Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for 2014

Question:

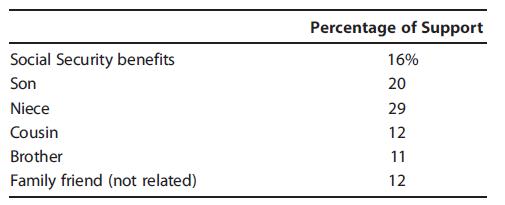

Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for 2014 and 2015 received their support from the following sources:

a. Which persons are eligible to claim the dependency exemptions under a multiple support agreement?

b. Must Wesley and Myrtle be claimed by the same person(s) for both 2014 and 2015? Explain.

c. Who, if anyone, can claim their medical expenses?

Transcribed Image Text:

Social Security benefits Son Niece Cousin Brother Family friend (not related) Percentage of Support 16% 20 29 12 11 12

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

a Under a multiple support agreement which allows multiple people to claim the dependency exemption for a qualifying relative if they collectively pro...View the full answer

Answered By

Ma Kristhia Mae Fuerte

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2016 Individual Income Taxes

ISBN: 9781305393301

39th Edition

Authors: James H. Boyd, William H. Jr. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for 2015 and 2016 received their support from the following sources:...

-

Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for 2013 and 2014 received their support from the following sources: Percentage of Support Social Security...

-

Wesley and Myrtle (ages 90 and 88, respectively) live in an assisted care facility and for 2016 and 2017 received their support from the following sources: __________________________________...

-

State Einstein's postulates of the special theory of relativity. ii. Write down Einstein's mass-energy equivalence formula. iii. In the case of two inertial frames of reference, S' moving at a...

-

Neagle Company has 8,000 machine hours available to use to produce either Product A or Product B. The cost accounting department developed the following unit information for each of the products:...

-

Interview three hospitality associates preferably one manager, one supervisor, and one associateto find out what motives them.

-

A better model for repeating an exam. A more realistic probability model for Elaines attempts to pass an exam in the previous exercise is as follows. On the first try she has probability 0.2 of...

-

1. Which inventory costing method generally results in less current taxes paid by the company? a. LIFO b. FIFO c. Moving Average d. All methods result in the same taxes paid 2. Which inventory...

-

How do we use the PESTEL framework to assess the key drivers for change? Select one: a. To identify short-term trends in the industry. b. To conduct an impact analysis on whether each opportunity or...

-

Assuming that the switch in Fig. 7.87 has been in position A for a long time and is moved to position B at t =0, find v0 (t) for t ¥ 0. 20 k 12 v (t 30 kS2

-

Taylor, age 18, is claimed as a dependent by her parents. For 2015, she has the following income: $4,000 wages from a summer job, $1,800 interest from a money market account, and $2,000 interest from...

-

Sam and Elizabeth Jefferson file a joint return and have three childrenall of whom qualify as dependents. If the Jeffersons have AGI of $332,000, what is their allowable deduction for personal and...

-

In a lithium-iodine (LiI) battery, a solid lithium anode is surrounded by a polymer impregnated with iodine. The net reaction, Li + I 2 LiI, has a standard reaction free energy of G 0 = 266.9 kJ/mol...

-

Joint Ventures are a common Mode of Entry in international business. Appreciate if in-depth elaboration provided on its advantages and disadvantages. Also briefly mention the factors which make joint...

-

The field excursion is intended to give students an opportunity to carry out an applied geographical research project based on observation, data recording, and analysis. Using a field site of your...

-

An angry coworker is expressing their needs through a rush of emotion and snide comments while another coworker is trying to interpret them to provide some help and support. You are a manager and...

-

You may have a general understanding of the difference between ethics and legality , but could you explain the distinction? It is not always easy to know where to draw the line between the two. Some...

-

Someone can be a good leader but not be a very good manager and vice-versa. Leadership is creating a vision for others to follow, establishing corporate values and ethics, and transforming the way...

-

The vectors P and Q are two adjacent sides of a parallelogram. Determine the area of the parallelogram when (a) P = -8i + 4j - 4k and Q = 3i + 3j + 6k, (b) P = 7i - 6j - 3k and Q = -3i + 6j - 2k

-

During the month, services performed for customers on account amounted to $7,500 and collections from customers in payment of their accounts totaled $6,000. At the end of the month, the Accounts...

-

A taxpayer sells a warehouse for a recognized gain. Depreciation had been properly claimed on the property, based on the straight-line method over a 39-year recovery period. Will the same amount of...

-

A taxpayer sells a warehouse for a recognized gain. Depreciation had been properly claimed on the property, based on the straight-line method over a 39-year recovery period. Will the same amount of...

-

A taxpayer sells a warehouse for a recognized gain. Depreciation had been properly claimed on the property, based on the straight-line method over a 39-year recovery period. Will the same amount of...

-

A firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8....

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

Study smarter with the SolutionInn App