Compute the taxable income for 2022 for Aiden on the basis of the following information. Aiden is

Question:

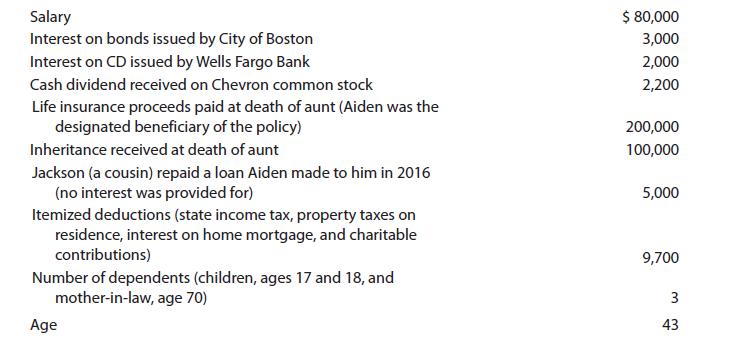

Compute the taxable income for 2022 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2020.

Transcribed Image Text:

Salary Interest on bonds issued by City of Boston Interest on CD issued by Wells Fargo Bank Cash dividend received on Chevron common stock Life insurance proceeds paid at death of aunt (Aiden was the designated beneficiary of the policy) Inheritance received at death of aunt Jackson (a cousin) repaid a loan Aiden made to him in 2016 (no interest was provided for) Itemized deductions (state income tax, property taxes on residence, interest on home mortgage, and charitable contributions) Number of dependents (children, ages 17 and 18, and mother-in-law, age 70) Age $ 80,000 3,000 2,000 2,200 200,000 100,000 5,000 9,700 3 43

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

The interest 3000 on the City of Boston bonds is an exclusion ie not taxable Also excluded from ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Compute the taxable income for 2014 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2012. Salary ............................. $...

-

Compute the taxable income for 2013 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2010....

-

Compute the taxable income for 2017 for Aiden on the basis of the following information. Aiden is married but has not seen or heard from his wife since 2015. Salary...

-

In your own words, define or explain the terms or symbols (a) (b) [ ]; (c) Spectator ion; (d) Weak acid.

-

Argosy Company began the current period with a $14,000 credit balance in the D. Argosy, Capital account. At the end of the period, the companys adjusted account balances include the following...

-

To present systems lessons on using performance measurement

-

A security code consists of three letters followed by one digit. The first letter cannot be an A, B, or C. What is the probability of guessing the security code in one trial?

-

Lanci was involved in an automobile accident with an uninsured motorist. Lanci and Metropolitan Insurance Company entered settlement negotiations and ultimately agreed to settle all claims for...

-

Santana Mortgage Company uses a process cost system to accumulate costs in its Application Department. When an application is completed, it is forwarded to the Loan Department for final processing....

-

Complete Form 941 for the 4th quarter for TCLH Industries (which is located at 202 Whitmore Avenue, Durham, NC 27701; Employer Identification #44-4444444). Assume that all necessary deposits were...

-

Compute the taxable income for 2022 in each of the following independent situations: a. Aaron and Michele, ages 40 and 41, respectively, are married and file a joint return. In addition to four...

-

Compute the 2022 tax liability and the marginal and average tax rates for the following taxpayers (use the 2022 Tax Rate Schedules in Appendix A for this purpose): a. Chandler, who files as a single...

-

The controller of Elton Furniture Store is currently trying to decide what depreciation method to use for a particular fixed asset. The controller has prepared the following list of possible...

-

(a)The local police station found that the speed of vehicles travelling around the suburb in the 60 km/hour zone varies uniformly between 55 km/hour and 62 km/hour. What is the probability that the...

-

Consider the following fixed-point iteration: xn+1 = g(xn), where [f(x)] 2 g(x) = x (x + f(x)) f(x)* (a) What is the order of convergence for the method? (e.g. what is p?). Hint: Show that the method...

-

Problem 1. In a study of infant birth weight and maternal factors, the newborn babies were categorized as being either small size for gestational age (N=201) or normal size (N=2089). The following...

-

Max 1 page allowed] Consider a DRAM chip of capacity 256 KB and each memory location contains 8 bits. The memory chip is organized in matrix form with equal number of rows and column for each memory...

-

find the dimensions of a notman window of perimeter 3 9 ft that will admit the greatest possible amount of light. Round answer to two decimal places

-

You are the administrative assistant for a division chief in a large holding company that owns several hotels and theme parks. You and the division chief have just come from the CEO's ofce, where you...

-

Kims Konstructions has assembled the following data for a proposed straw-reinforced brick maker (SRBM): SRBM Cost: $26,000 Life: 5 years Revenue (p.a.) $11,000 Operating Expenses (p.a.) $3,000...

-

Ray and Carin are partners in an accounting firm. The partners have entered into an arm's length agreement requiring Ray to purchase Carin's partnership interest from Carin's estate if she dies...

-

Ray and Carin are partners in an accounting firm. The partners have entered into an arm's length agreement requiring Ray to purchase Carin's partnership interest from Carin's estate if she dies...

-

Ray and Carin are partners in an accounting firm. The partners have entered into an arm's length agreement requiring Ray to purchase Carin's partnership interest from Carin's estate if she dies...

-

Discuss American History

-

Your firm has developed a new lithium ion battery polymer that could enhance the performance of lithion ion batteries. These batteries have applications in many markets including cellphones, laptops,...

-

Need help analyzing statistical data 1. ANOVA) True or false: If we assume a 95% confidence level, there is a significant difference in performance generally across all groups. 2. (t-test) True or...

Study smarter with the SolutionInn App