(7) A company is planning to re-equip one of its major production plants and one of two...

Question:

(7) A company is planning to re-equip one of its major production plants and one of two types of machine, the Zeta and the Precision II, is to be purchased. The prices of the two machines are very similar so the choice of machine is to be based on two factors: running costs and reliability. It is agreed that these two factors can be represented by the variables ‘average weekly operating costs’ and ‘number of breakdowns in the first year of operation.’ The company’s production manager estimates that the following probability distributions apply to the two machines. It can be assumed that the probability distributions for operating costs and number of breakdowns are independent.

(8) The managers of the Lightning Cycle Company are hoping to develop a new bicycle braking system. Two alternative systems have been proposed and, although the mechanics 146 of the two systems are similar, one design will use mainly plastic components while the other will use mainly metal ones. Ideally, the design chosen would be the lightest and the most durable but, because some of the technology involved is new, there is some uncertainty about what the characteristics of the resulting product would be.

The leader of Lightning’s research and development team has estimated that if the plastic design is developed there is a 60% chance that the resulting system would add 130 grams to a bicycle’s weight and would have a guaranteed lifetime of 1 year. He also reckons that there is a 40% chance that a product with a 2-year lifetime could be developed, but this would weigh 180 grams.

Alternatively, if the metal design was developed the team leader estimates that there is a 70% chance that a product with a 2-year guaranteed life and weighing 250 grams could be developed. However, he estimates that there is a 30% chance that the resulting product would have a guaranteed lifetime of 3 years and would weigh 290 grams.

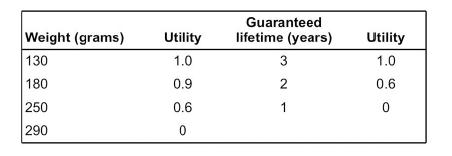

It was established that, for the team leader, weight and guaranteed lifetime were mutually utility independent. The following utilities were then elicited from him:

After further questioning the team leader indicated that he would be indifferent between the following alternatives:

A. A product which was certain to weigh 130 grams, but which had a guaranteed lifetime of only 1 year.

B. A gamble which offered a 0.7 probability of a product with a weight of 130 grams and a guaranteed lifetime of 3 years and a 0.3 probability of a product with a weight of 290 grams and a guaranteed lifetime of 1 year.

Finally, the team leader said that he would be indifferent between alternatives C and D below.

C. A product which was certain to weigh 290 grams, but which had a guaranteed lifetime of 3 years.

D. A gamble which offered a 0.9 probability of a product with a weight of 130 grams and a guaranteed lifetime of 3 years and a 0.1 probability of a product with a weight of 290 grams and a guaranteed lifetime of 1 year.

(a) What do the team leader’s responses indicate about his attitude to risk and the relative weight which he attaches to the two attributes of the proposed design?

(b) Which design should the team leader choose, given the above responses?

(c) What further analysis should be conducted before a firm recommendation can be made to the team leader?

Step by Step Answer:

Decision Analysis For Management Judgment

ISBN: 9781118740736,9781118889251

5th Edition

Authors: Paul Goodwin , George Wright