During 2007 Calico Company experienced the following accounting events: 1. Provided ($120,000) of services on account. 2.

Question:

During 2007 Calico Company experienced the following accounting events:

1. Provided \($120,000\) of services on account.

2. Collected \($85,000\) cash from accounts receivable.

3. Wrote off \($1,800\) of accounts receivable that were uncollectible.

4. Loaned \($3,000\) to an individual, Emma Gardner, in exchange for a note receivable.

5. Paid \($90,500\) cash for operating expenses.

6. Estimated that uncollectible accounts expense would be 2 percent of credit sales. Recorded the year-end adjusting entry.

7. Recorded the year-end adjusting entry for accrued interest on the note receivable. Calico made the loan on August 1. It had a six-month term and a 6 percent rate of interest.

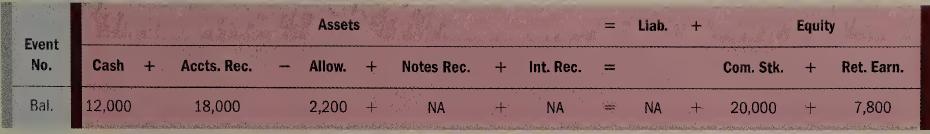

Calico’s ledger balances on January 1, 2007, were as follows:

Required:

a. Record the 2007 events in ledger accounts using the horizontal format shown above.

b. Determine net income for 2007.

c. Determine net cash flow from operating activities for 2007.

d. Determine the net realizable value of accounts receivable at December 31, 2007.

e. What amount of interest revenue will Calico recognize on its note receivable in 2008?

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay