A company has the following results for the three years to 31 March 2021: Assuming that the

Question:

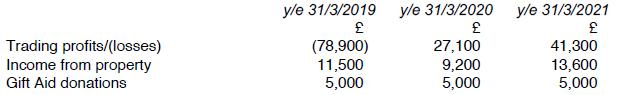

A company has the following results for the three years to 31 March 2021:

Assuming that the trading loss of £78,900 is carried forward and that maximum loss relief is taken as soon as possible, calculate the company's taxable total profits for each of these three years. Should the company claim less than maximum loss relief in any year?

Transcribed Image Text:

Trading profits/(losses) Income from property Gift Aid donations y/e 31/3/2019 y/e 31/3/2020 (78,900) 11,500 5,000 27,100 9,200 5,000 y/e 31/3/2021 41,300 13,600 5,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Trading profits Income from property Less Trading losses bf Less Qualifying charitable donations Tax...View the full answer

Answered By

Grace Igiamoh-Livingwater

I am a qualified statistics lecturer and researcher with an excellent interpersonal writing and communication skills. I have seven years tutoring and lecturing experience in statistics. I am an expert in the use of computer software tools and statistical packages like Microsoft Office Word, Advanced Excel, SQL, Power Point, SPSS, STATA and Epi-Info.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Timbuk2 Inc. manufactures over 100,000 different versions of messenger bags. Suppose Timbuk2 implements an order-up-to model to manage its inventory of a particular plastic buckle. Timbuk2 places an...

-

A company has the following results for the three years to 31 March 2022: Assuming that the trading loss is carried forward and that maximum loss relief is taken as soon as possible, calculate the...

-

A company has the following results for the three years to 31 March 2021: Assuming that the trading loss is carried forward and that maximum loss relief is taken as soon as possible, calculate the...

-

In the context of channel-of-distribution structures, discuss the distinguishing features of the Japanese distribution structure. Now, explain why the Japanese have not embraced the U.S distribution...

-

The research/policy paper is a distillation of the readings, discussion, and individual reflections on a particular area in border security. The topic for the paper "Illegal immigration". Explain it.

-

(c) Compare graphically the estimates of the genotype mean yields obtained by the two methods. How much effect will the choice of method have on the decisions made by a breeder seeking genetic...

-

What are the FASB's key initiatives in its international convergence project? LO4

-

Facts: Your client is the plaintiff in a workers' compensation case. She was injured in 1993 in state A. In 1995, her employer destroyed all the business records relating to the client. The...

-

2. A 8.25%, 15-year convertible bond has a conversion rate of 38. Currently, the stock is at $26. Calculate the price of the bond if it is trading at a 12 percent conversion premium.

-

A company has the following results for the year to 31 December 2020: Assuming that a claim is made for the trading loss to be relieved against total profits, compute the company's taxable total...

-

In the year to 31 March 2019, a company incurred a trading loss of 270,000 which was carried forward. The company's results for the next two years were: (a) Compute the company's taxable total...

-

Solvent A is to be separated from water by distillation to produce a distillate containing 95 mol% A at a 95% recovery. The feed is available in two saturated-liquid streams, one containing 40 mol% A...

-

D manufacturing Company uses a process cost system. In the second department, Department X, spoiled units occur when units are 70% complete. Direct Materials are added at the end of the process....

-

This week, I read Pat Friman's 2021 article, "There Is no Such Thing As a Bad Boy: The Circumstances View of Problem Behavior," on adopting The Circumstances View when working with clients. In this...

-

Download the labour force statistic for Australia from the ABS website here. Use the data to answer the following questions only. You do not have to analyze the data. Show proof when you make...

-

Split Corporation manufactures products X, Y, and Z from a joint production process. Joint costs are allocated to products based on relative sales values of the products at the split-off point....

-

A television show conducted an experiment to study what happens when buttered toast is dropped on the floor. When 44 buttered slices of toast were dropped, 28 of them landed with the buttered side up...

-

a. Explain why WestJet and JetBlue decided to upgrade their reservation systems? b. Compare and contrast the software upgrade processes of WestJet and JetBlue?

-

U.S. households have become smaller over the years. The following table from the 2010 GSS contains information on the number of people currently aged 18 years or older living in a respondent's...

-

In January 2019 Katrina buys an item of movable plant and machinery for use in her business. The plant costs her 50,000 and capital allowances are claimed. Compute the chargeable gain arising in...

-

In January 2022 Karl sells a one-quarter interest in a chattel for 2,500. On the date of this sale, the remaining three-quarters interest is valued at 8,500. The chattel had cost Karl 3,850 in...

-

In September 2021 Kevin sells a drawing for 2,000. He bought the drawing in February 2015 for 50,000 when it was thought (incorrectly) to be by a famous artist. Compute the allowable loss.

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App