During the quarter to 31 December 2021, a taxable person makes the following supplies: Input tax for

Question:

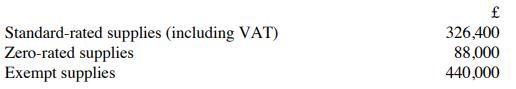

During the quarter to 31 December 2021, a taxable person makes the following supplies:

Input tax for the quarter is £118,000. Of this input tax, 35% is attributed to taxable supplies, 40% is attributed to exempt supplies and 25% is unattributed. Compute the VAT provisionally payable to or reclaimable from HMRC for the quarter.

Transcribed Image Text:

Standard-rated supplies (including VAT) Zero-rated supplies Exempt supplies 326,400 88,000 440,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To compute the VAT provisionally payable or reclaimable from HMRC well need to calculate the output ...View the full answer

Answered By

Tobias sifuna

I am an individual who possesses a unique set of skills and qualities that make me well-suited for content and academic writing. I have a strong writing ability, allowing me to communicate ideas and arguments in a clear, concise, and effective manner. My writing is backed by extensive research skills, enabling me to gather information from credible sources to support my arguments. I also have critical thinking skills, which allow me to analyze information, draw informed conclusions, and present my arguments in a logical and convincing manner. Additionally, I have an eye for detail and the ability to carefully proofread my work, ensuring that it is free of errors and that all sources are properly cited. Time management skills are another key strength that allow me to meet deadlines and prioritize tasks effectively. Communication skills, including the ability to collaborate with others, including editors, peer reviewers, and subject matter experts, are also important qualities that I have. I am also adaptable, capable of writing on a variety of topics and adjusting my writing style and tone to meet the needs of different audiences and projects. Lastly, I am driven by a passion for writing, which continually drives me to improve my skills and produce high-quality work.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

During the quarter to 31 December 2020, a taxable person Standard-rated supplies (including VAT) Zero-rated supplies Exempt supplies Input tax for the quarter is 118,000. Of this input tax, 35% is...

-

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2021 (all amounts shown are VAT-exclusive): Tracey drives a car with an emission rating of 128 g/km and...

-

Explain the meaning of the terms emoluments, employments and office for the purposes of PAYE as you earn systems. 2. Explain the actual receipts basis of assessing the emoluments from the employment...

-

Elastic bands are attached to tuning fork 1 ( which was 2 5 6 Hz ) to reduce its frequency. It is sounded again with tuning fork 2 ( 2 5 5 Hz ) , making 1 2 beats in 6 . 0 s . What is the new...

-

Reconsider Prob. 14136. Determine the desired quantities using EES (or other) software instead of the psychrometric chart. What would the answers be at a location at an atmospheric pressure of 80 kPa?

-

What are the main points of difference between CAQDAS and quantitative data analysis software such as SPSS?

-

More tetrahedral dice. Tetrahedral dice are described in Exercise 18.9. Give a probability model for rolling two such dice. That is, write down all possible outcomes and give a probability to each....

-

Lindex Company uses a process costing system. The following data are available for one department for October: The department started 390,000 units into production during the month and transferred...

-

According to the information below, actual ADR is lower than budgeted ADR

-

A residential project has the following information: Four major activities are scheduled across a 4-month time span (shown in the below bar chart). Assuming the monthly indirect cost (i.e., site...

-

Phoebe made the following transfers during 2021-22: None of the gifts are regarded as normal expenditure out of income. Phoebe made no transfers at all during 2020-21. Calculate the value of each of...

-

With regard to the VAT default surcharge, complete the following table: Quarter to 31 March 2020 30 June 2020 30 September 2020 31 December 2020 31 March 2021 30 June 2021 30 September 2021 31...

-

Suppose f (x) = 3x4 8x 3 + 6x + 1. From calculus, the second derivative of f is given by f (x) = 36x 2 48x. The function f is concave up where f (x) > 0 and concave down where f (x) < 0. Determine...

-

If the dose rate from a sample of Ga-67 is 0.052 mSv per hour at a distance of 1.1 m, then what would be dose rate at 3.5 m ?

-

A 1.6x10^9 p/s point source of Po210-Be source of 4.5 MeV is stored behind a X cm of paraffin, the dose equivalent rate is not to exceed 0.10 mSvh-1h at a distance of 1m. What is the X cm needed to...

-

X 10 Let A = -9 y 7 4 Z 210 If the kernel of A contains the vector what are x, y, and z? -2

-

8-22. E.O.Q., Carrying cost = Storing cost + Interest. Following data are available with respect to a certain material. Annual requirement.......... Cost to place an order.. Annual interest rate. _...

-

A new company started production. Job 1 was completed, and Job 2 remains in production. Here is the information from the job cost sheets from their first and only jobs so far: Job 1 Hours Total Cost...

-

In a spark-ignition engine, some cooling occurs as the gas is expanded. This may be modeled by using a polytropic process in lieu of the isentropic process. Determine if the polytropic exponent used...

-

Three forces with magnitudes of 70pounds, 40 pounds, and 60 pounds act on an object at angles of 30, 45, and 135, respectively, with the positive x-axis. Find the direction and magnitude of the...

-

At the start of business on 1 January 2024, the statements of financial position of A1 Ltd and A2 Ltd were as follows: On 1 January 2024, A1 Ltd acquired 100% of the share capital of A2 Ltd for...

-

Klarke plc acquired a subsidiary company, Cameroon Ltd, on 1 October 2022. The statements of financial position of Klarke plc and Cameroon Ltd as at 30 September 2023 are as follows: Additional...

-

On 1 January 2023, a company which prepares accounts to 31 December grants "share appreciation rights" to thirty of its employees. By virtue of these rights, the employees concerned will become...

-

Carnes Cosmetics Co.'s stock price is $58, and it recently paid a $2.50 dividend. This dividend is expected to grow by 21% for the next 3 years, then grow forever at a constant rate, g; and r s =...

-

You are the digital marketing director for High West fashions, a regional clothing company that specializes in custom t-shirts. Your company has decided to launch an online advertising campaign that...

-

In-the-money put options will automatically get exercised at the expiration. True OR False

Study smarter with the SolutionInn App