The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35%

Question:

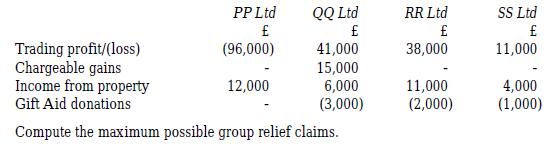

The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35% by RR Ltd, 23% by SS Ltd. The remaining 10% is owned by various individuals, none of whom own more than 1%. All companies are UK resident and prepare accounts to 31 July. Results for the year to 31 July 2017 are as follows:

Transcribed Image Text:

PP Ltd (96,000) 12,000 QQ Ltd Trading profit/(loss) Chargeable gains Income from property Gift Aid donations Compute the maximum possible group relief claims. 41,000 15,000 6,000 (3,000) RR Ltd 38,000 11,000 (2,000) SS Ltd 11,000 4,000 (1,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

I see here that you have provided a financial summary of several companies along with their ownership structure and you have asked to compute the maxi...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35% by RR Ltd and 23% by SS Ltd. The remaining 10% is owned by various individuals, none of whom own more than 1%. All...

-

The ordinary share capital of W Ltd (which is a trading company) is owned 30% by X Ltd, 25% by Y Ltd and 45% by Z Ltd. All companies are UK resident and prepare accounts to 31 March. Results for the...

-

The government is set a big project and incorporated AA Ltd to fulfil the gap in energy supply. After several rounds of bidding, eventually the ordinary share capital of AA Ltd (a trading company) is...

-

Refer to the GrandScapes data set. Requirements 1. Compute the direct labor rate variance and the direct labor efficiency variance. 2. What is the total variance for direct labor? 3. Who is generally...

-

What is a lesion?

-

Refer to the data in exercise 2. The estimated regression equation for those data is a. Develop a 95% confidence interval for the mean value of y when x1 45 and x2 15. b. Develop a 95% prediction...

-

What do you mean by triple column cash book? Why is it necessary to maintain a cash book?

-

Journalize the following transactions in the accounts of Pro Medical Co., a medical equipment company that uses the direct write-off method of accounting for uncollectible receivables: Jan. 30. Sold...

-

Activity 2: Complete the following use case description table for the use case' Add a new vehi an existing insurance policy

-

P Ltd is the parent company of a small group. All companies in the group are UK resident and all of the issued shares of each company are ordinary shares. Shareholdings within the group are as...

-

A company with seven 51% subsidiaries has taxable total profits of 140,000 for the year to 31 March 2018. Dividends received in the year were 50,000. Calculate the corporation tax liability for the...

-

Transactions involving the common stock account of Higrade Gas Company during the 2-year period 2013 to 2014 were as follows: 2013 Jan. 1 Had a balance of 200,000 shares of $10 par common stock. Apr....

-

Revenue and cash receipts journals; accounts receivable subsidiary and general ledgers Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period...

-

Panguitch Company had sales for the year of $100,000. Expenses (except for income taxes) for the year totaled $80,000. Of this $80,000 in expenses, $10,000 is bad debt expense. The tax rules...

-

Assume that the composition of federal outlays and receipts shown in the figure remained the same in 2019. In the figure, the categories "Defense and homeland security" and "Non-defense...

-

1) A car's age is a _ variable. Quantitative O Categorical 2) A car's maker is a variable O Quantitative Categorical 3) A house's square footage is a _________variable O Quantitative O Categorical 4)...

-

The following table shows the distribution of clients by age limits. Use the grouped data formulas to calculate the variance and standard deviation of the ages. Rango de edad Cantidad de clientes...

-

Ryans Music provides individual music lessons in the homes of clients. The following data are provided with respect to the last 12 months of activity ending 30 June 2013. Lesson selling price*...

-

Chicago Company sold merchandise to a customer for $1,500 cash in a state with a 6% sales tax rate. The total amount of cash collected from the customer was $558. $600. $642. $636. Nevada Company...

-

Melissa is a sole trader. Her capital gains and capital losses for 2021-22 are 27,000 and 700 respectively. She has capital losses brought forward from 2020-21 of 12,900 and she also has unrelieved...

-

In 2021-22, Ahmed has capital gains of 130,000 and allowable losses of 24,000. He also has capital losses brought forward of 3,700. Ahmed's taxable income for 2021-22 (after deduction of the personal...

-

Rosemary's capital gains and losses in recent years (and the annual exemption for each year) have been as follows: There were no unrelieved losses to bring forward from 2017-18 or earlier. Compute...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App