Quadrant Ltd has the following results for its three most recent accounting periods: Notes: 1. There were

Question:

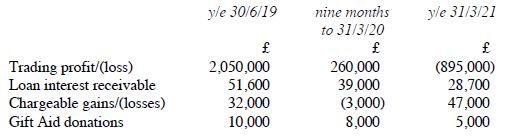

Quadrant Ltd has the following results for its three most recent accounting periods:

Notes:

1. There were no trading losses brought forward on 1 July 2018.

2. Capital losses brought forward on 1 July 2018 were £67,300.

3. Following a bad trading result for the year to 31 March 2021, the company expects to return to making a sizeable trading profit in future years.

Required:

(a) Compute the company's corporation tax liability for each of the three accounting periods, assuming that no claims are made in relation to the trading loss.

(b) Compute the company's corporation tax liability for each of the three accounting periods, assuming that claims are made to relieve the £895,000 trading loss at the earliest possible opportunity. Also compute the amount of any trading losses which will be carried forward.

(c) Calculate the amount of tax which would be saved in consequence of the claims referred to in (b) above. Would you recommend these claims?

Step by Step Answer: