You are in charge of the audit of the United Widget Workers of America, a labor union

Question:

You are in charge of the audit of the United Widget Workers of America, a labor union that your firm has been auditing for several years. In performing the audit for the year ended June 30, 198X, you note that the union signed a new contract with all employers as of January 1, 198X. The new contract requires that increased medical benefits be paid to those who retire after 1/1 /8X. These benefits are to be paid for by additional employer contributions of 1 % of gross wages.

Under the contract, the union was required to set up a separate trust for the employees covered for the additional benefits. Those covered by the old contract were to remain under the previous trust. These are referred to below as the “old trust” and the “new trust.”

In conducting the audit, you note that the books have not been kept by trust. The client informs you that there has been a lack of communication between its legal and its accounting department. After discussion with the client, you conclude that it will be easy to make the adjustment for the income that should be in each trust and for the administrative expenses that should be charged to each trust. However, the volume of medical benefits is such that it is not practical to analyze each benefit payment to determine whether it applies to the old or the new trust. Accordingly, the client wishes your advice on whether an appropriate sampling scheme is feasible.

During the six months ending June 30, the client wrote 7,000 checks for benefits, which totaled \($38\) million. Medical benefits are paid mainly through doctors’ consulting arrangements. The doctor lists on a form (voucher) the patient seen, the Social Security number, the service rendered, and the charge, and submits the form for payment once a month. Each form and related check will generally have several hundred line items. The client has an index file of employees by Social Security number. This will permit it to identify which trust the employee belongs to.

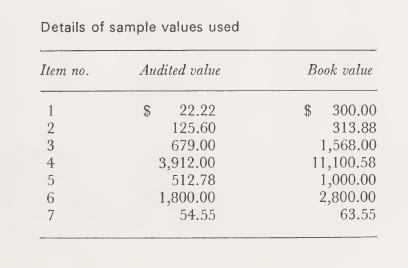

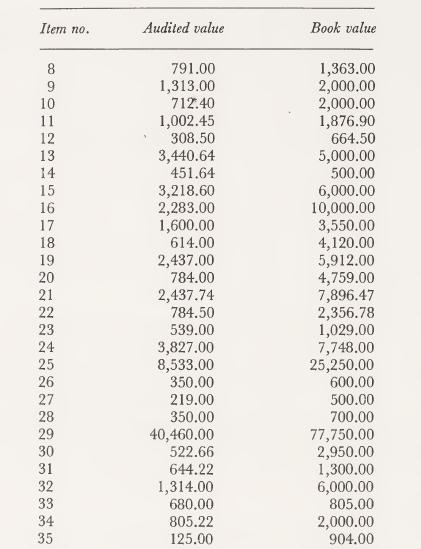

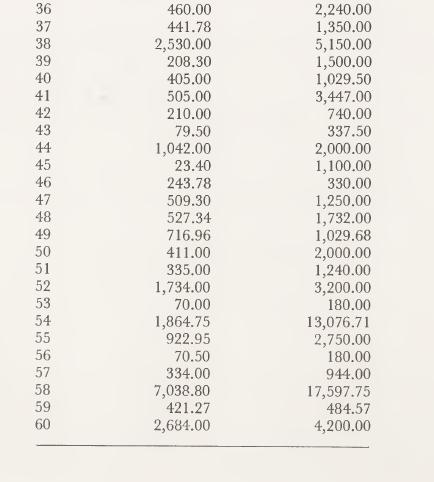

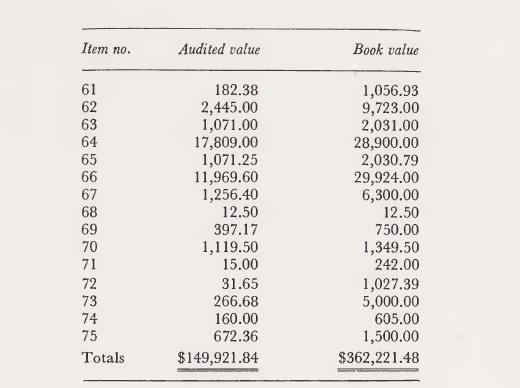

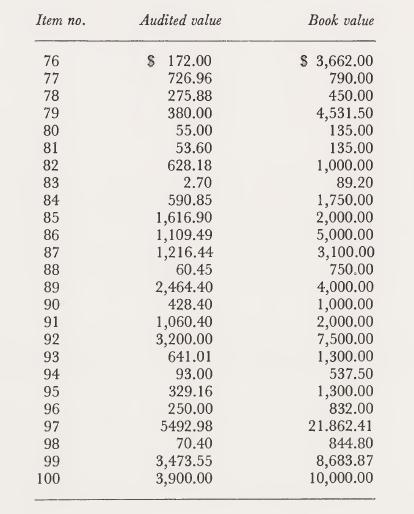

You decide that the proper technique is either ratio or difference estimation. The sampling unit is defined as the check, since the population size for the line items is not determinable. You define the total payment as the book value and the amount applicable to the new trust as the audited value.

You decide to randomly select 75 items to obtain more information about the population. The sample information is included below. In addition, you and the client agree on a confidence level of 95% and an allowable error of \($1,900,000\).

Required :

a. Is the appropriate statistical test an interval estimate or a hypothesis test? Explain.

b. Calculate the required sample size using difference estimation.

c. Calculate the required sample size using ratio estimation.

d. Compare your answers and explain the reason for the difference.

e. Based on the results of the sample size calculation, 25 additional items were selected. Using all 100 sample items, calculate the confidence limits using difference and ratio estimation.

f. Prepare an entry to adjust the recorded book value if the allowable error requirements are satisfied. After the adjustment is made, use the statistical method resulting in the lowest computed precision interval.

Step by Step Answer:

Applications Of Statistical Sampling To Auditing

ISBN: 9780130391568

1st Edition

Authors: Alvin A. Arens, James K. Loebbecke