What will be the values of A Corporation, B Company, and C Company after three years? Assume

Question:

What will be the values of A Corporation, B Company, and C Company after three years? Assume that each business

(a) Required a $5,000,000 initial investment,

(b) Earns an annual 10% before-tax rate of return on the beginning-of-the-year investment,

(c) Can reinvest its after-tax cash flow back into the business, and

(d) There is no unrealized appreciation of their assets. Use spreadsheet software such as Microsoft Excel to prepare your answer.

Transcribed Image Text:

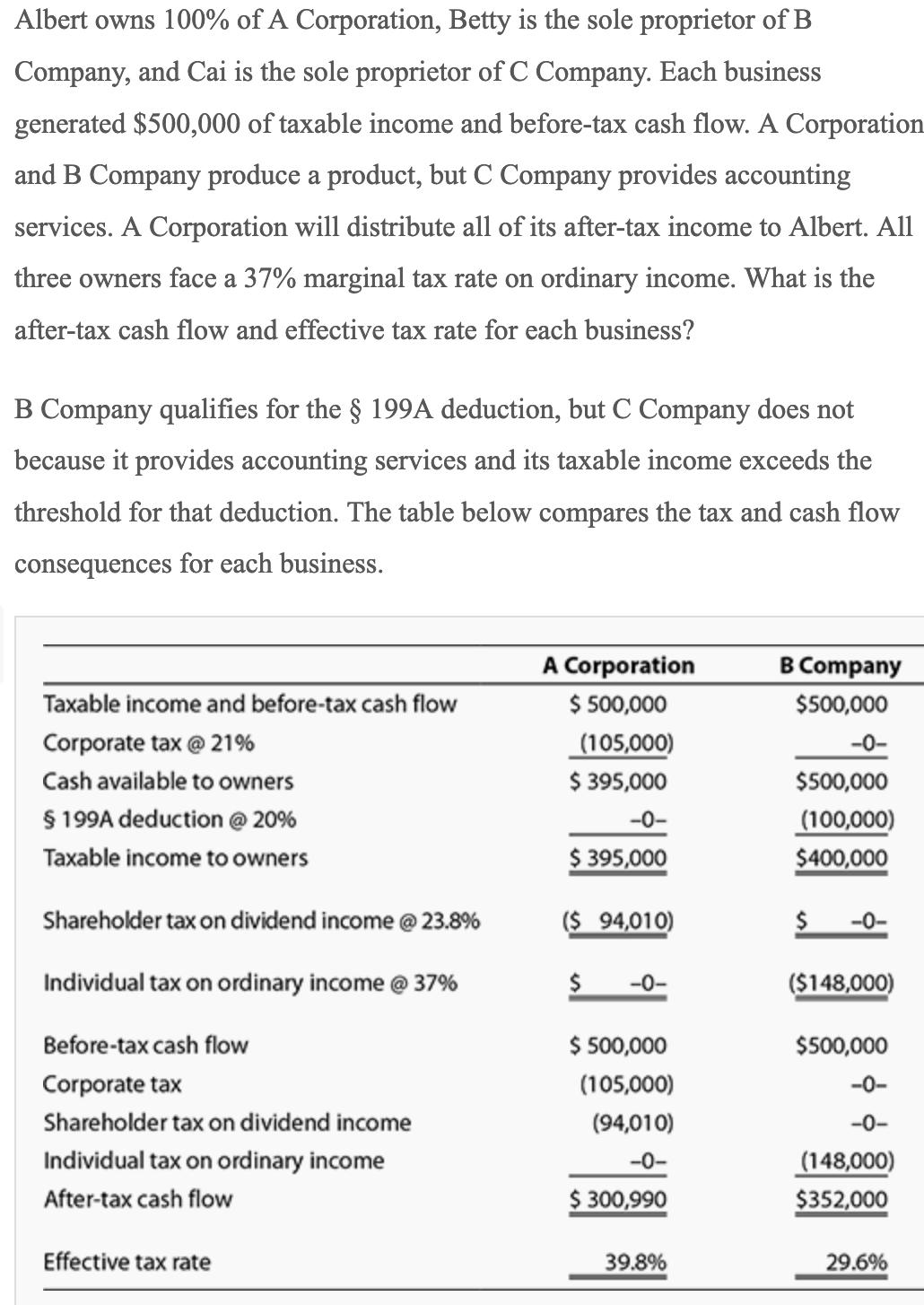

Albert owns 100% of A Corporation, Betty is the sole proprietor of B Company, and Cai is the sole proprietor of C Company. Each business generated $500,000 of taxable income and before-tax cash flow. A Corporation and B Company produce a product, but C Company provides accounting services. A Corporation will distribute all of its after-tax income to Albert. All three owners face a 37% marginal tax rate on ordinary income. What is the after-tax cash flow and effective tax rate for each business? B Company qualifies for the § 199A deduction, but C Company does not because it provides accounting services and its taxable income exceeds the threshold for that deduction. The table below compares the tax and cash flow consequences for each business. Taxable income and before-tax cash flow Corporate tax @ 21% Cash available to owners § 199A deduction @ 20% Taxable income to owners Shareholder tax on dividend income @ 23.8% Individual tax on ordinary income @ 37% Before-tax cash flow Corporate tax Shareholder tax on dividend income Individual tax on ordinary income After-tax cash flow Effective tax rate A Corporation $ 500,000 (105,000) $ 395,000 -0- $ 395,000 ($ 94,010) $ $ 500,000 (105,000) (94,010) -0- $ 300,990 39.8% B Company $500,000 -0- $500,000 (100,000) $400,000 $ -0- ($148,000) $500,000 (148,000) $352,000 29.6%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 20% (5 reviews)

