in millions). Prepare its statement of cash flows under the indirectmethod. E 500 Cash from sales...

-

Excerpts from Crozier Industries financial records as of December 31, 1997, follow: Sales Sales Returns Costs of Goods Sold Dividends Rent Expense Wages Payable Loss on Sale of Food Services Division...

-

What are the four Is of services?

-

The Bakery by the Bay produces organic bread that is sold by the loaf. Each loaf requires 1/ 2 of a pound of flour. The bakery pays $ 2.00 per pound of the organic flour used in its loaves. The...

-

Oriole Toothpaste Company initiates a defined benefit pension plan for its 50 employees on January 1, 2017. The insurance company which administers the pension plan provided the following selected...

-

A researcher believes there is risk between the strain of human papillomavirus (HPV) infection and the risk of cervical cell abnormalities. What percentage has an abnormal cervical biopsy?

-

Shelly has $200,000 of QBI from her local jewelry store (a sole proprietorship). Shellys proprietorship paid $30,000 in W2 wages and has $20,000 of qualified property. Shellys spouse earned $75,900...

-

Alton Newman, age 67, is married and files a joint return with his wife, Clair, age 65. Alton and Clair are both retired, and during 2021, they received Social Security benefits of $10,000. Both...

-

Bill Gross is both a serial entrepreneur and the founder of Idealab, an incubator-type organization that has launched over 75 companies. Hes also an Internet pioneer and the creator of the...

-

Which alternative strategy do each of the following fall under? 1. Nike could set more aggressive sustainability targets and timelines for each product category, allocating additional resources to...

-

Find the critical value Za/2 that corresponds to the given confidence level. 88%

-

A study was conducted to determine the proportion of people who dream in black and white instead of color. Among 296 people over the age of 55, 73 dream in black and white, and among 294 people under...

-

The other strategy could be to develop a completely distinct product line. This would allow Nike to develop sustainable products without affecting their main products. It could target specific green...

-

A drug is used to help prevent blood clots in certain patients. In clinical trials, among 4705 patients treated with the drug, 170 developed the adverse reaction of nausea. Construct a 95% confidence...

-

Compare and contrast the jury of executive opinion and the Delphi techniques.

-

What types of inventory issues Starbucks might reflect upon at the end of each year? The mission of Starbucks is to inspire and nurture the human spiritone person, one cup, and one neighborhood at a...

-

Red, White, and Blue are unrelated corporations engaged in real estate development. The three corporations formed a joint venture (treated as a partnership) to develop a tract of land. Assuming that...

-

Red, White, and Blue are unrelated corporations engaged in real estate development. The three corporations formed a joint venture (treated as a partnership) to develop a tract of land. Assuming that...

-

Zorn conducted his professional practice through Zorn, Inc. The corporation uses a fiscal year ending September 30 even though the business purpose test for a fiscal year cannot be satisfied. For the...

-

3. The nominal interest rate compounded monthly when your $7,000 becomes $11,700 in eight years is ________

-

An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39%. Stock B has an expected return of 14% and a...

-

Advanced Small Business Certifica Drag and Drop the highlighted items into the correct boxes depending on whether they increase or decrease Alex's stock basis. Note your answers- you'll need them for...

Study smarter with the SolutionInn App