Low1 Ltd is a wholly-owned subsidiary of High1 Ltd. Both companies are UK resident and prepare accounts

Question:

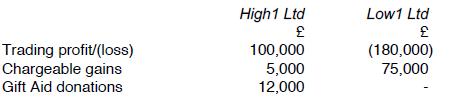

Low1 Ltd is a wholly-owned subsidiary of High1 Ltd. Both companies are UK resident and prepare accounts to 31 March each year. Results for the year to 31 March 2021 are:

Show how the trading loss sustained by Low1 Ltd may be relieved.

Transcribed Image Text:

Trading profit/(loss) Chargeable gains Gift Aid donations High1 Ltd 100,000 5,000 12,000 Low1 Ltd (180,000) 75,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 20% (5 reviews)

High1 Ltd has taxable total profits of 93000 100000 5000 12000 This s...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Low1 Ltd is a wholly -owned subsidiary of High 1 Ltd. Both companies are UK resident and prepare accounts to 31 March each year. Results for the year to 31 March 2018 are: High1 Ltd Low1 Ltd...

-

Bassnote Ltd is a wholly -owned subsidiary of Apexine Ltd. Both companies are UK resident and prepare accounts to 31 March each year . The results for the year to 31 March 2018 are as follows:...

-

Basenote Ltd is a wholly-owned subsidiary of Apexine Ltd. Both companies are UK resident and prepare accounts to 31 March each year. Results for the year to 31 March 2021 are as follows: Calculate...

-

To compute trend percents the analyst should: A. Select a base period, assign each item in the base period statement a weight of 100%, and then express financial numbers from other periods as a...

-

All of your hard work and relentless efforts have paid off! Your company is doing better than expected. In fact, you will be meeting next month with and presenting to a group of investors to secure...

-

Review the advantages and disadvantages of working and doing business in Brazil, Russia, India, and China. Which advantages are most appealing to you and why? Which disadvantages concern you the most...

-

Why do accounting and reporting prac tices differ throughout the world? LO4

-

1. What is the basis for the determination that an employer should or should not be required to test applicants on an individual basis? 2. Should an employer have available as a defense that the cost...

-

Sam Long anticipates he will need approximately $225,500 in 14 years to cover his 3-year-old daughters college bills for a 4-year degree. How much would he have to invest today at an interest rate of...

-

S1 Ltd and S2 Ltd belong to the same capital gains group. In May 2017, S1 Ltd transferred a chargeable asset to S2 Ltd. The original cost of this asset to S1 Ltd was 10,000 and its market value in...

-

A company which has seven 51% subsidiaries has taxable total profits of 140,000 for the year to 31 May 2020. Dividends received in the year were 50,000. Calculate the corporation tax liability for...

-

China is a signatory country to the Madrid Protocol on the international registration of trademarks. Starbucks opened its first cafe in China in 1999 and has added outlets in numerous locations...

-

Question: 9. Purchases and sales during a recent period for Bottineau Inc. were Purchases During the Period Sales During the Period 1st purchase 1,500 units x $ 4 1st sale 700 units x $13 2nd...

-

# The following is a partial relative frequency distribution of consumer preferences for four products-A, B, C, and D. Required: Determine the relative frequency for Product B: Relative Frequency...

-

Domino Company's operating percentages were as follows: Revenues 100% Cost of goods sold Variable 50% Fixed 10% 60% Gross profit 40% Other operating expenses Variable 20% Fixed 15% 35% Operating...

-

Marcus Stewart, the production manager at Galvin Company, purchased a cutting machine for the company last year. Six months after the purchase of the cutting machine, Stewart learned about a new...

-

The TechTeach Company produces and sells 7,000 modular computer desks per year at a selling price of $750 each. Its current production equipment, purchased for $1,950,000 and with a 5-year useful...

-

Store Front www.storefront.net is a vendor of e-business software at its site, the company providers demonstrations illustrating the types of storefronts that is can create for shoppers. The site...

-

1-Stern observed all of the following results EXCEPT _______ in his experiment. A-one of the recombinant phenotypes was associated with an X chromosome of normal length B-the number of car, B+ male...

-

A private company's share capital consists of 5,000 ordinary shares, held as follows: Is the company a close company? Sejanus (a manager) Claudius (a director) Agrippa (a director) Cleopatra (a...

-

Andrew Pearson is a shareholder of APP Nottingham Ltd. Which of the following (if any) are his associates when deciding whether the company is a close company? (a) his sister (d) his father (b) his...

-

A company has the following results for the four years to 31 March 2023: Calculate the total repayment of corporation tax (with interest) to which the company is entitled, assuming that: (a) all...

-

explain the concept of Time Value of Money and provide and example. In addition to your discussion, please explain the differences between Stocks and Bonds

-

Wildhorse Inc. has just paid a dividend of $3.80. An analyst forecasts annual dividend growth of 9 percent for the next five years; then dividends will decrease by 1 percent per year in perpetuity....

-

Jenny wanted to donate to her alma mater to set up a fund for student scholarships. If she would like to fund an annual scholarship in the amount of $6,000 and her donation can earn 5% interest per...

Study smarter with the SolutionInn App