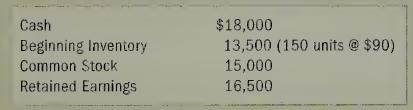

The accounting records of Clear Photography, Inc., reflected the following balances as of January 1, 2007: The

Question:

The accounting records of Clear Photography, Inc., reflected the following balances as of January 1, 2007:

The following five transactions occurred in 2007:

1. First purchase (cash) 120 units @ \($92\) .

2. Second purchase (cash) 200 units @ \($100\) .

3. Sales (all cash) 300 units @ \($185\) .

4. Paid \($15,000\) cash for operating expenses.

5. Paid cash for income tax at the rate of 40 percent of income before taxes.

Required:

a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flows (2) LIFO cost flow, and (3) weighted-average cost flow'. Compute income tax expense for each method.

b. Use a vertical model to show the 2007 income statement and statement of cash flows under FIFO, LIFO, and weighted average.

Step by Step Answer:

Survey Of Accounting

ISBN: 9780077503956

1st Edition

Authors: Thomas Edmonds, Philip Olds, Frances McNair, Bor-Yi Tsay