Kevin begins trading on 1 January 2016 . Taxable turnover during the first two years of trading

Question:

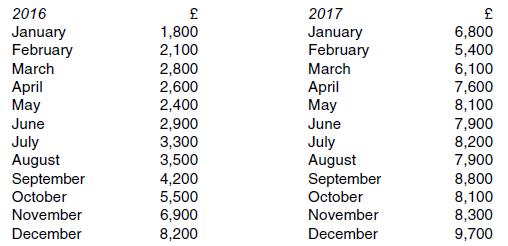

Kevin begins trading on 1 January 2016 . Taxable turnover during the first two years of trading is as follows:

The turnover in January 2017 includes £2,000 relating to the sale of machinery previously used in the trade. The VAT registration threshold was £ 82,000 until 1 April 2016 and £83,000 until 1 April 2017. State the date on which Kevin must register for VAT.

Transcribed Image Text:

2016 January February March April May June July August September October November December 1,800 2,100 2,800 2,600 2,400 2,900 3,300 3,500 4,200 5,500 6,900 8,200 2017 January February March April May June July August September October November December 6,800 5,400 6,100 7,600 8,100 7,900 8,200 7,900 8,800 8,100 8,300 9,700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 40% (5 reviews)

At the end of each month cumulative taxable turnover during the previous 12 mon...View the full answer

Answered By

Grace Igiamoh-Livingwater

I am a qualified statistics lecturer and researcher with an excellent interpersonal writing and communication skills. I have seven years tutoring and lecturing experience in statistics. I am an expert in the use of computer software tools and statistical packages like Microsoft Office Word, Advanced Excel, SQL, Power Point, SPSS, STATA and Epi-Info.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Kent Duncan is exploring the possibility of opening a self-service car wash and operating it for the next five years until he retires. He has gathered the following information: a. A building for the...

-

Tasmanian Motor Rental (TMR) is set up as a proprietary company in car rental industry and is considering whether to enter the discount rental car market in Tasmania. This project would involve the...

-

On January 1, 2010, Parker, Inc., a U.S.-based firm, acquired 100 percent of Suffolk PLC located in Great Britain for consideration paid of 52,000,000 British pounds (£), which was equal to...

-

Julia Robertson is a senior at Tech, and she's investigating different ways to finance her final year at school. She is considering leasing a food booth outside the Tech stadium at home football...

-

How long do the symptoms of Multiple Sclerosis last?

-

The U.S. Census Bureau reported the following total manufacturing shipments for the three years from 2005 through 2007. a. The CPI for 20052007 is given in Table 17.8. Use this information to deflate...

-

What is the need for maintaining subsidiary books?

-

As a new sales representative for Misco Equipment Corporation, you take a customer out to dinner. Before dinner is over, you have shaken hands on a deal to sell the customer nearly a half-million...

-

A firm using a Leveraged vs a Conservative Capital Structure would have the following characteristics: I. More flexible to changes in the economy II. Less flexible to changes in the economy III. More...

-

Sanjay began trading on 1 February 2017, selling standard -rated goods and services. He decided not to register for VAT voluntarily. His turnover (excluding VAT) for the first 16 months of trading...

-

(a) Jim is a sole trade r with a taxable turnover of 7 5,000 per annum. Is he required to register with HMRC? (b)Pearl and Dean are in partnership, operating a business with a taxable turnover of...

-

What advantages does the retail inventory method have over the gross profit method?

-

I have attached a case study, primarily based on your textbook chapter reading assignments. The background material for the case also references chapters 3 and 15, not assigned for this course....

-

On December 1 , 2 0 2 5 , Sandhill Distributing Company had the following account balances.DebitCash$ 7 , 1 0 0 Accounts Receivable 4 , 5 0 0 Inventory 1 1 , 9 0 0 Supplies 1 , 2 0 0 Equipment 2 2 ,...

-

Cindy Greene works at Georgia Mountain Hospital. The hospital experiences a lot of business closer to summer when the temperature is warmer. Cindy is meeting with her supervisor to go over the budget...

-

Use z scores to compare the given values. Based on sample data, newborn males have weights with a mean of 3247.4 g and a standard deviation of 575.4 g. Newborn females have weights with a mean of...

-

Gignment FULL SCAL Exercise 4- The following ndependent situations require professional judgment for determining when to recognize revenue from the transactions. Identify when revenue should be...

-

The management of Kayla Industries has been aggressive in trying to build market share. The price was set at $5 per unit, well below the existing market price. Variable costs were $4.50 per unit, and...

-

The following selected information was taken from Sun Valley Citys general fund statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 2019: Revenues:...

-

Otlay Ltd prepares accounts to 31 July each year. The company's financial statements for the year to 31 July 2022 showed a liability for current tax of 120,000. This was an estimate of the current...

-

A summarised statement of comprehensive income of Scharp Ltd for the year to 30 June 2024 is shown below, together with the company's statement of financial position at that date (with comparatives...

-

Northerley plc prepares accounts to 31 December each year and has operated a defined benefit pension scheme for many years. At 31 December 2022, the present value of the defined benefit obligation...

-

You would like to have a balance of $600,000 at the end of 15 years from monthly savings of $900. If your returns are compounded monthly, what is the APR you need to meet your goal?

-

Explain the importance of covariance and correlation between assets and understanding the expected value, variance, and standard deviation of a random variable and of returns on a portfolio.

-

On August 1 , 2 0 2 3 , Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased...

Study smarter with the SolutionInn App