Listed here are data for five companies. These data are from companies annual reports for the fiscal

Question:

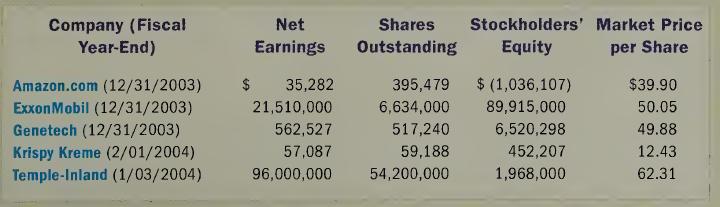

Listed here are data for five companies. These data are from companies’ annual reports for the fiscal year indicated in the parentheses. The market price per share is the closing price of the companies’ stock as of November 17, 2004. Except for market price per share, all amounts are in thousands. The shares outstanding number is the weighted-average number of shares the company used to compute its basic earnings per share.

Required:

a. Compute the earnings per share (EPS) for each company.

b. Compute the P/E ratio for each company.

c. Using the P/E ratios, rank the companies’ stock in the order that the stock market appears to value the companies, from most valuable to least valuable. Identify reasons the ranking based on P/E ratios may not represent the market’s optimism about one or two companies.

d. Compute the book value per share for each company.

e. Compare each company’s book value per share to its market price per share. Based on the data, rank the companies from most valuable to least valuable. (The higher the ratio of market value to book value, the greater the value the stock market appears to be assigning to a company’s stock.)

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay