Pierce, a married individual, received the following in 20X14: Considering only the above, what is Pierces 20X14

Question:

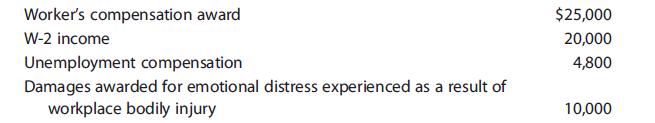

Pierce, a married individual, received the following in 20X14:

Considering only the above, what is Pierce’s 20X14 gross income?

a. $49,800

b. $34,800

c. $30,000

d. $24,800

Transcribed Image Text:

Worker's compensation award W-2 income Unemployment compensation Damages awarded for emotional distress experienced as a result of workplace bodily injury $25,000 20,000 4,800 10,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (7 reviews)

To calculate Pierces 20X14 gross income you need to add up all th...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-4. Ivan and Irene paid the following in 2012 (all by check or can otherwise be...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Dalmo Bhd is an investment holding company and currently it has 3 subsidiaries as stated below. Dalmo Bhd group of companies financial year end is 31st March. The shareholding structure of Dalmo...

-

Software for You encounters revenue-allocation decisions with its bundled product sales. Here, two or more units of the software are sold as a single package. Managers at Software for You are keenly...

-

Chester's Chippers makes oversized golf clubs. The company president has asked you to show her how master scheduling techniques could be applied to her business. You have the following data: a....

-

Describe Ashley Stewarts retail strategy using the six Ps. Ashley Stewart43 An auditorium full of graduate and undergraduate students was eager to hear what James Rhee, the CEO of Ashley Stewart, the...

-

Use regression analysis on deseasonalized demand to forecast demand in summer 2013, given the following historical demanddata: YEAR SEASON ACTUAL DEMAND 2011 Spring 205 Summer Winter Summer Winter...

-

Bauer Industries is an automobile manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12.0%...

-

The OLTP system data for the Fitchwood Insurance Company is in a series of flat files. What process do you envision would be needed in order to extract the data and create the ERD shown in Figure...

-

Cole, a 48-year-old married individual, received the following in 20X14: In addition, Cole spent $500 on lottery scratch-off cards in 20X14. All of the cards were losers except for one, from which...

-

The following pertain to Joyce in 20X14: What total amount from the above may be excluded from Joyces 20X14 gross income? a. $5,650 b. $350 c. $5,150 d. $850 Medical insurance premiums paid by...

-

The free cash flow to the firm is closest to A. $23,031,000. B. $25,441,000. C. $36,091,000. Alan Chin, the chief executive officer of Thunder Corporation, has asked his chief financial officer,...

-

Considering your self-reflection, your personal and professional experience, and the other ideas related to leadership that you have explored in your studies so far, address the following: Provide a...

-

This research report analyzes the economics of Toyota's automobile industry between 2012-2022. The company was founded in Japan in 1937 and became one of the largest companies in the world in 2020....

-

Define workplace violence and discuss the different forms it can take. Analyze and share an example of workplace violence (maintaining confidentiality where necessary), or a hypothetical scenario....

-

Prepare a lengthy journal article on how to use learning theories (behaviorism, social cognitive, information processing, and constructivism) to improve their effectiveness as communicators of the...

-

Reflect on two to three (2-3) TV shows in which characters demonstrate aggression or violence. Consider the context in which this aggression or violence occurred and ways in which it can lead to...

-

Knowing that the tension in cable AD is 180 lb, determine (a) The angle between cable AD and the boom AB, (b) The projection on AB of the force exerted by cable AD at point A. 6 ft 3 ft 7.5t 6.5t 4.5...

-

Describe the general ways that the revised Form 990, applicable for tax year 2008 and beyond, is different from previous versions.

-

Liang, a U.S. citizen, owns 100% of ForCo, a foreign corporation not engaged in a U.S. trade or business. Is Liang subject to any U.S. income tax on her dealings with ForCo? Explain.

-

Liang, a U.S. citizen, owns 100% of ForCo, a foreign corporation not engaged in a U.S. trade or business. Is Liang subject to any U.S. income tax on her dealings with ForCo? Explain.

-

BlueCo, a domestic corporation, incorporates GreenCo, a new wholly owned entity in Germany. Under both German and U.S. legal principles, this entity is a corporation. BlueCo faces a 35% U.S. tax...

-

Read the following and then answer the questions below:September 12: A Brisbane business offers by letter to sell 500 tyres to a New Zealand company. The Brisbane company does not specify a method of...

-

Fred returns home from work one day to discover his house surrounded by police. His wife is being held hostage and threatened by her captor. Fred pleads with the police to rescue her and offers...

-

Would like you to revisit one of these. Consideration must be clear and measurable.if you can't measure it then how can you show it has / has not been done?How can you sue someone for breach of...

Study smarter with the SolutionInn App