A financial advisor wants to determine what factors influence a mutual funds rate of return. A random

Question:

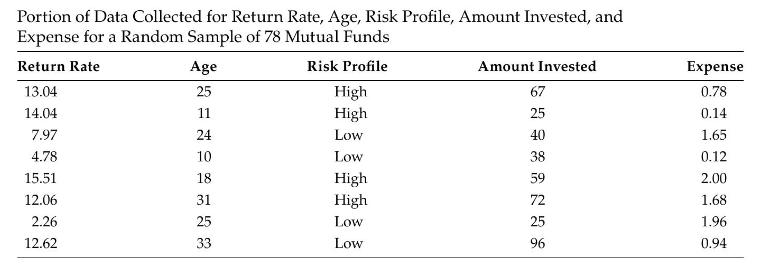

A financial advisor wants to determine what factors influence a mutual funds rate of return. A random sample of 1-year return rates (expressed as a percentage) for 78 mutual funds was collected along with measures of the age of the fund (rounded to the nearest year), the risk profile of the fund (high or low risk), the amount invested in the fund (in millions of dollars), and the expense to manage the fund (expressed as a percentage). A portion of the data is given in Table 9.7.

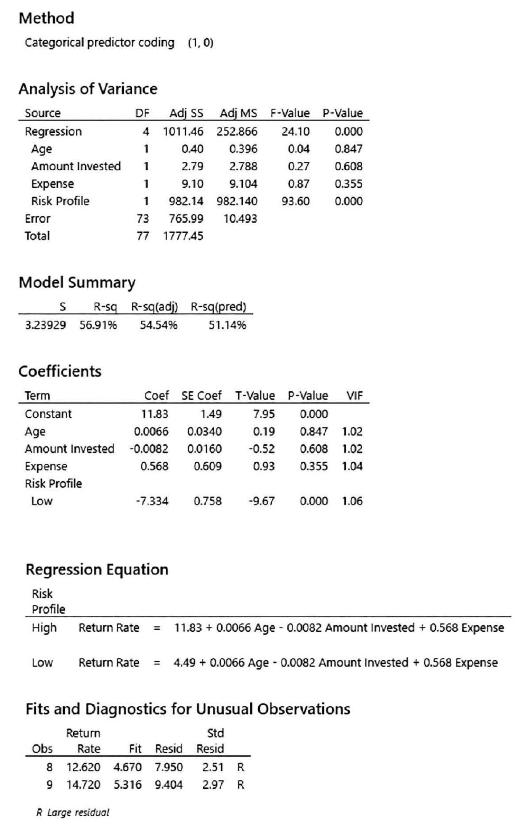

Use the information from the printout in Figure 9.21 and answer each of the following questions \((\alpha=0.10)\) :

a. Which variables are continuous and which variables are discrete (nominal/ ordinal)?

b. Write the population regression equation.

c. Write the estimated regression equation.

d. Is the overall model useful in predicting the rate of return?

e. What are the effects of each of the different predictor (independent) variables? Interpret any and all significant effects.

f. Find and interpret the coefficient of determination.

g. Determine you believe that whether any of your predictor variables are highly correlated with each other.

h. Do you think the given model is a good model for predicting the rate of return? Justify your answer.

Figure 9.21

Table 9.7

Step by Step Answer: