Game, Set and Match begin trading in partnership on 1 August 2015 , preparing accounts to 31

Question:

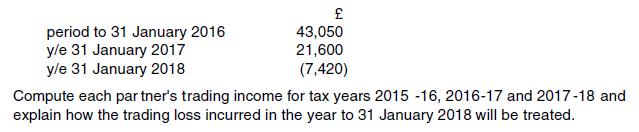

Game, Set and Match begin trading in partnership on 1 August 2015 , preparing accounts to 31 January each year and sharing profits equall y. With effect from 1 March 2016 , they agree to share profits in the ratio 1:2:2. The adjusted trading profits/(losses) of the partnership are as follows:

Transcribed Image Text:

period to 31 January 2016 y/e 31 January 2017 y/e 31 January 2018 43,050 21,600 (7,420) Compute each partner's trading income for tax years 2015-16, 2016-17 and 2017-18 and explain how the trading loss incurred in the year to 31 January 2018 will be treated.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

The allocation of trading profit or loss for each period of account is Notes i The basis period for ...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

You are a Senior Tax Consultant in a Tax Consultancy firm. The Tax Manager has presented the following information relating to two (2) of your clients in respect of which you should prepare...

-

Cluppins and Raddle form a partnership on 1 November 2017, preparing accounts to 31 May each year. Bardell is admitted as a partner on 1 January 2019. Cluppins leaves the partnership on 29 February...

-

Cluppins and Raddle form a partnership on 1 November 2013 , preparing accounts to 31 May each year. Bardell is admitted as a partner on 1 January 2015 . Cluppins leaves the partnership on 29 February...

-

Find reactions of support 1,2 and 3 F=10KN, a=2m, ?a=60 (45%) F 2a

-

Suppose that X is a negative binomial random variable with p _ 0.2 and r _ 4. Determine the following: (a) E(X1) (b) P(X =20) (c) P(X =19) (d) P(X =21) (e) The most likely value for X

-

What purpose does a study of current demographic trends serve from the point of view of the HR function in organisations? LO4

-

Explain why the balance as per the cash book and the balance as per the passbook must theoretically agree.

-

Department of Crinkle Chips had 110,000 partially completed units in work in process at the end of March. All of the direct materials had been added to these units, but the units were only 68% of the...

-

Please solve by hand and not on the computer. Thanks. What is the price of a call option with the same exercise price

-

Gordon is self -employed and a member of a registered pension scheme. His trading income for tax year 2016-17 is 27,800 but this falls to only 2,500 in 2017-18. (a) How much may Gordon contribute to...

-

Wardle, Jingle and Tro tter began trading on 1 October 2015 , preparing accounts to 30 September each year and sharing profits in the ratio 7:2:1. Results for the first two years of trading are as...

-

Water at 27C can exist in different phases dependent upon the pressure. Give the approximate pressure range in kPa for water being in each one of the three phases vapor, liquid or solid.

-

CLT HW Score: 0/19 0/19 answered Question 4 < = 31. You intend to draw a A population of values has a normal distribution with = 232.9 and random sample of size n = 165. Please show your answers as...

-

Q-3: Estimate fxy dx + x2 dy: where c is given by [Hint: Use Green's theorem -1

-

1. Determine completely the resultant of the four forces shown in the figure. Each force makes a 15 angle with the vertical, except the 200 N force which is vertical. Find the action line (position)...

-

1: Based on the results of your Learning Style produce a 1 pg reflection. (this is the result of the test i took: Your learning preference:Multimodal (AK) SharePeople with your preference like:...

-

Explain what the petty cashier should do if he or she thinks that the imprest amount is inadequate.

-

As a trainee accountant, you have been asked to determine the monetary value that should be assigned to the inventory of sporting equipment on hand as at the end of the financial year for Sportit...

-

A horizontal annulus with inside and outside diameters of 8 and 10 cm, respectively, contains liquid water. The inside and outside surfaces are maintained at 40 and 20oC, respectively. Calculate the...

-

During the quarter to 31 December 2020, Nancy makes supplies as follows: Compute the VAT provisionally payable to HMRC for the quarter. Standard-rated supplies (excluding VAT) Zero-rated supplies...

-

Sanjay began trading on 1 February 2020, selling standard-rated goods and services. He decided not to register for VAT voluntarily. His taxable turnover (excluding VAT) for the first 16 months of...

-

A standard-rated supply is made in May 2020 at a price of 340, plus VAT. Calculate the VAT chargeable and the consideration for the supply if: (a) no discount is offered (b) a 2% discount is offered...

-

Justice Corporation Comparative Balance Sheet December 31, 2025 and 2024 2025 2024 Assets Current Assets: $ Cash and Cash Equivalents 2,254 $ 1,876 Justice Corporation reported the following...

-

The Fields Company has two manufacturing departments forming and painting. The company uses the FIFO method of process costing at the beginning of the month the forming department has 33.000 units in...

-

A comparative balance sheet for Lomax Company containing data for the last two years is as follows: Lomax Company Comparative Balance Sheet This Year Last Year $ 96,000 $ 70,000 640,000 672,500...

Study smarter with the SolutionInn App