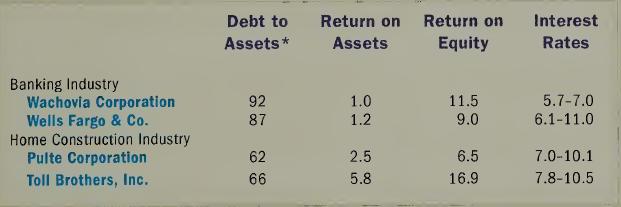

Following are the debt to assets, return on assets, and return on equity ratios for four companies

Question:

Following are the debt to assets, return on assets, and return on equity ratios for four companies from two different industries. The range of interest rates each company was paying on its long-term debt is provided. Each of these public companies is a leader in its particular industry, and the data are for the fiscal years ending in 1997. All numbers are percentages.

Required:

a. Based only on the debt to assets ratios, the banking companies appear to have the most financial risk. Generally, companies that have more financial risk are charged higher interest rates. Write a brief explanation of why the banking companies can borrow money at lower interest rates than the construction companies.

b. Explain why the return on equity ratio for Wachovia is more than 10 times higher than its return on assets ratio, and Pulte’s return on equity ratio is less than 3 times higher than its return on assets ratio.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay