Debra acquired the following new assets during 2022. Determine Debras cost recovery deductions for the current year.

Question:

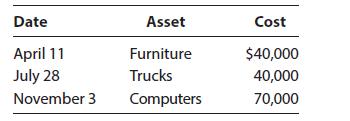

Debra acquired the following new assets during 2022.

Determine Debra’s cost recovery deductions for the current year. Debra does not elect immediate expensing under § 179. She does not claim any available additional first-year depreciation.

Transcribed Image Text:

Date April 11 July 28 November 3 Asset Furniture Trucks Computers Cost $40,000 40,000 70,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 90% (11 reviews)

The midquarter convention must be used because the cost of the computers acquired in the fou...View the full answer

Answered By

Pharashram rai

i am highly creative, resourceful and dedicated freelancer an excellent record of successful classroom presentations and writing . I have more than 4 years experience in tutoring students especially by using my note making strategies and engineering field . Especially adept at teaching methods of maths and writing , and flexible teaching style with the willingness to work beyond the call of duty. Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with .

4.80+

65+ Reviews

270+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Debra acquired the following new assets during 2014. Determine Debras cost recovery deductions for the current year. Debra does not elect immediate expensing under § 179. She does not claim any...

-

Debra acquired the following new assets during 2016: Determine Debra's cost recovery deductions for the current year. Debra does not elect immediate expensing under § 179. She does not claim any...

-

Debra acquired the following new assets during 2017. Determine Debras cost recovery deductions for the current year. Debra does not elect immediate expensing under § 179. She does not claim any...

-

Solve e x+yi = 7.

-

Develop an activity diagram based on the following narrative. Note any ambiguities or questions that you have as you develop the model. If you need to make assumptions, also note them. The purchasing...

-

Shelby Company instituted a defined-benefit pension plan for its employees at the beginning of 1992. An actuarial method that is acceptable under generally accepted accounting principles indicates...

-

Asia represents the universal powerhouse of production but only features partially in Inditexs approach. What made Asia the first worlds supplier of fashion products and a main sourcing spot in the...

-

Suppose a five-year, $1000 bond with annual coupons has a price of $900 and a yield to maturity of 6%. What is the bonds coupon rate?

-

Pompeii's Pizza has a delivery car that it uses for pizza deliveries. The transmission needs to be replaced and there are several other repairs that need to be done. The car is nearing the end of its...

-

Did GE violate the rules for revenue recognition (pre-2016-change) on the "sale" of its locomotives? Explain.

-

On August 2, 2022, Wendy purchased a new office building for $3,800,000. On October 1, 2022, she began to rent out office space in the building. On July 15, 2026, Wendy sold the office building. a....

-

Juan acquires a new 5-year class asset on March 14, 2022, for $200,000. This is the only asset Juan acquired during the year. He does not elect immediate expensing under 179. He does not claim any...

-

Consider the results of a small opinion poll concerning the chances of another stock market crash in the next 12 months comparable to the crash of 1987, shown in Table 17.4.4. a. Fill in the Total...

-

Childhood leukemia, a hematological malignancy, is the most common form of childhood cancer, representing 29% of cancers in children aged 0 to 14 years in 2018. Imagine that you work in the State...

-

Question 1 Approximating functions using linear functions or higher degree polynomials is a very useful scientific tool! This concept generalizes to Taylor Polynomials, but is most simply illustrated...

-

Find the volume of the solid of revolution formed by rotating the specified region R about the x axis. Volume Formula Suppose f(x) is continuous and f(x) 0 on a x b, and let R be the region under the...

-

As machines get older, the cost of maintaining them tends to increase. Suppose for a particular machine, the rate at which the maintenance cost is increasing is approximated by the function C' (t) =...

-

At Edsel Automotive, the management team is planning to expand one of its plants by adding a new assembly line for sport utility vehicles (SUVs). The cost of setting up the new SUV assembly line is...

-

On June 1, Depot Company began operations. On September 1, Depot Company has the following accounts and account balances: Cash $17,400, Accounts Receivable $2,000, Supplies $1,900, Accounts Payable...

-

General Electric Capital, a division of General Electric, uses long-term debt extensively. In a recent year, GE Capital issued $11 billion in long-term debt to investors, then within days filed legal...

-

Lisa sells business property with an adjusted basis of $130,000 to her son, Alfred, for its fair market value of $100,000. a. What is Lisa's realized and recognized gain or loss? b. What is Alfred's...

-

Lisa sells business property with an adjusted basis of $130,000 to her son, Alfred, for its fair market value of $100,000. a. What is Lisa's realized and recognized gain or loss? b. What is Alfred's...

-

Lisa sells business property with an adjusted basis of $130,000 to her son, Alfred, for its fair market value of $100,000. a. What is Lisa's realized and recognized gain or loss? b. What is Alfred's...

-

You have just been hired as a new management trainee by Earrings Unlimited, a distributor of earrings to various retail outlets located in shopping malls across the country. In the past, the company...

-

Brief Exercise 10-6 Flint Inc. purchased land, building, and equipment from Laguna Corporation for a cash payment of $327,600. The estimated fair values of the assets are land $62,400, building...

-

"faithful respresentation" is the overriding principle that should be followed in ones prepaparation of IFRS-based financial statement. what is it? explain it fully quoting IAS. how this this...

Study smarter with the SolutionInn App