Duffy Associates is a partnership engaged in real estate development. Olinto, a civil engineer, billed Duffy $40,000

Question:

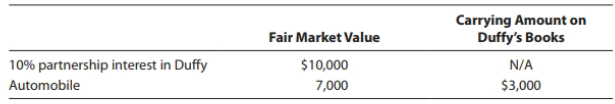

Duffy Associates is a partnership engaged in real estate development. Olinto, a civil engineer, billed Duffy $40,000 in the current year for consulting services rendered. In full settlement of this invoice, Olinto accepted a $15,000 cash payment plus the following:

What amount should Olinto, a cash basis taxpayer, report on his current-year return as income for the services rendered to Duffy?

a. $15,000

b. $28,000

c. $32,000

d. $40,000

Transcribed Image Text:

Carrying Amount on Fair Market Value Duffy's Books N/A 10% partnership interest in Duffy $10,000 Automobile $3,000 7,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (12 reviews)

Answered By

Tobias sifuna

I am an individual who possesses a unique set of skills and qualities that make me well-suited for content and academic writing. I have a strong writing ability, allowing me to communicate ideas and arguments in a clear, concise, and effective manner. My writing is backed by extensive research skills, enabling me to gather information from credible sources to support my arguments. I also have critical thinking skills, which allow me to analyze information, draw informed conclusions, and present my arguments in a logical and convincing manner. Additionally, I have an eye for detail and the ability to carefully proofread my work, ensuring that it is free of errors and that all sources are properly cited. Time management skills are another key strength that allow me to meet deadlines and prioritize tasks effectively. Communication skills, including the ability to collaborate with others, including editors, peer reviewers, and subject matter experts, are also important qualities that I have. I am also adaptable, capable of writing on a variety of topics and adjusting my writing style and tone to meet the needs of different audiences and projects. Lastly, I am driven by a passion for writing, which continually drives me to improve my skills and produce high-quality work.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Comprehensive

ISBN: 9781337703017

42th Edition

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

Question Posted:

Students also viewed these Business questions

-

For tax year 2016 what proportion of individual income tax returns was filed on a Form 1040EZ, Form 1040A and Form 1040? What proportion was electronically filed?

-

Arno and Bridgette are married and have combined W-2 income of $74,612. They paid $344 when they filed their taxes. How much income tax did their employers withhold during the year? a. $5,350. b....

-

Mimi is 22 years old and is a full-time student at Ocean County Community College. She lives with her parents, who provide all of her support. During the summer, she put her Web design skills to work...

-

Use the Chain Rule to evaluate the partial derivative at the point specified. /u and /v at (u, v) = (1,1), where f(x, y, z) = x + yz, x = u + v, y = u + v, z , Z = uv

-

(a) Show that if any 14 integers are selected from the set S = {1, 2, 3, ..., 25}, there are at least two whose sum is 26. (b) Write a statement that generalizes the results of part (a) and Example...

-

Set up equations (do not solve) to solve the triangle in Fig. 9.73 by the law of cosines. Why is the law of sines easier to use? Fig. 9.73 A 10 30 a 20

-

CompuTechs Western Division has an opportunity to transfer component Z50 to the companys Eastern Division. The Western Division, which offers its Z50 product to outside markets for $150, incurs...

-

In 2010, its first year of operations, Kimble Corp. has a $900,000 net operating loss when the tax rate is 30%. In 2011, Kimble has $360,000 taxable income and the tax rate remains 30%. Instructions...

-

At the end of its first year of operations on December 3 1 , 2 0 2 2 , Sunland Company's accounts show the following. \ table [ [ Partner , Drawings,,Capital ] , [ Art Niensted,,$ 2 6 , 6 8 0 , $ 5 5...

-

The nuclear pore complex (NPC) creates a barrier to the free exchange of molecules between the nucleus and cytosol, but in a way that remains mysterious. In yeast, for example, the central pore of...

-

On April 27, 2018, Auk Corporation acquires 100% of die outstanding stock of Amazon Corporation (E & P of $750,000) for $1.2 million. Amazon Corporation has assets with a fair market value of $1.4...

-

At partnership inception, Black acquires a 50% interest in Decorators Partnership by contributing property with an adjusted basis of $250,000. Black recognizes a gain if: I. The fair market value of...

-

Ken (birthdate July 1, 1985) and Amy (birthdate July 4, 1987) Booth have brought you the following information regarding their income, expenses, and withholding for the year. They are unsure which of...

-

Why do you think diversity is important to organizations and what can a do to increase diversity in leadership? What is Servant Leadership? How can you apply this in your life? What is effective team...

-

How do you envision overcoming any potential resistance or skepticism from your colleagues in the vet tech field as you introduce these transformative strategies, and what steps do you think will be...

-

Managers encourage employees to do misleading activities such as speak falsehood and deceive customers which is clearly visible in the statement in the case " Sales are everything" wherein an...

-

Your Topic is "Why do you think there are so few people who succeed at both management and leadership? Is it reasonable to believe someone can be good at both?" Locate two to three articles about...

-

Explain the various benefits associated with professional networking. Also, expand on your answers how those would benefit you personally. PLEASE DO FAST AND CORRECT need correct answer

-

In Exercises a portion of the graph of a function defined on [-2, 2] is shown. Complete each graph assuming that the graph is (a) even, (b) odd. 0 2 X

-

Assume Eq. 6-14 gives the drag force on a pilot plus ejection seat just after they are ejected from a plane traveling horizontally at 1300 km/h. Assume also that the mass of the seat is equal to the...

-

Discuss why Congress has instructed taxpayers that real property be depreciated using the mid-month convention as opposed to the half-year or mid-quarter conventions used for tangible personal...

-

Discuss why Congress has instructed taxpayers that real property be depreciated using the mid-month convention as opposed to the half-year or mid-quarter conventions used for tangible personal...

-

Compare and contrast the differences between computing depreciation expense for tangible personal property and depreciation expense for real property under both the regular tax and alternative tax...

-

Practice Problem 1 The stockholders equity accounts of Bramble Corp. on January 1, 2017, were as follows. Preferred Stock (6%, $100 par noncumulative, 4,400 shares authorized) $264,000 Common Stock...

-

JVCU Which of the following is considered cash for financial reporting purposes? 1 JVCU Which of the following is considered cash for financial reporting purposes? 1

-

Required information The Foundational 15 [LO8-2, LO8-3, LO8-4, LO8-5, LO8-7, LO8-9, L08-10) (The following information applies to the questions displayed below.) Morganton Company makes one product...

Study smarter with the SolutionInn App