During the quarter to 31 December 2020, Nancy makes supplies as follows: Compute the VAT provisionally payable

Question:

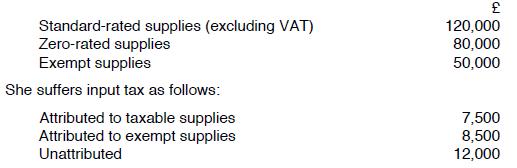

During the quarter to 31 December 2020, Nancy makes supplies as follows:

Compute the VAT provisionally payable to HMRC for the quarter.

Transcribed Image Text:

Standard-rated supplies (excluding VAT) Zero-rated supplies Exempt supplies She suffers input tax as follows: Attributed to taxable supplies Attributed to exempt supplies Unattributed 120,000 80,000 50,000 7,500 8,500 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Output tax Standardrated supplies 120000 20 Zerorated supplies 80000 0 Input t...View the full answer

Answered By

Lilian Nyambura

Hi, am Lilian Nyambura, With extensive experience in the writing industry, I am the best fit for your writing projects. I am currently pursuing a B.A. in Business Administration. With over 5 years of experience, I can comfortably say I am good in article writing, editing and proofreading, academic writing, resumes and cover letters. I have good command over English grammar, English Basic Skills, English Spelling, English Vocabulary, U.S. English Sentence Structure, U.K. or U.S. English Punctuation and other grammar related topics. Let me help you with all your essays, assignments, projects, dissertations, online exams and other related tasks. Quality is my goal.

4.80+

378+ Reviews

750+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

During the quarter to 31 December 2017, Nancy makes supplies as follows: Standard-rated supplies (excluding VAT) Zero-rated supplies Exempt supplies She suffers input tax as follows: Attributed to...

-

During the quarter to 31 December 2017, a taxable person makes the following supplies: Standard-rated supplies (including VAT) Zero-rated supplies Exempt supplies Input tax for the quarter is...

-

During the quarter to 31 December 2021, a taxable person makes the following supplies: Input tax for the quarter is 118,000. Of this input tax, 35% is attributed to taxable supplies, 40% is...

-

Song Corp's stock price at the end of last year was $26.25 and its earnings per share for the year were $1.30. What was its P/E ratio?

-

Identify which of the following regular tax amounts create AMT preferences. a. Depletion expense. b. Employee's exclusion for an employer's contribution to the employee's pension plan. c. Incentive...

-

-Discuss the following statement: Group cohesiveness is the good, warm feeling we get from working in groups and is something that all group leaders should strive to develop in the groups they lead....

-

What is the difference between positive change and negative change? Do positive changes create stress for an individual? Why or why not? AppendixLO1

-

For what purposes are departmental reports useful to management?

-

22. During the current year, Ros Company's cash balance increased from RM79,000 to RM91,300. Ros's net cash flow from operating activities was RM37,300 and its net cash flow from financing activities...

-

(a) During the quarter to 31 August 2020, Justin makes taxable supplies of 30,000 and exempt supplies of 20,000. Input tax incurred is 1,500. Does he pass either of the two simplified de minimis...

-

Sanjay began trading on 1 February 2020, selling standard-rated goods and services. He decided not to register for VAT voluntarily. His taxable turnover (excluding VAT) for the first 16 months of...

-

The root-mean-square speed of a certain gaseous oxide is 493 m/s at 20C. What is the molecular formula of the compound?

-

Use your own academic report, issued by your institute, as an example. Ask a database administrator how they use normalization steps to transform the details of the report into a set of relations in...

-

Francis Corp. has two divisions, Eastern and Western. The following information for the past year is for each division: Francis has established a hurdle rate of 9 percent. Required: 1. Compute each...

-

The enzyme lipase catalyzes the hydrolysis of esters of fatty acids. The hydrolysis of p-nitrophenyloctanoate was followed by measuring the appearance of p-nitrophenol in the reaction mixture: The...

-

Use values of r cov (Table 17.1) to estimate the XY bond lengths of ClF, BrF, BrCl, ICl and IBr. Compare the answers with values in Fig. 17.8 and Table 17.3, and comment on the validity of the method...

-

From a square whose side has length \(x\), measured in meters, create a new square whose side is \(10 \mathrm{~m}\) longer. Find an expression for the sum of the areas of the two squares as a...

-

The following measurements were collected hourly from two production processes. a. Construct a run chart for each of the processes. b. What can you conclude from the pattern of points on these two...

-

1. True or False. Pitfalls to consider in a statistical test include nonrandom samples, small sample size, and lack of causal links. 2. Because 25 percent of the students in my morning statistics...

-

Oscar created Lavender Corporation four years ago. The C corporation has paid Oscar as president a salary of $200,000 each year. Annual earnings after taxes approximate $700,000 each year. Lavender...

-

Tammy and Willy own 40% of the stock of Roadrunner, an S corporation. The other 60% is owned by 99 other shareholders, all of whom are single and unrelated. Tammy and Willy have agreed to a divorce...

-

Clay Corporation has been an S corporation since its incorporation 10 years ago. During the first three years of operations, it incurred total losses of $250,000. Since then, Clay has generated...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App