In testing the cash discounts on vendors invoices, the auditor did not expect to find any errors

Question:

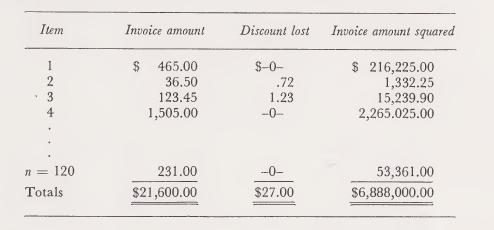

In testing the cash discounts on vendors’ invoices, the auditor did not expect to find any errors in the sample, and therefore he used attributes sampling techniques. Based upon the statistical requirements for the test, a sample size of 120 items was randomly selected and carefully tested. Much to the auditor’s surprise, there were fifteen sample items where the client had failed to take the discount even though company policy clearly indicated one should have been taken. At this point, he decided to switch to variables estimation to measure the amount of the lost discounts.

Required:

a. Is it acceptable to change to variables estimation at this point? Explain.

b. What would be the purpose of making the calculations ? Would the test be a hypothesis test or interval estimation ? Explain.

c. If ratio estimation is used, explain how the auditor should proceed.

d. Calculate the confidence limits for the discounts not taken, assuming a confidence level of 90%, from the following information:

The population of vendors’ invoices consisted of 6,000 invoices totaling \($1,038,000.\) The sum of the discounts lost squared is \($53.00.\) The sum of the discounts lost times the invoice amount is \($5,530.\)

e. State in words the meaning of the confidence limits calculated in d.

Step by Step Answer:

Applications Of Statistical Sampling To Auditing

ISBN: 9780130391568

1st Edition

Authors: Alvin A. Arens, James K. Loebbecke