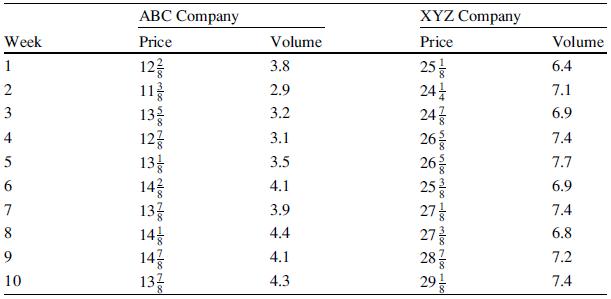

The following table shows the price and volume of shares (in thousands) traded for ABC Company and

Question:

The following table shows the price and volume of shares (in thousands) traded for ABC Company and XYZ Company in the first 10 weeks of 1991.

Compute the market-value-weighted index using week 1 as the base.

Transcribed Image Text:

Week 1 2 3 4 56 9 7 8 9 10 ABC Company Price 12 100 mloo ni100 1100 11 13 12 -100 13- 143 N100 00 133 14 -1000 11000 100 14 133 Volume 3.8 2.9 3.2 3.1 3.5 4.1 3.9 4.4 4.1 4.3 XYZ Company Price 25/ 24/ Noo in 100 inloo enloo-loo enloo 100-100 24 26//2 26/ 25 27/ 27 28/ 29- Volume 6.4 7.1 6.9 7.4 7.7 6.9 7.4 6.8 7.2 7.4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

Answered By

Umber Talat

I am providing full time mentoring and tutoring services in Business Finance, Contemporary issue in Global Economy, Quantitative Techniques, Principles of Marketing, strategic marketing, International Marketing, Organizational Behavior (OB), Consumer Behavior, Sales Force Management, Strategic Brand Management, Services Marketing, Integrated Marketing Communication (IMC), Principles of Management, General Management, Strategic Management, Small and Medium Enterprise Management, Innovation Management, Change Management, Knowledge Management, Strategic Planning, Operations Management, Supply Chain Management, Logistics Management, Inventory management, Total Quality Management (TQM), Productions Management, Project Management, Production Planning, Human Resource Management (HRM), Human Resource Development, Strategic HRM, Organizational Planning, Performance and Compensation Management, Recruitment and Selection, Organizational Development, Global Issues in Human Resource Management, Retail Marketing, Entrepreneurship, Entrepreneurial Marketing, International Business, Research Methods in Business, Business Communication, Business Ethics.

4.70+

158+ Reviews

236+ Question Solved

Related Book For

Statistics For Business And Financial Economics

ISBN: 9781461458975

3rd Edition

Authors: Cheng Few Lee , John C Lee , Alice C Lee

Question Posted:

Students also viewed these Business questions

-

Redo question 43, this time using week 5 as the base. Compare the results to your results in question 43. Question 43 Use the data given in question 42, and use week 1 as the base, to compute: (a)...

-

Use the data given in question 42, and use week 1 as the base, to compute: (a) The Laspeyres aggregative quantity index (b) The Paasche aggregative quantity index (c) Fishers ideal quantity index...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Jimmy and Elizabeth plan on getting married on the 15th of August. Elizabeth decides that she would prefer to have the reception in her backyard, so she rents an event tent from CELEBRATE Ltd, a firm...

-

Read article from RFID Journal.com (Mississippi Blood Services Banks on RFID) link provided below and write a summary from that article. www.rfidjournal.com/articles/view?247

-

Consider an American call option with a continuously changing strike price X() where dX()/d Define the following new set of variables: Show that the governing equation for the price of the above...

-

Consider your favorite restaurant. Are the terminal values of this company apparent to the customer? If so, what are they? What instrumental values do the employees use to demonstrate the restaurants...

-

1 Outline the role that a government-owned company might take in its management of a major piece of transport infrastructure (could be a road, railway or airport, for instance). 2 Should it be...

-

Calculate the price of the following bonds, where F is the face value, c is the coupon rate, N is the number of years to maturity, and i is the interest rate (or discount rate, or yield). Please show...

-

Required information The Foundational 15 (Algo) [LO14-2, LO14-3, LO14-4, LO14-5, LO14-6] [The following information applies to the questions displayed below.] Markus Company's common stock sold for...

-

The following table shows the price per pound and the volume (in thousands of pounds) for chicken and beef at Eat More Grocery Store. Use week 1 as the base to: (a) Compute the Laspeyres aggregative...

-

The following table shows the average price, taken monthly, of Widget Company stock over the last year. (a) Form a price index, using week 1 as the base. (b) Form a price index, using week 7 as the...

-

Paul and Julie Leonards two-story home in Pascagoula, Mississippi, is only twelve feet above sea level and less than two hundred yards from the Gulf of Mexico. In 1989, the Leonards bought a...

-

Stefney Christian Date: 06/26/2023 To: From: New England Patriot Subject: Analysis of Aircraft Purchase vs. Chartering Decision I've done a thorough analysis of the decision to buy or charter a plane...

-

The Giovonis' monthly income is $9000. The have 14 remaining payments of $269 on a new car and 16 payments of $70 remaining on their living room furniture. The taxes and insurance on the house are...

-

2. Determine the following inverse z-transforms using partial fraction expansion method. a. The sequence is right sided (causal). 1 z 14z 2 + 4z-3 X(z) = 11 1 Z-1 13 + 2-2 8 1 -3 4Z b. The sequence...

-

(4 pts) 1. Find all vertical and horizontal asymptotes of the function f(x) (You do NOT need to show the limit work) 2x2-2 x+4x+3

-

Cherboneau Novelties produces drink coasters (among many other products). During the current year (year 0), the company sold 532,000 units (packages of 6 coasters). In the coming year (year 1), the...

-

Five years ago, Cora incorporated Gold, Inc., by contributing $80,000 and receiving 100% of the Gold common stock. Gold, Inc. is engaged in a retail business. Cora is single. Gold experienced...

-

A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7 percent and a standard deviation of 12 percent. The risk-free rate is 2.7 percent, and the expected...

-

Suppose the risk-free rate is 2.1 percent and the market portfolio has an expected return of 10.6 percent. The market portfolio has a variance of .0432. Portfolio Z has a correlation coefficient with...

-

Mitra Company sells equipment on March 31, 2014, for $15,000 cash. The equipment was purchased on January 5, 2009, at a cost of $86,400, and had an estimated useful life of six years and a residual...

-

Caspian Sea Drinks needs to raise $74.00 million by issuing additional shares of stock. If the market estimates CSD will pay a dividend of $2.69 next year, which will grow at 3.45% forever and the...

-

i need help in B and C Integrative Case 5-72 (Algo) Cost Estimation, CVP Analysis, and Decision Making (LO 5-4.5.9) Luke Corporation produces a variety of products, each within their own division....

-

Relate PSA (Public Securities Association) speed to the average life of a MBS. Describe the PSA measure and discuss which MBS would have the greater average life, one with a PSA of 100 or one with a...

Study smarter with the SolutionInn App