Answer Business AfterTax Cash Flow Effective Tax Rate A Corporation 30...View the full answer

Answered By

Aidelyn Dela Peña

I have been teaching students in the public for more than 8 years now. It is so fulfilling as a teacher to know that your students have learned massively from you in any subject area since I specialized in general education. While having time off from face-to-face teaching due to pandemic, I endeavored in tutoring students online who specifically need assistance in English and Writing. As a former CourseHero Tutor, I have guided students to learn basic and general skills required in answering their homework in English, Writing, Math, Algebra, Ecological Science, Environmental Science and History. Moreover, I had consistently received helpful ratings on the platform and have accumulated a general average of 87% performance as a tutor expert.

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Albert owns 100% of A Corporation, Betty is the sole proprietor of B Company, and Cai is the sole proprietor of C Company. Each business generated $500,000 of taxable income and before-tax cash flow....

-

Youve just been hired onto ABC Company as the corporate controller. ABC Company is a manufacturing firm that specializes in making cedar roofing and siding shingles. The company currently has annual...

-

A Continuous fractional column, operating at atmospheric pressure, is to be designed to separate a mixture containing 20 per cent benzene in toluene into an overhead product containing 90 percent...

-

Answer each of the following related to international accounting standards. 1. Which method, indirect or direct, is acceptable for reporting operating cash flows under IFRS? 2. For each of the...

-

Lundy Manufacturing produces and sells football equipment. The company was involved in the following transactions or events during 1997.

-

Describe marketing activities that will (a) address each of the four Is as they relate to your service and (b) encourage the development of relationships with your customers.

-

West Company acquired 60 percent of Solar Company for $300,000 when Solars book value was $400,000. The newly comprised 40 percent noncontrolling interest had an assessed fair value of $200,000. Also...

-

Principles of auditing ch 6 Evidence QUESTION 4 In testing for lower-of-cost-or-market, the auditor is gathering evidence to support which of the following assertions? A. Rights and obligations. B....

-

Pastina Company sells various types of pasta to grocery chains as private label brands. The company?s reporting year-end is December 31. The unadjusted trial balance as of December 31, 2021, appears...

-

Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a...

-

Burgundy, Inc., and Violet are equal partners in the calendar year BV LLC. Burgundy uses a fiscal year ending April 30, and Violet uses a calendar year. Burgundy receives an annual guaranteed payment...

-

a. Use definition (2) to find the slope of the line tangent to the graph of f at P. b. Determine an equation of the tangent line at P. f(x) = x/x + 1 ; P(-2, 2) Data from Definition (2) f(a + h) ...

-

Consider the following account balances (in thousands) for the Shaker Corporation In the Dec 31.2021 Cash $200,000 and Capital $2,000,000 and Retained earnings $1,500,000 The balances of raw...

-

Unless otherwise stated, assume gravitational acceleration g = 9.81 m/s and the density of water to be 1000 kg/m. Unless otherwise stated, give all numerical answers to 3 significant figures, such as...

-

The purpose of this installment is to classify stock, bond, and mutual fund investments, explore tools for their evaluation and select these securities based on your investment philosophy and goals....

-

Jackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided...

-

Caldwell (2003) explores differences between the roles of leaders and managers. "Leaders...envision, initiate, or sponsor strategic change of a far-reaching or transformational nature. In contrast,...

-

Product fraud and recalls are damaging to an organization's reputation and profitability. How can supplier development and relationship help in avoiding such scandals?

-

7. Baladna wants to analyze process that includes delivery by suppliers, production inside the company, transportation to to its customers and information systems. Then it also wants to find out...

-

Indicate whether each of the following statements is true or false. a. The government never pays a taxpayer interest on an overpayment of tax. b. The IRS can compromise on the amount of tax liability...

-

Indicate whether each of the following statements is true or false. a. The government never pays a taxpayer interest on an overpayment of tax. b. The IRS can compromise on the amount of tax liability...

-

Indicate whether each of the following statements is true or false. a. The government never pays a taxpayer interest on an overpayment of tax. b. The IRS can compromise on the amount of tax liability...

-

You are evaluating a new project for the firm you work for, a publicly listed firm. The firm typically finances new projects using the same mix of financing as in its capital structure, but this...

-

state, "The subscription price during a rights offering is normally r; lower ; lower r; higher er; higher than the rights-on price and

-

Arnold inc. is considering a proposal to manufacture high end protein bars used as food supplements by body builders. The project requires an upfront investment into equipment of $1.4 million. This...

Study smarter with the SolutionInn App