Compute the Federal income tax liability for the Valerio Trust. The entity reports the following transactions for

Question:

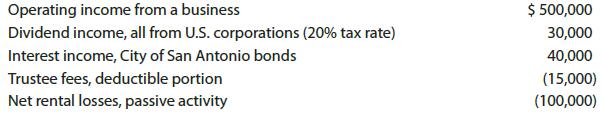

Compute the Federal income tax liability for the Valerio Trust. The entity reports the following transactions for the 2021 tax year. The trustee accumulates all accounting income for the year.

Transcribed Image Text:

Operating income from a business Dividend income, all from U.S. corporations (20% tax rate) Interest income, City of San Antonio bonds Trustee fees, deductible portion Net rental losses, passive activity $ 500,000 30,000 40,000 (15,000) (100,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

The taxexempt interest on the bonds is not included in NII for the 38 tax 1411c1Ai Ordin...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Compute the Federal income tax liability for the Valerio Trust. The entity reports the following transactions for the 2017 tax year. The trustee accumulates all accounting income for the year....

-

Compute the Federal income tax liability for the Valerio Trust. The entity reports the following transactions for the 2015 tax year. The trustee accumulates all accounting income for the year....

-

Compute the Federal income tax liability for the Valerio Trust. The entity reports the following transactions for the 2016 tax year. The trustee accumulates all accounting income for the year....

-

(8) (Non circular cylinder) A solid right (noncircular) cylinder has its base the R in the xy-plane and is bounded above by is 22-y + +5 5 * (x + y) dx dy paraboloid 2= x + y . The cylinder's volume....

-

Define robbery, burglary, safe burglary, and theft.

-

Please help and show all work (CHAPTER 9) I recommend solving this problem in Excel. When you do correct referencing to the cells with intermediate results, it will help you avoid any rounding...

-

2. What is a reportable segment according to FASB ASC Topic 280? What criteria are used in determining what operating segments are also reportable segments?

-

Soybean oil is to be pumped from a storage tank to a processing vessel. The distance is 148 m and included in the pipeline are six right-angle bends, two gate valves and one globe valve. If the...

-

An American company is considering entering into a joint venture with a firm in Kenya, Africa. Describe what cultural and accounting practice differences each party should consider and explain why.

-

The Fuentes family has developed a profitable business in which all adult members participate. They would like to make sure that the business stays in the family in the event of any future negative...

-

Construct a table and send it to your instructor with information about donor-advised funds (DAFs). For any two of the past five years, report the amount of assets held by DAFs, total dollar...

-

While on holiday, Yushan likes to stay in youth hostels. The company that owns the hostels claims that the average price of a night's stay is $43. Yushan spends one night each in six different...

-

To create 3 scenarios (positive, neutral and negative) for the development of the restaurant. Include the following important factors in your assessments: border trade as one of the most important...

-

Description of market segment Aged between 34 and 58 Regular commuters Clerical or professional Income over $50K Moderately price-sensitive but may see higher price as an indicator of quality...

-

How has the job of the manager changed over time (since the publication of the Mintzberg article below)? What factors have contributed to shifts in the manager's role? What new roles are managers...

-

a. illustrate the fives modes within which an ethical leader can exercise authority b. Evaluate four factors related to interpersonal dimension that relate to unethical behaviour of leaders c. Assess...

-

Complete the following writing assignment: Analyze the attached 10_pages. Write about them, summarize what you read, and connect it to personal experiences. CHAPTER 15 Sexual Dysfunctions and...

-

Charles is a 60% partner in CD Partnership, a calendar year partnership. For 2016, Charles received a Schedule K-1 that reported his share of partnership items as follows: Partnership ordinary...

-

1. Below is depicted a graph G constructed by joining two opposite vertices of C12. Some authors call this a "theta graph" because it resembles the Greek letter 0. a. What is the total degree of this...

-

Tab exchanges real estate used in his business along with stock for real estate to be held for investment. The stock transferred has an adjusted basis of $45,000 and a fair market value of $50,000....

-

Tab exchanges real estate used in his business along with stock for real estate to be held for investment. The stock transferred has an adjusted basis of $45,000 and a fair market value of $50,000....

-

Shontelle owns an apartment house that has an adjusted basis of $760,000 but is subject to a mortgage of $192,000. She transfers the apartment house to Dave and receives from him $120,000 in cash and...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App