At the time of Mateos death, he was involved in the transactions described below. Mateo was a

Question:

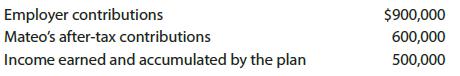

At the time of Mateo’s death, he was involved in the transactions described below.• Mateo was a participant in his employer’s contributory qualified pension plan. The plan balance of $2,000,000 is paid to Olivia, Mateo’s daughter and beneficiary. The distribution consists of the following.

• Mateo was covered by his employer’s group term life insurance plan for employees. The $200,000 proceeds are paid to Olivia, as designated beneficiary.

a. What are the Federal estate tax consequences of these events?b. Would the answer to part (a) change if Olivia was Mateo’s surviving spouse (not his daughter)? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted: