Compute Aidens 2014 taxable income on the basis of the following information. Aiden is married but has

Question:

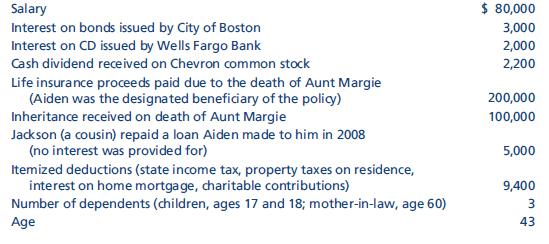

Compute Aiden’s 2014 taxable income on the basis of the following information. Aiden is married but has not seen or heard from his wife for over three years.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (3 reviews)

To calculate Aidens taxable income we need to determine his total income and then subtract ...View the full answer

Answered By

Nikka Ella Clavecillas Udaundo

I have a degree in psychology from Moi University, and I have experience working as a tutor for students in both psychology and other subjects. I am passionate about helping students learn and reach their potential, and I firmly believe that everyone has the ability to succeed if they receive the right support and guidance. I am patient and adaptable, and I will work with each individual student to tailor my teaching methods to their needs and learning style. I am confident in my ability to help students improve their grades and reach their academic goals, and I am excited to work with a new group of students.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2015

ISBN: 9781305310810

38th Edition

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

Question Posted:

Students also viewed these Business questions

-

Compute Aiden's 2016 taxable income on the basis of the following information. Aiden is married but has not seen or heard from his wife for over three years. Salary...

-

Compute Aiden's 2015 taxable income on the basis of the following information. Aiden is married but has not seen or heard from his wife for over three years. Salary...

-

Compute Aidens 2019 taxable income on the basis of the following information. Aiden is married but has not seen or heard from his wife for over three years....

-

Recall the heat equation which we solved numerically T= = DTxx There we implemented an explicit numerical scheme (FTCS) which led to a conditionally stable solution - meaning that for certain time...

-

In 1968, the Supreme Court ruled that citizens can sue to stop the government from spending that violates the Constitution. In a recent 5 4 decision, the Court ruled that a tax credit that can be...

-

Suppose that the members of your class enter into an agreement under whose terms all would chip in to pay for the damage to any automobile owned by a class member that was damaged in a collision....

-

The following excerpt is from Coca-Cola Companys 2017 annual report filed with the SEC. Management evaluates the performance of our operating segments separately to individually monitor the different...

-

Identify the factors that are relevant in determining the annual depreciation charge, and explain whether these factors are determined objectively or whether they are based on judgment.

-

4/ You are proposing a new project that involves buying a new grinding machine. You are confident in your estimates of costs and returns but are concerned that the salvage value of the machine at the...

-

Gibson Agency Case: 1. Calculate and present the budgeted profit for each of Gibson's clients for each of the years 2016 through 2019, using the current costing system (i.e., the one described in the...

-

Compute Emilys 2014 taxable income on the basis of the following information. Her filing status is single.

-

Determine the amount of the 2014 standard deduction allowed in the following independent situations. In each case, assume that the taxpayer is claimed as another persons dependent. a. Curtis, age 18,...

-

(a) Using only the valence atomic orbitals of a hydrogen atom and a fluorine atom, and following the model of Figure 9.46, how many MOs would you expect for the HF molecule? (b) How many of the MOs...

-

Based on the reading,How to make sure your next product or service launch drives growth (click the underlined link),what stands out to you as the most important factor in a differentiated launch...

-

OM in the News has previously looked at the Waffle House Index, used to measure the damage from hurricanes. The index made the news again for Hurricane Ian. According to the Boston Globe, 40 Waffle...

-

Mixture of persuasive and negative formal I am Elizabeth grinderFirst part email Next part setting up the meeting Final part memo The reader is Robert * do not come off accusatory*** Project TWO:...

-

Anyone who has sampled today's social media offerings has probably experienced this situation: You find a few fascinating blogs, a few interesting people to follow on Twitter, a couple of podcast...

-

a. Begin with a converging lens of focal length f. Place an illuminated object a distance p, in front of the lens. For all positive values of p;: 1. calculate and sketch a graph of the location of...

-

What is the p-value from the test performed in Problem 12.1? Nutrition Researchers compared protein intake among three groups of postmenopausal women: (1) women eating a standard American diet (STD),...

-

Portal Manufacturing has total fixed costs of $520,000. A unit of product sells for $15 and variable costs per unit are $11. a). Prepare a contribution margin income statement showing predicted net...

-

Government G levies an income tax with the following rate structure. Percentage RateBracket 6% .Income from 0 to $30,000 10 .Income from $30,001 to $70,000 20 .Income from $70,001 to $200,000 28...

-

Refer to Government Gs rate structure described in the preceding problem. Taxpayer O earns $50,000 annually during years 1 through 10. Taxpayer P earns $20,000 annually during years 1 through 5 and...

-

Jurisdiction Z levies an excise tax on retail purchases of jewelry and watches. The tax equals 3 percent of the first $1,000 of the purchase price plus 1 percent of the purchase price in excess of...

-

THIS IS ONE QUESTION WITH TWO PARTS. PLEASE ANSWER COMPLETELY AND SHOW ALL WORK. (NO EXCEL) Information for Question 1: State Probability Retum on A Return on B Return on C Retum on Portfolio X Boom...

-

Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (2.0 hrs. @ $13.00 per hr.) Overhead (2.0 hrs. @ $18.50 per hr.) Total standard cost $25.00 26.00 37.00 $88.00 The predetermined overhead rate...

-

Problem 1-28 (Algo) (LO 1-4, 1-5, 1-6b 1-7) Harper, Inc., acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2020, for $316,100 in cash. The book value of Kinman's...

Study smarter with the SolutionInn App