In the year to 31 March 2019, a company incurred a trading loss of 270,000 which was

Question:

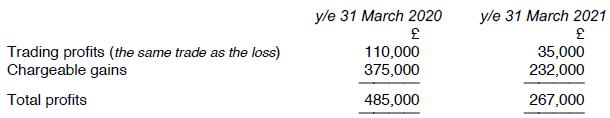

In the year to 31 March 2019, a company incurred a trading loss of £270,000 which was carried forward. The company's results for the next two years were:

(a) Compute the company's taxable total profits for the years to 31 March 2020 and 2021, assuming that maximum loss relief is taken as soon as possible.

(b) Would the company be wise to claim maximum loss relief in these years if the main rate of corporation tax was expected to rise in FY2021? What should the company do if the main rate of corporation tax was expected to fall in FY2021?

(c) How would the answer to part (a) of the question differ if the trading loss of £270,000 had been incurred in the year to 31 March 2017 and trading profits for the years to 31 March 2018 and 2019 were £27,000 and £58,000 respectively? Again assume that maximum loss relief is taken as soon as possible.

Step by Step Answer: