I Gold and Silver are two unrelated calendar year corporations. For the current year, each had the

Question:

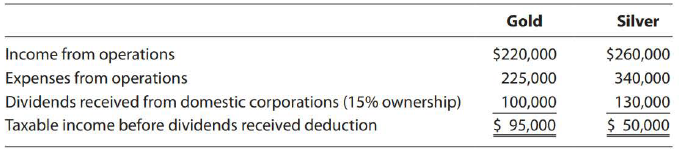

I Gold and Silver are two unrelated calendar year corporations. For the current year, each had the following transactions:

What is the dividends received deduction for:

a. Gold Corporation?

b. Silver Corporation?

Transcribed Image Text:

Silver Gold Income from operations Expenses from operations Dividends received from domestic corporations (15% ownership) Taxable income before dividends received deduction $220,000 225,000 $260,000 340,000 130,000 $ 50,000 100,000 $ 95,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

a 47500 Taxable income before the DRD is 95000 The full DRD is 50000 1000...View the full answer

Answered By

Leah Muchiri

I am graduate in Bachelor of Actuarial Science and a certified accountant. I am also a prolific writer with six years experience in academic writing. My working principle are being timely and delivering 100% plagiarized free work. I usually present a precised solution to every work am assigned to do. Most of my student earn A++ GRADE using my precised and correct solutions.

4.90+

52+ Reviews

125+ Question Solved

Related Book For

South-Western Federal Taxation 2019 Individual Income Taxes

ISBN: 9781337702546

42nd Edition

Authors: James C. Young, William H. Hoffman, William A. Raabe, David M. Maloney, Annette Nellen

Question Posted:

Students also viewed these Business questions

-

Gold and Silver are two unrelated calendar year corporations. For the current year, each had the following transactions: What is the dividends received deduction for: a. Gold Corporation? b. Silver...

-

Calculate the price of a one-year European option to give up 100 ounces of silver in exchange for one ounce of gold. The current prices of gold and silver are $1520 and $16, respectively; the...

-

A number of industrial products include gold and silver as a component because they have very good conductive properties. The S& M Smelting Company engages in the recovery of gold from such products...

-

Claud Chapperon is a self-employed distributor of wholesale clothing who began trading on 1 July 2012. His summarised accounts for the year to 30 June 2020 are shown below. The figures in brackets...

-

Three alternatives are being considered for an engineering project. Their cash-flow estimates are shown in the accompanying table. A and B are mutually exclusive, and C is an optional add-on feature...

-

Draw a scatter diagram and find \(r\) for the data shown in each table in Problems 25-30. 10 20 30 30 50 60 y 20 48 60 58 70 75

-

Understand how to make sound decisions with incomplete information. (p. 208)

-

GfK Roper surveyed people worldwide asking them how important is acquiring wealth to you. Of 1535 respondents in India, 1168 said that it was of more than average importance. In the United States of...

-

1 2 . sin 5 11 Mother Question 14 Nana Cathed how sowe Pepe LO 2015 H in the areas where the hobby Mon to another 1080. E S 36 5 B 6 6 1 2 . sin 5 11 Mother Question 14 Nana Cathed how sowe Pepe LO...

-

Curts Casting manufactures metal parts in a large manufacturing facility. Curts customers order 100,000 tons of castings each quarter. The facility has a practical capacity of 150,000 tons. Curt...

-

In 2018, Emily receives a distribution of $125,000 from her wholly owned calendar year corporation. As of January 1, 2018, the corporation has accumulated E & P of $15,000 and for 2018 has current E...

-

Banana Corporation is a May 31 fiscal year corporation. Calculate Banana's tax liability if taxable income is $900,000 for: a. The fiscal year ended May 31, 2017 b. The fiscal year ended May 31, 2018...

-

Calculate the future value of $4000 in a. Three years at an interest rate of 6% per year. b. Six years at an interest rate of 6% per year. c. Three years at an interest rate of 12% per year. d. Why...

-

Why do you think diversity is important to organizations and what can a do to increase diversity in leadership? What is Servant Leadership? How can you apply this in your life? What is effective team...

-

How do you envision overcoming any potential resistance or skepticism from your colleagues in the vet tech field as you introduce these transformative strategies, and what steps do you think will be...

-

Managers encourage employees to do misleading activities such as speak falsehood and deceive customers which is clearly visible in the statement in the case " Sales are everything" wherein an...

-

Your Topic is "Why do you think there are so few people who succeed at both management and leadership? Is it reasonable to believe someone can be good at both?" Locate two to three articles about...

-

Explain the various benefits associated with professional networking. Also, expand on your answers how those would benefit you personally. PLEASE DO FAST AND CORRECT need correct answer

-

What capabilities and benefits will result from the development of next generation TMS tools?

-

Refer to the table to answer the following questions. Year Nominal GDP (in billions) Total Federal Spending (in billions) Real GDP (in billions) Real Federal Spending (in billions) 2000 9,817 578...

-

Alison incurs the following research expenditures. In-house wages ........................................................... $60,000 In-house supplies...

-

In March 2018, Serengeti exercised an ISO that had been granted by his employer, Thunder Corporation, in December 2015. Serengeti acquired 5,000 shares of Thunder stock for the exercise price of $65...

-

Brennen sold a machine used in his sole proprietorship for $180,000. The machine was purchased eight years ago for $340,000. Depreciation up to the date of the sale for regular income tax purposes...

-

How do external factors such as changing consumer preferences affect the retail industry?"

-

Production costs that are not attached to units that are sold are reported as: Cost of goods sold Selling expenses Administrative costs Inventory

-

Please show workings :) Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: Life of...

Study smarter with the SolutionInn App