Emerald Corporation, a calendar year and accrual method taxpayer, provides the following information and asks you to

Question:

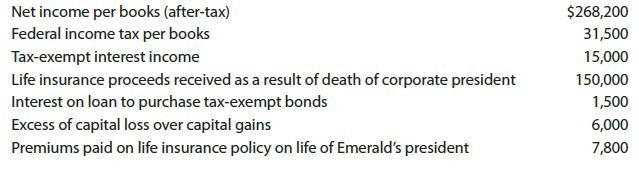

Emerald Corporation, a calendar year and accrual method taxpayer, provides the following information and asks you to prepare Schedule M–1 for 2021:

Transcribed Image Text:

Net income per books (after-tax) Federal income tax per books Tax-exempt interest income Life insurance proceeds received as a result of death of corporate president Interest on loan to purchase tax-exempt bonds Excess of capital loss over capital gains Premiums paid on life insurance policy on life of Emerald's president $268,200 31,500 15,000 150,000 1,500 6,000 7,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

Emeralds net income per books is reconciled to taxable income as follo...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Corporations, Partnerships, Estates And Trusts

ISBN: 9780357519240

45th Edition

Authors: William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Emerald Corporation, a calendar year and accrual method taxpayer, provides the following information and asks you to prepare Schedule M-1 for 2017: Net income per books (after-tax)...

-

Emerald Corporation, a calendar year and accrual method taxpayer, provides the following information and asks you to prepare Schedule M-1 for 2018: Net income per books (after-tax)...

-

Emerald Corporation, a calendar year and accrual method taxpayer, provides the following information and asks you to prepare Schedule M1 for 2019: Net income per books (after-tax)...

-

Can you describe the initialisation, exploration and exploitation phases of the cat hunting optimisation algorithm?

-

Calculate Laspeyres price indexes for 20112013 from the following data. Use 2005 as the baseyear. Quantity Price Item 2005 2005 2011 2012 2013 21 $0.50 $0.67 $0.68 $0.71 6 1.23 1.85 1.90 191 17 0.84...

-

Contribution Margin, Break-Even Units, Contribution Margin Income Statement, Margin of Safety Zebra Company manufactures custom-designed skins (covers) for iPods and other portable MP3 devices....

-

1. Intercompany profit elimination entries in consolidation workpapers are prepared in order to: a Nullify the effect of intercompany transactions on consolidated statements b Defer intercompany...

-

For a multistage bioseparation process described by the transfer function, Calculate the response to a step input change of magnitude, 1.5. (a) Obtain an approximate first- order-plus-delay model...

-

We would like to understand by department whether there is a significant pay difference between men and women in 2017 (average gross salary by gender per pay period). The gender is coming from the...

-

1. Calculate monthly accrued interest expense for the installment note to Ford Credit (based on 365 days per year and interest starting to accrue on December 17, 20XX). Make the appropriate adjusting...

-

Jennifer is a CPA and a single taxpayer using the standard deduction. In 2021, her CPA practice generates qualified business income of $162,550 and she has no other items of income, deduction, or...

-

Elliot operates his clothing store as a single member LLC (which he reports as a sole proprietorship). In 2021, his proprietorship generates qualified business income of $280,000, he pays W2 wages of...

-

The approximate rate of change in the number of design patent applications received in the United States in recent years is given by p(t) = 0.01056t + 1.94, where t represents the number of years...

-

GATE 2024-EE Question

-

GATE 2024-EE Question

-

GATE 2024-EE Question

-

What is Netduino?

-

What is Appolonius theorem?

-

Mandelate esters exhibit spasmolytic activity (they act as muscle relaxants). The nature of the alkyl group (R) greatly affects potency. Research indicates that the optimal potency is achieved when R...

-

A police officer pulls you over and asks to search your vehicle because he suspects you have illegal drugs inside your car. Since he doesn't have reasonable suspicion to search your car, legally he...

-

In late 2022, the Polks come to you for tax advice. They are considering selling some stock investments for a loss and making a contribution to a traditional IRA. In reviewing their situation, you...

-

Locate the court decision with the following citation: 144 T.C. 279. a. What is the name of the case? b. Which court heard this case? c. In what year was the case decided? d. What was the issue (or...

-

Kathy and Brett Ouray married in 2004. They began to experience marital difficulties in 2018 and, in the current year, although they are not legally separated, consider themselves completely...

-

Which of the following is a limitation of both return on investment and residual income? A. Favors large units. B. There is disincentive for high return on investment units to invest. C. Can lead to...

-

For anOld Country Links, Incorporated, produces sausages in three production departments Mixing , Casing and Curing, and Packaging. In the Mixing Department, meats are prepared, ground and mixed with...

-

A manufacturing firm uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs, based on machine hours required. At the beginning of 2 0 1 9 , the firm expected to...

Study smarter with the SolutionInn App