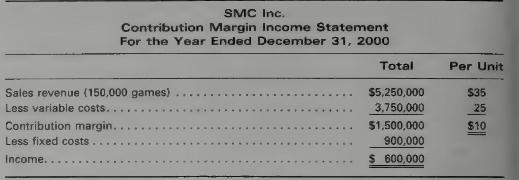

SMC Inc. is a producer of hand-held electronic games. Its 2000 income statement was as follows: In

Question:

SMC Inc. is a producer of hand-held electronic games. Its 2000 income statement was as follows:

In preparing its budget for 2001, SMC is evaluating the effects of changes in costs, prices, and volume on income.

Required:

Evaluate the following independent cases, and determine SMC's 2001 budgeted income or loss in each case. (Assume that 2000 figures apply unless stated otherwise.)

1. Fixed costs increase $\$ 150,000$.

2. Fixed costs decrease $\$ 100,000$.

3. Variable costs increase $\$ 3$ per unit.

4. Variable costs decrease $\$ 4$ per unit.

5. Sales price increases $\$ 5$ per unit.

6. Sales price decreases $\$ 5$ per unit.

7. Sales volume increases 25,000 units.

8. Sales volume decreases 15,000 units.

9. Sales price decreases $\$ 4$ per unit, sales volume increases 40,000 units, and variable costs decrease by $\$ 2.50$ per unit.

10. Fixed costs decrease by $\$ 100,000$, and variable costs increase $\$ 4$ per unit.

11. Sales volume increases 30,000 units, with a decrease in sales price of $\$ 2$ per unit. Variable costs drop $\$ 1.50$ per unit, and fixed costs increase $\$ 50,000$.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780538846172

1st Edition

Authors: James D. Stice, W. Steve Albrecht, Earl Kay Stice, K. Fred Skousen