A company (which is not a member of a group) has the following results for the year

Question:

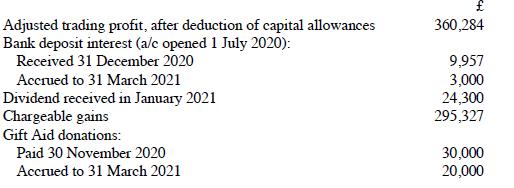

A company (which is not a member of a group) has the following results for the year to 31 March 2021:

The company intends to make Gift Aid donations of £30,000 every six months, starting on 30 November 2020.

(a) Compute the company's corporation tax liability for the year.

(b) State the date (or dates) on which this tax is due to be paid.

Transcribed Image Text:

Adjusted trading profit, after deduction of capital allowances Bank deposit interest (a/c opened 1 July 2020): Received 31 December 2020 Accrued to 31 March 2021 Dividend received in January 2021 Chargeable gains Gift Aid donations: Paid 30 November 2020 Accrued to 31 March 2021 360,284 9,957 3,000 24,300 295,327 30,000 20,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (4 reviews)

To compute the companys corporation tax liability for the year to 31 March 2021 we need to consider various components of its financial results Here i...View the full answer

Answered By

Gauri Hendre

I worked as EI educator for Eduphy India YT channel. I gave online tutorials to the students who were living in the villages and wanted to study much more and were preparing for NEET, TET. I gave tutions for topics in Biotechnology. I am currently working as a tutor on course hero for the biochemistry, microbiology, biology, cell biology, genetics subjects. I worked as a project intern in BAIF where did analysis on diseases mainly genetic disorders in the bovine. I worked as a trainee in serum institute of India and Vasantdada sugar institute. I am working as a writer on Quora partner program from 2019. I writing on the topics on social health issues including current COVID-19 pandemic, different concepts in science discipline. I learned foreign languages such as german and french upto A1 level. I attended different conferences in the science discipline and did trainings in cognitive skills and personality development skills from Lila Poonawalla foundation. I have been the member of Lila poonawalla foundation since 2017. Even I acquired the skills like Excel spreadsheet, MS Office, MS Powerpoint and Data entry.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A company (which is not a member of a group) has the following results for the year to 31 March 2022: The company intends to make Gift Aid donations of 30,000 every six months, starting on 30...

-

You work for firm XYZ situated in the United States, and your boss has become concerned about the current economic environment, especially as it is related to the different types of exposures that...

-

A company has the following results for the year to 31 March 2018: The company intends to make Gift Aid donations of 30,000 every six months, starting on 30 November 2017. (a) Compute the company's...

-

A record company needs to produce 100 gold records at one or more of its three studios. the cost of producing x records at studio 1 is 10 x; the cost of producing y records at studio 2 is 2y 2 ; the...

-

How IBM is using cloud computing? What is its vendors and technologies associated with it.

-

10.5 Return to the data on yields of wheat genotypes, investigated in an alphalpha design, presented in Table 9.5.

-

Even if all companies in the world were to use IFRS, what are two obstacles to the worldwide com parability of financial statements? LO4

-

For each of the transactions listed in Test Yourself Question 3, what will be the ultimate effect on the money supply if the required reserve ratio is one-eighth (12.5 percent)? Assume that the...

-

If a 90-day bill with a face value of $100,000 is issued at an annual discount rate of 6.75%, what will be the net proceeds of the issue after paying an acceptance fee of $100? A. $98,124.87 B....

-

A company (which is not a member of a group) has the following results for the 14 months to 31 December 2020: Accrued building society interest was 3,000 on 31 October 2019, 4,000 on 31 October 2020...

-

State the date (or dates) on which a "large" company would be required to settle its corporation tax liability for each of the following accounting periods: (a) the eleven months to 31 May 2020 (b)...

-

In your words, what is the locational impact of inventory? How does it differ for transit inventories and safety stocks?

-

In 2022, Andrew, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did...

-

1. What is the cost of direct materials used? 2. What is the cost of indirect materials used? 3. What is the cost of direct labour? 4. What is the cost of indirect labour? 5. What is the cost of...

-

Finding Critical Values. In Exercises 5-8, find the critical value za/2 that corresponds to the given confidence level. 5. 90% 6. 99%

-

You are an attorney at the law firm that represents Danfield's Auto Express. Your supervisor, Attorney Donna Defense, wants you to draft an internal memorandum of law to her assessing whether or not...

-

I desperately need help in this assignment, please help me!! Case Study Assignment You have recently been recruited by Velvet Chocolates Lid, a chocolate manufacturer, as an assistant management...

-

What are some reasons why Virginia's IT problems can be considered the result of poor execution by Northrop Grumman? What are some reasons, if any, why Northrop might be executing this project poorly?

-

In the operation of an automated production line with storage buffers, what does it mean if a buffer is nearly always empty or nearly always full?

-

Edwina bought a chargeable asset in August 2010 for 240,000, paying acquisition costs of 12,000. In June 2017 she sold a one-quarter interest in the asset for 100,000 and incurred disposal costs of...

-

David was given a chargeable asset in November 2015 at which time the asset had a market value of 7,500. He sold the asset in January 2022. Compute the chargeable gain or the allowable loss if his...

-

Carol purchased a holiday flat in December 2013 for 100,000. She spent 5,000 on installing central heating in February 2014 and a further 750 on repainting the interior of the flat in March 2014. The...

-

Read the following and then answer the questions below:September 12: A Brisbane business offers by letter to sell 500 tyres to a New Zealand company. The Brisbane company does not specify a method of...

-

Fred returns home from work one day to discover his house surrounded by police. His wife is being held hostage and threatened by her captor. Fred pleads with the police to rescue her and offers...

-

Would like you to revisit one of these. Consideration must be clear and measurable.if you can't measure it then how can you show it has / has not been done?How can you sue someone for breach of...

Study smarter with the SolutionInn App