Compute the taxable income for 2015 for Aiden on the basis of the following information. Aiden is

Question:

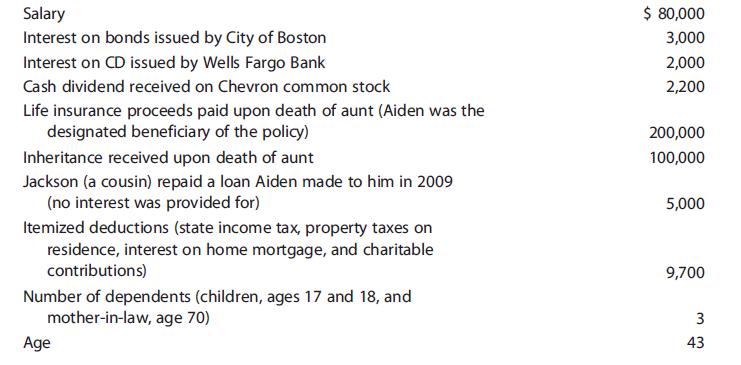

Compute the taxable income for 2015 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2013.

Transcribed Image Text:

Salary Interest on bonds issued by City of Boston Interest on CD issued by Wells Fargo Bank Cash dividend received on Chevron common stock Life insurance proceeds paid upon death of aunt (Aiden was the designated beneficiary of the policy) Inheritance received upon death of aunt Jackson (a cousin) repaid a loan Aiden made to him in 2009 (no interest was provided for) Itemized deductions (state income tax, property taxes on residence, interest on home mortgage, and charitable contributions) Number of dependents (children, ages 17 and 18, and mother-in-law, age 70) Age $ 80,000 3,000 2,000 2,200 200,000 100,000 5,000 9,700 3 43

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Calculate Gross Income a Salary 80000 b Interest on bonds issued by City of Boston 3000 c Interest o...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Compute the taxable income for 2013 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2010....

-

Compute the taxable income for 2014 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2012. Salary ............................. $...

-

Compute the taxable income for 2017 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2015. Salary...

-

On January 1, 2014, Ultra Green Packaging purchased a used machine for $156,000. The next day, it was repaired at a cost of $4,068 and mounted on a new platform that cost $5,760. Management estimated...

-

Listed below are eight technical accounting terms introduced in this chapter. Retail method FIFO method Lower- of- cost- or- market Gross profit method LIFO method Specific identification Flow...

-

Latasha Hinkson recently graduated with a bachelor's degree in hospitality management and has been hired as the front-desk manager in a medium-size hotel in New York City.The hotel's clientele is...

-

The airport van. Your company operates a van service from the airport to downtown hotels. Each van carries 7 passengers. Many passengers who reserve seats dont show upin fact, the probability is 0.25...

-

Ken, a salaried employee, was terminated from his company in April of this year. Business had been slow since the beginning of the year, and each of the operating plants had laid off workers. Ken's...

-

Loss Company had losses of $100,000 to carry forward. In the loss year it had the following shareholders with the following shareholding: A 25% B 25% C 25% D 25% In the gain year, it had assessable...

-

PHB Company currently sells for $ 32.50 per share. In an attempt to determine whether PHB is fairly priced, an analyst has assembled the following information: The before - tax required rates of...

-

Determine the amount of the standard deduction allowed for 2015 in the following independent situations. In each case, assume that the taxpayer is claimed as another persons dependent. a. Curtis, age...

-

Compute the taxable income for 2015 for Emily on the basis of the following information. Her filing status is single. Salary Interest income from bonds issued by Xerox Alimony payments received...

-

At December 31, 2012, Cascade Company had a net deferred tax liability of $450,000. An explanation of the items that compose this balance is as follows. In analyzing the temporary differences, you...

-

9. For diatomic molecules, the correct statement(s) about the molecular orbitals formed by the overlap of two 2pz orbitals is (are) (A) orbital has a total of two nodal planes. (B) * orbital has one...

-

12. The treatment of galena with HNO3 produces a gas that is (A) paramagnetic (C) an acidic oxide (B) bent in geometry (D) colorless

-

Determine the position of the centre of gravity (c.g.) and 2nd moment of inertia with respect to c.g. of the section shown below, where A = mm and B = 5 mm. a) x B A y B Calculate the x = mm with...

-

7. Consider the design of a burglar alarm for a house. When activated an alarm and lights will be activated to encourage the unwanted guest to leave. This alarm be activated if an unauthorized...

-

A uniform flat plate of metal is situated in the reference frame shown in the figure below.

-

A 260-lb force is applied at A to the rolled-steel section shown. Replace that force with an equivalent force-couple system at the center C of the section. 260 lb 2.5 in 4 in in. 2 in

-

On July 1, 2011, Flashlight Corporation sold equipment it had recently purchased to an unaffiliated company for $480,000. The equipment had a book value on Flashlights books of $390,000 and a...

-

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the stock of Emu Corporation (an S corporation). In the current year, each corporation has operating income of...

-

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the stock of Emu Corporation (an S corporation). In the current year, each corporation has operating income of...

-

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the stock of Emu Corporation (an S corporation). In the current year, each corporation has operating income of...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

Wileys CPA Excel Exam Review Study Guide Regulation 2022 2022 Edition - ISBN: 1119848288 - Free Book

Study smarter with the SolutionInn App