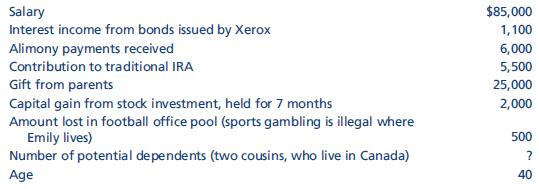

Compute Emilys 2014 taxable income on the basis of the following information. Her filing status is single.

Question:

Compute Emily’s 2014 taxable income on the basis of the following information. Her filing status is single.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

The tax year is 2022 her filing status Single As per IRS gifts from parents are not taxable to the r...View the full answer

Answered By

Nikka Ella Clavecillas Udaundo

I have a degree in psychology from Moi University, and I have experience working as a tutor for students in both psychology and other subjects. I am passionate about helping students learn and reach their potential, and I firmly believe that everyone has the ability to succeed if they receive the right support and guidance. I am patient and adaptable, and I will work with each individual student to tailor my teaching methods to their needs and learning style. I am confident in my ability to help students improve their grades and reach their academic goals, and I am excited to work with a new group of students.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2015

ISBN: 9781305310810

38th Edition

Authors: William H. Hoffman, William A. Raabe, David M. Maloney, James C. Young

Question Posted:

Students also viewed these Business questions

-

Compute the taxable income for 2014 for Emily on the basis of the following information. Her filing status is single. Salary ............................... $85,000 Interest income from bonds issued...

-

Compute the taxable income for 2017 for Emily on the basis of the following information. Her filing status is single. Salary...

-

Compute Emilys 2015 taxable income on the basis of the following information. Her filing status is single. Salary ............................. $85,000 Interest income from bonds issued by Xerox...

-

Andrew owns a commercial office building that is insured under three property insurance contracts. He has $100,000 of insurance from Company A, $200,000 from Company B, and $200,000 from Company C....

-

California law requires registered domestic partners to treat their earnings as common property for state tax purposes. Because federal tax law generally respects state property law, the Internal...

-

A friend tells you about a plan for the formation of an insurance company that will issue insurance policies to protect a person who buys stock against a decline in the value of that stock. Explain...

-

Derive eq. (20.4) from eq. (20.3) and the approximations quoted in the text.

-

Shorts Company has three process departments: Mixing, Encapsulating, and Bottling. At the beginning of the year, there were no work-in-process or finished goods inventories. The following data are...

-

What type of leases are the most common for Retail Buildings NNN FSG FSG with expense stop NNN with expense stop QUESTION 20 What are the characteristics of a Full Service Gross with expense stop...

-

Quote and cite this text from Deering Woods Condominium Association v. Margaret F. Spoon, an opinion located at 377 Md. 250. Further, even if we were to decide that the waiver of claim bylaw...

-

Paul and Sonja, who are married, reported 2014 itemized deductions of $8,200 and $400, respectively. Paul suggests that they file their Federal income tax returns separatelyhe will itemize his...

-

Compute Aidens 2014 taxable income on the basis of the following information. Aiden is married but has not seen or heard from his wife for over three years.

-

What do you see in your everyday life that results from the process of globalization?

-

The Role of Leadership in Shaping Organizational Culture Recent research stated that [c]ompanies with an established organizational culture that includes strong capabilities for change, commitment to...

-

Unscheduled absences by clerical and production workers are an important cost in many companies. Reducing the rate of absenteeism is, therefore, an important goal for a company's human relations...

-

Many of the largest tech firms, including Google, Apple, Amazon, and Microsoft, have spent hundreds of millions of dollars to improve their information technology infrastructure. Now, these companies...

-

In the business sense, a product refers to a commodity available for purchase, encompassing both services and tangible or intangible items. It may exist in physical, virtual, or cyber forms. Every...

-

Data Exploration and Multiple Linear Regression (MLR) using SAS. The "College" data set contains the statistics for many US Colleges from 1995 issue of US News and World Report. It has 777...

-

Compare the means of each specific pair of groups using the LSD methodology? Nutrition Researchers compared protein intake among three groups of postmenopausal women: (1) women eating a standard...

-

What are some of the features of the Unified Process (UP)?

-

Mr. and Mrs. J own a dry cleaning business that generates $125,000 taxable income each year. For the past few years, the couples federal tax rate on this income has been 32 percent. Congress recently...

-

Jurisdiction B levies a flat 7 percent tax on the first $5 million of annual corporate income. a. Jersey Inc. generated $3.9 million income this year. Compute Jerseys income tax and determine its...

-

Jurisdiction X levies a flat 14 percent tax on individual income in excess of $35,000 per year. Individuals who earn $35,000 or less pay no income tax. a. Mr. Hill earned $98,750 income this year....

-

Just work out the assignment on your own sheet, you dont need the excel worksheet. Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great...

-

Financial information related to the proprietorship of Ebony Interiors for February and March 2019 is as follows: February 29, 2019 March 31, 2019 Accounts payable $310,000 $400,000 Accounts...

-

(b) The directors of Maureen Company are considering two mutually exclusive investment projects. Both projects concern the purchase of a new plant. The following data are available for each project...

Study smarter with the SolutionInn App