Calculate the amount of CGT payable for 2020-21 by each of the following individuals. In each case,

Question:

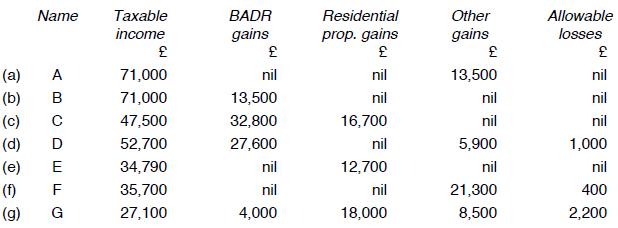

Calculate the amount of CGT payable for 2020-21 by each of the following individuals. In each case, "taxable income" comprises the individual's total income, less reliefs which may be deducted from total income and less the personal allowance

Assume in each case that there are no Gift Aid donations or pension contributions.

Transcribed Image Text:

Name (a) A (b) B (c) (d) D (e) E (f) F (g) G 6 Taxable income 71,000 71,000 47,500 52,700 34,790 35,700 27,100 BADR gains nil 13,500 32,800 27,600 nil nil 4,000 Residential prop. gains nil nil 16,700 nil 12,700 nil 18,000 Other gains 13,500 nil nil 5,900 nil 21,300 8,500 Allowable losses nil nil nil 1,000 nil 400 2,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

a Taxable income exceeds the basic rate limit so the other gains are taxed at 20 CGT payable is 1350...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Calculate the amount of CGT payable for 2019/20 by each of the following individuals. In each case, taxable income comprises the individuals total income, less reliefs which may be deducted from...

-

Calculate the amount of CGT payable for 2017-18 by each of the following individuals. In each case, "taxable income" comprises the individual's total income, less reliefs which may be deducted from...

-

Calculate the personal sav ings allowance available in 2017 -18 to a taxpayer with taxable income for the year (i.e. net income less any available personal allowance) of: (a) 20,000 (b) 33,501 (c)...

-

Problem 1 , Refer to Problem I. (a) Find the cumulative distribution function F(x). Be sure to write your answer in the appropriate way. (b) Find the mean value of X, i.e. find E(X). (c) Find the...

-

Describe/Explain at least two steps you could take to check whether or not a data set is normally distributed with reason.

-

Is the balanced scorecard a useful tool for developing, controlling and enhancing the strategy implementation process of an organisation? Why or why not? AppendixLO1

-

2 Qu efecto tiene el valor agregado en la posicin competitiva de una tienda?

-

The following information, in T-account format, is provided for Mars Company for the year 2012: Additional information: a. Sales revenue for the period was $164,000. Accounts receivable (net)...

-

A year ago, you deposited $30,000 into a retirement savings account at a fixed rate of 5.5 percent. Today, you could earn a fixed rate of 6.5 percent on a similar type account. However, your rate is...

-

Three taxpayers each have 3,000 of capital losses brought forward. Calculate their taxable gains for 2020-21 if their total gains and losses for the year are as follows: (a) Taxpayer A has gains of...

-

Four taxpayers each make three chargeable disposals during 2020-21. Compute their taxable gains for the year (assuming that there are no unrelieved losses brought forward or carried back) if these...

-

How do the concepts of theater, role theory, and script theory help to provide insights into consumer behavior during the service encounter?

-

Research the control system used by your corporation and select pieces of evidence of informational and behavioral control. Be aware that the evidence must respond to the full definition of each type...

-

What strategies can organizations employ to effectively manage workforce diversity and foster inclusion to leverage the full potential of their human capital in a globalized marketplace ?

-

You are given an array of integers representing the prices of a stock on different days. Write a function in JavaScript to calculate the maximum profit that can be obtained by buying and selling the...

-

The following selected information is available for the payroll computations of a company for the month of November 2021: Name of the Employee Gross Payroll for the month Elvira Robles Gloria...

-

Enter the code (from the Code tab) into your compiler. Compile your code and run it. Answer the following critical thinking questions. Save your answers in a Word document. What happens if you enter...

-

Describe Wi-Fi, cellular service, and WiMAX.

-

A fuel pump sends gasoline from a car's fuel tank to the engine at a rate of 5.88 10-2 kg/s. The density of the gasoline is 735 kg/m3, and the radius of the fuel line is 3.18 10-3 m. What is the...

-

Based on the facts and results of Problems, determine Kantners change in net deferred tax asset or net deferred tax liability for the current year. Provide the journal entry to record this amount. In...

-

Trip Garage, Inc. (459 Ellis Avenue, Harrisburg, PA 17111), is an accrual basis taxpayer that repairs automobiles. In late December 2014, the company repaired Samuel Mosley's car and charged him...

-

Alva received dividends on her stocks as follows. Amur Corporation (a French corporation whose stock is traded on an established U.S. securities market) ................. $60,000 Blaze, Inc., a...

-

Discuss American History

-

Your firm has developed a new lithium ion battery polymer that could enhance the performance of lithion ion batteries. These batteries have applications in many markets including cellphones, laptops,...

-

Need help analyzing statistical data 1. ANOVA) True or false: If we assume a 95% confidence level, there is a significant difference in performance generally across all groups. 2. (t-test) True or...

Study smarter with the SolutionInn App