(a) Sharon started a business on 1 April 2019. She chose 31 December as her annual accounting...

Question:

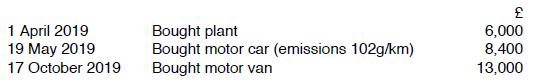

(a) Sharon started a business on 1 April 2019. She chose 31 December as her annual accounting date and her first accounts covered the period from 1 April 2019 to 31 December 2019. During this period she bought plant and machinery as follows:

She claims maximum capital allowances in all chargeable periods. Prepare a capital allowances computation for the nine months to 31 December 2019.

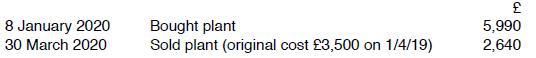

(b) Sharon's acquisitions and disposals of plant and machinery during the year to 31 December 2020 are as follows:

Prepare a capital allowances computation for the year to 31 December 2020.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: