Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM

Question:

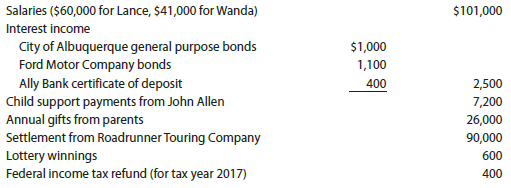

Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2018, the Deans recorded the following receipts.

Wanda previously was married to John Allen. When they divorced in 2013, Wanda was awarded custody of their two children, Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John was obligated to pay alimony and child support?the alimony payments were to terminate if Wanda remarried.

In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. Because the driver was clearly at fault, the owner of the bus, Roadrunner Touring Company, paid her medical expenses (including a one-week stay in a hospital). To avoid a lawsuit, Roadrunner also transferred to her $90,000 cash in settlement of the personal injuries she sustained.

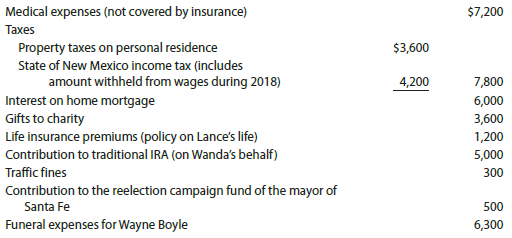

The Deans made the following 2018 expenditures.

The life insurance policy was taken out by Lance several years ago and designates Wanda as the beneficiary. As a part-time employee, Wanda is excluded from coverage under her employer?s pension plan. Consequently, she provides for her own retirement with a traditional IRA obtained at a local trust company. Because the mayor is a member of the local Chamber of Commerce, Lance felt compelled to make the political contribution.

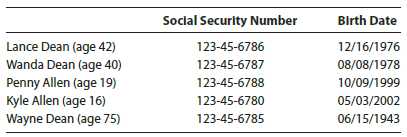

The Dean household includes the following, for whom they provide more than half of the support.

Penny graduated from high school on May 9, 2018, and is undecided about college. This year, she earned $8,500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Lance?s widower father who died on December 20, 2017. For the past few years, Wayne qualified as a dependent of the Deans.

Federal income tax withheld is $4,200 (Lance) and $2,100 (Wanda). The proper amount of Social Security and Medicare tax was withheld. All members of the family were covered by health insurance for all of 2018.

Determine the 2018 Federal income tax for the Deans on a joint return by completing the appropriate forms. They do not want to contribute to the Presidential Election Campaign Fund. If an overpayment results, it is to be refunded to them. Suggested software: ProConnect Tax Online.

Step by Step Answer:

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman