Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2021

Question:

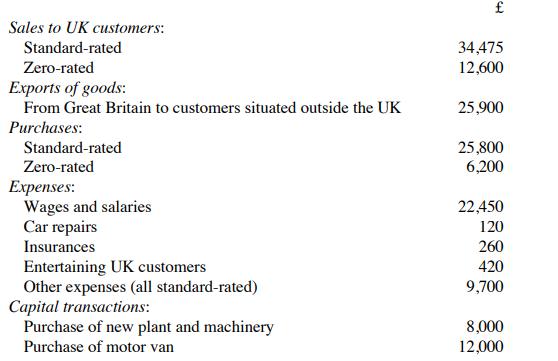

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2021 (all amounts shown are VAT-exclusive):

Tracey drives a car with an emission rating of 128 g/km and reclaims input tax on all of the fuel used by this car, whether for business or private motoring. She does not keep detailed mileage records. Calculate the amount of VAT due for the quarter.

Transcribed Image Text:

Sales to UK customers: Standard-rated Zero-rated Exports of goods: From Great Britain to customers situated outside the UK Purchases: Standard-rated Zero-rated Expenses: Wages and salaries Car repairs Insurances Entertaining UK customers Other expenses (all standard-rated) Capital transactions: Purchase of new plant and machinery Purchase of motor van 34,475 12,600 25,900 25,800 6,200 22,450 120 260 420 9,700 8,000 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

To calculate the VAT due for the quarter we need to consider both the output VAT collected on sales and the input VAT that can be reclaimed on purchas...View the full answer

Answered By

ZIPPORAH KISIO LUNGI

I have worked on several other sites for more than five years, and I always handle clients work with due diligence and professionalism. Am versed with adequate experience in the fields mentioned above in which have delivered quality papers in research, thesis, essays, blog articles, and so forth.

I have gained extensive experience in assisting students to acquire top grades in biological, business and IT papers. Notwithstanding that, I have 7+ years of experience in corporate world software design and development.

5.00+

194+ Reviews

341+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Tracey is a sole trader. She has the following transactions during the quarter to 31 December 2017 (all amounts shown are VAT-exclusive): Tracey drives a car with an emission rating of 16 4 g/km and...

-

Sebastian is self-employed. He drives a car with an emission rating of 168 g/km and he charges the cost of all the petrol used to his business bank account. In the quarter to 31 July 2021, he uses...

-

In integrative problem 86 in Chapter 4, you were asked to calculate Carmins gross income for 2013. This is the second phase, which provides the additional information necessary for you to calculate...

-

A charge q is placed a distance from the origin, and a charge 2q is placed a distance 2r. There is a charge Q at the origin. If a charges are positive, which charge is at the higher potential? A q B)...

-

A natural-draft cooling tower is to remove 50 MW of waste heat from the cooling water that enters the tower at 42C and leaves at 27C. Atmospheric air enters the tower at 1 atm with dry- and wet-bulb...

-

To what extent does CAQDAS help with qualitative data analysis?

-

Birth order. A couple plan to have three children. There are 8 possible arrangements of girls and boys. For example, GGB means the first two children are girls and the third child is a boy. All 8...

-

Blue Jay Delivery Service is incorporated on January 2, 2010, and enters into the following transactions during its first month of operations: January 2: Filed articles of incorporation with the...

-

Sales and Production Budgets budget: \ table [ [ , Rumble,Thunder ] , [ Estimated inventory ( units ) , June 1 , 2 8 0 , 8 2 ] , [ Desired inventory ( units ) , June 3 0 , 3 2 2 , 7 1 ] , [ Expected...

-

Mandy Peters, the lead accountant of Ross Co., would like to buy a new general ledger software program. She couldnt do it because all funds were frozen for the rest of the fiscal period. Mandy called...

-

Phoebe made the following transfers during 2021-22: None of the gifts are regarded as normal expenditure out of income. Phoebe made no transfers at all during 2020-21. Calculate the value of each of...

-

During the quarter to 31 December 2021, a taxable person makes the following supplies: Input tax for the quarter is 118,000. Of this input tax, 35% is attributed to taxable supplies, 40% is...

-

Consider the reaction FeO(s) + CO(g) Fe(s) + CO 2 (g) for which K P is found to have the following values: a. Calculate ÎG o R , ÎS o R , and ÎHR???? for this reaction at...

-

Companies in the tire manufacturing business use a lot of property, plant, and equipment. Tyrell Rubber and Tire Corporation and Maxwell Rubber and Tire Manufacturing are two of the leading...

-

(7%) Problem 11: A student launches a small rocket which starts from rest at ground level. At a height h = 2.09 km, the rocket reaches a speed of v = 291 m/s. At that height, the rocket runs out of...

-

2. For the following three sets of electric field lines, what charge or charges would make such lines? Indicate their locations and type of charge (e.g. positive/negative) a.

-

What is the most important take-home point that you learned from this video? https://www.youtube.com/watch?v=nUZqvsF_Wt0 2. Policy Problems. What is onepolicy that creates inequality in the labor...

-

An employee had $20,300 in gross earnings up to September 20, 2021. She has the following information for her pay for the week ending September 27, 2021. Her employer contributes 100% toward CPP and...

-

How does a diesel engine differ from a gasoline engine?

-

In Exercises 1-2, rewrite each verbal statement as an equation. Then decide whether the statement is true or false. Justify your answer. 1. The logarithm of the difference of two numbers is equal to...

-

On 31 December 2023, A3 Ltd paid 550,000 so as to acquire 80% of the ordinary share acapital of A4 Ltd. The statements of financial position of the two companies just after this transaction were as...

-

Consider each of the following assets and liabilities which appear in a company's statement of financial position at 30 April 2024: (a) A motor lorry which originally cost 100,000 is shown at its...

-

The statements of financial position of AA Ltd and of BB Ltd as at 30 April 2024 are as follows: The following information is relevant:(i) AA Ltd acquired the entire share capital of BB Ltd on 30...

-

( US$ millions ) 1 2 / 3 1 / 2 0 1 4 1 2 / 3 1 / 2 0 1 3 1 2 / 3 1 / 2 0 1 2 1 2 / 3 1 / 2 0 1 1 Net income $ 1 4 , 4 3 1 $ 1 2 , 8 5 5 $ 1 0 , 7 7 3 $ 9 , 7 7 2 Depreciation 3 , 5 4 4 2 , 7 0 9 1 ,...

-

net present value of zero

-

Suppose at Time 0 a dealer buys $100 par of a 4%-coupon 30-year bond for a price of par and posts the bond as collateral in a repo with zero haircut. The repo rate is 5%. Then, 183 days later, the...

Study smarter with the SolutionInn App