Repeat questions 2327, using GM stocks rates of return. Question 25 Using R 2 as the measure

Question:

Repeat questions 23–27, using GM stock’s rates of return.

Question 25

Using R2 as the measure of goodness of fit, compare the market model estimated in question 23 with the CAPM version estimated in question 24.

Question 24

In finance, we sometimes choose to estimate the capital asset pricing (CAPM)

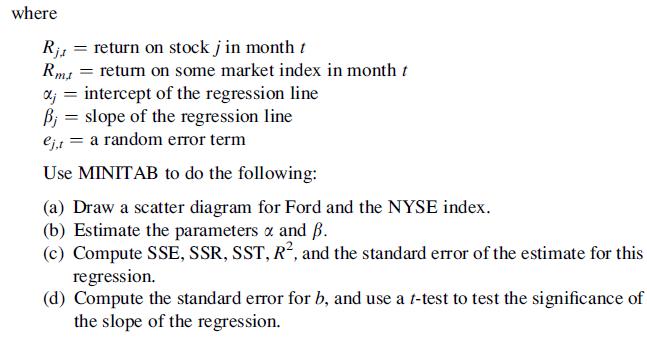

version of the market model, which is given by the equation![]()

where Rj,t is the return on a risk-free asset (such as T-bills) in month t. Repeat parts (a)–

(d) of question 23 for the CAPM version of the market model using the MINITAB program.

Question 23

In finance, we are often interested in how the return of one stock is related to some market index such as the NYSE. The model we usually estimate to understand this relationship is known as the market model and is given by the equation![]()

Question 26

Find a 95 % confidence interval for the slope coefficients you calculated in questions 23 and 24. Which estimate of b has the wider confidence interval?

Question 27

Suppose we are interested in testing whether β is equal to 1. Then we would test H0: β = 1 against H1: β ≠ 1. Using the model given in question 23, test this hypothesis.

Step by Step Answer:

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee