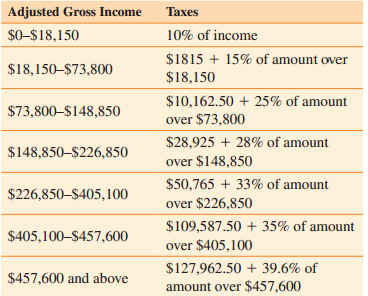

The federal income tax rate schedule for a joint return in 2014 is illustrated in the table

Question:

Transcribed Image Text:

Adjusted Gross Income Taxes $0-$18,150 10% of income $1815 + 15% of amount over $18,150-$73,800 $18,150 $10,162.50 + 25% of amount over $73,800 $73,800-$148,850 $28,925 + 28% of amount over $148,850 $148,850–$226,850 $50,765 + 33% of amount over $226,850 $226,850-$405,100 $109,587.50 + 35% of amount $405,100-$457,600 over $405,100 $127,962.50 + 39.6% of $457,600 and above amount over $457,600

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 46% (13 reviews)

The family paid more than 1016250 but less tha...View the full answer

Answered By

Rinki Devi

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions.

Hi there! Are you looking for a committed, reliable, and enthusiastic tutor? Well, teaching and learning are more of a second nature to me, having been raised by parents who are both teachers. I have done plenty of studying and lots of learning on many exciting and challenging topics. All these experiences have influenced my decision to take on the teaching role in various capacities. As a tutor, I am looking forward to getting to understand your needs and helping you achieve your academic goals. I'm highly flexible and contactable. I am available to work on short notice since I only prefer to work with very small and select groups of students.

I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and helped them achieve great subject knowledge.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

A Survey of Mathematics with Applications

ISBN: 978-0134112107

10th edition

Authors: Allen R. Angel, Christine D. Abbott, Dennis Runde

Question Posted:

Students also viewed these Mathematics questions

-

Refer to Exercise 19.24. Is there sufficient evidence to infer that people who work for themselves (WRKSLF: 1 = Self-employed, 2 = Work for someone else) differ from those who work for someone else...

-

Does age (AGE) affect ones belief concerning the federal income tax that one has to pay (TAX: Do you consider the amount of federal income tax that you have to pay as too high, about right, or too...

-

The Bureau of Labor Statistics reports that one use of the Consumer Price Index is to periodically adjust the federal income tax structure, which sets higher tax rates for higher income brackets....

-

Explain why an economic tradeoff exists between the number of trays and the reflux ratio.

-

Use Worksheet 11.2 to help Clayton and Julie Grover, a married couple in their early 40s, evaluate their securities portfolio, which includes these holdings. a. IBM. (NYSE; symbol IBM): 100 shares...

-

In the coming year, Game Monster, Inc. will be introducing its fi rst product, a wrist brace that protects serious video gamers from repetitive-motion injuries. The brace will be sold for $12 to...

-

(c) Obtain diagnostic plots of the residuals and consider whether the assumptions on which the analysis is based are reasonable.

-

On January 1, 2014, the ledger of Werth Company contains the following liability accounts. Accounts Payable ......... $35,000 Sales Taxes Payable ........ 5,000 Unearned Service Revenue ..... 12,000...

-

Current Attempt in Progress The following data were taken from the records of Grouper Company for the fiscal year ended June 30, 2022. Raw Material Inventory 7/1/21 $51,600 Factory Insurance $5,200...

-

Find a current computer ad in a magazine or newspaper or online. Identify each of the featured items in the ad, show its position in the system block diagram of Figure 11.1, explain how it operates,...

-

Which of the following SQL statements determines how many total customers were referred by other customers? a. SELECT customer#, SUM (referred) FROM customers GROUP BY customer#; b. SELECT COUNT...

-

Use the following SELECT statement to answer. 1 SELECT customer#, COUNT(*) 2 FROM customers JOIN orders USING (customer#) 3 WHERE orderdate > '02-APR-09' 4 GROUP BY customer# 5 HAVING COUNT(*) > 2;...

-

Tracking requests is a common need for both systems development projects and also for IS departments and, indeed, with any service department. With accurate request tracking, management can get...

-

Sample for a Poll There are 30,488,983 Californians aged 18 or older. If The Gallup organization randomly selects 1068 adults without replacement, are the selections independent or dependent? If the...

-

Part A: You have successfully graduated Conestoga College and have joined a public accounting firm in their tax department. You have been assigned to work on a project with Emily Wilson, one of the...

-

Write a program that gets a list of integers from input, and outputs negative integers in descending order (highest to lowest). Ex: If the input is: 10 -7 4-39 -6 12 -2 the output is: -2-6-7-39 For...

-

The manager of a division that produces add-on products for the automobile industry had just been presented the opportunity to invest in two independent projects. The first is an air conditioner for...

-

4. We are interested in the effect on test scores of the student-teacher ratio (STR). The following regression results have been obtained using the California data set. All the regressions used...

-

If the price of oil increases, the OPEC countries are in agreement. If there is no U.N. debate, the price of oil increases. The OPEC countries are in disagreement. Therefore, there is a U.N. debate.

-

Find i 0 (t) for t > 0 in the circuit in Fig. 16.72 . 2 + Vo 1 7.5e-2t u(t) V ( +) 4.5[1 u(t)]V 0.5v. 1H

-

Construct a truth table for the statement. p ~q

-

A leap year has 366 days and a week has eight days if and only if an hour has 24 minutes. Determine the truth value of the statement.

-

Use an Euler diagram to determine whether the syllogism is valid or invalid. All yo-yos are toys. All Slinkies are toys. All Slinkies are yo-yos.

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

-

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

Study smarter with the SolutionInn App