Jeremy, who has been married for many years, was born in 1934 and he receives a retirement

Question:

Jeremy, who has been married for many years, was born in 1934 and he receives a retirement pension of £28,000 per annum. He also receives dividend income of £4,500 per annum. In 2007 he purchased an annuity from which a monthly income of £325 (gross) is paid to him. The annuity was not purchased with assets held under a registered pension scheme. The capital element of each monthly payment is agreed with HMRC to be £300 and income tax is being deducted from the income element. Jeremy owns a furnished cottage which he rents to holidaymakers. In tax year 2020-21 it was let for 20 weeks at a weekly rental of £300.

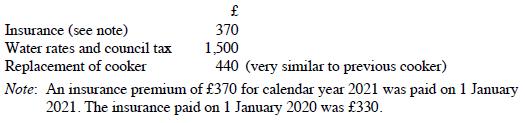

The following expenditure was incurred:

You are required:

To calculate the income tax payable by Jeremy for the year 2020-21, assuming that he is not a Scottish taxpayer, the property income is not assessed on the accruals basis and no elections have been made with respect to the MCA.

Step by Step Answer: