The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited

Question:

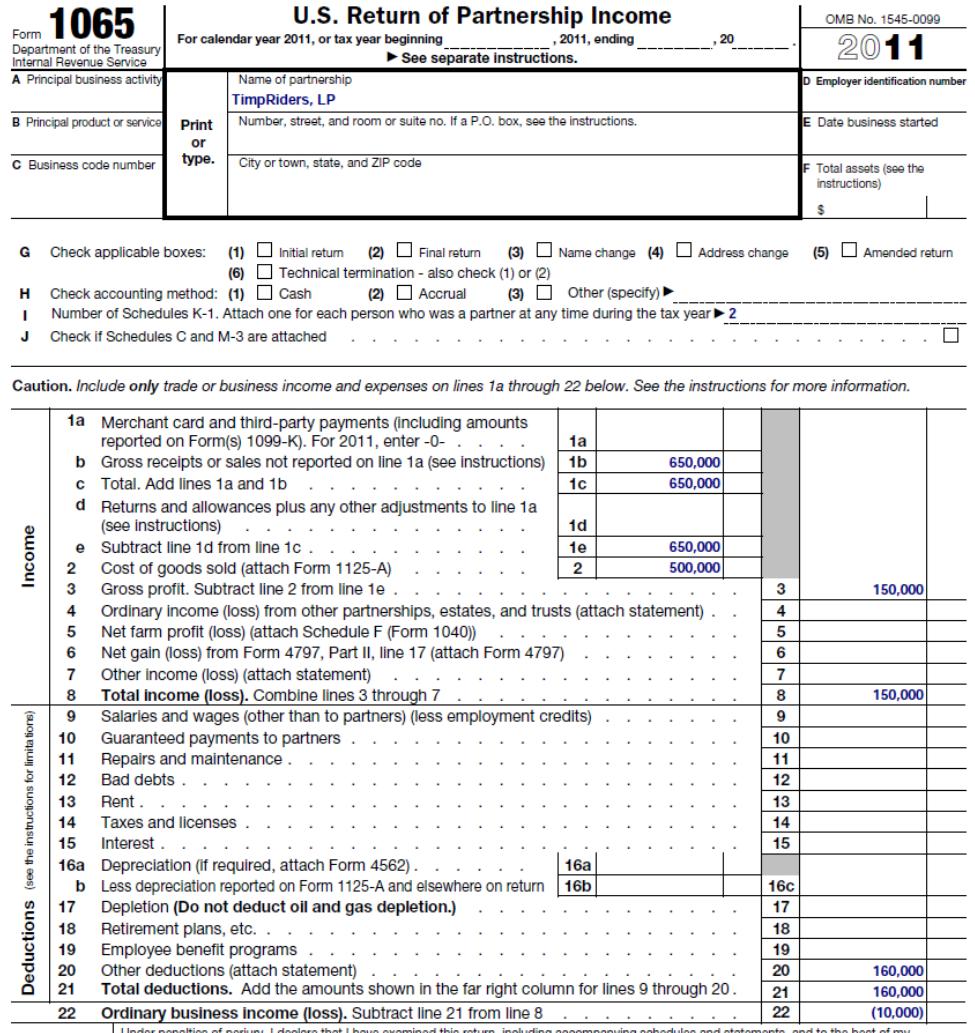

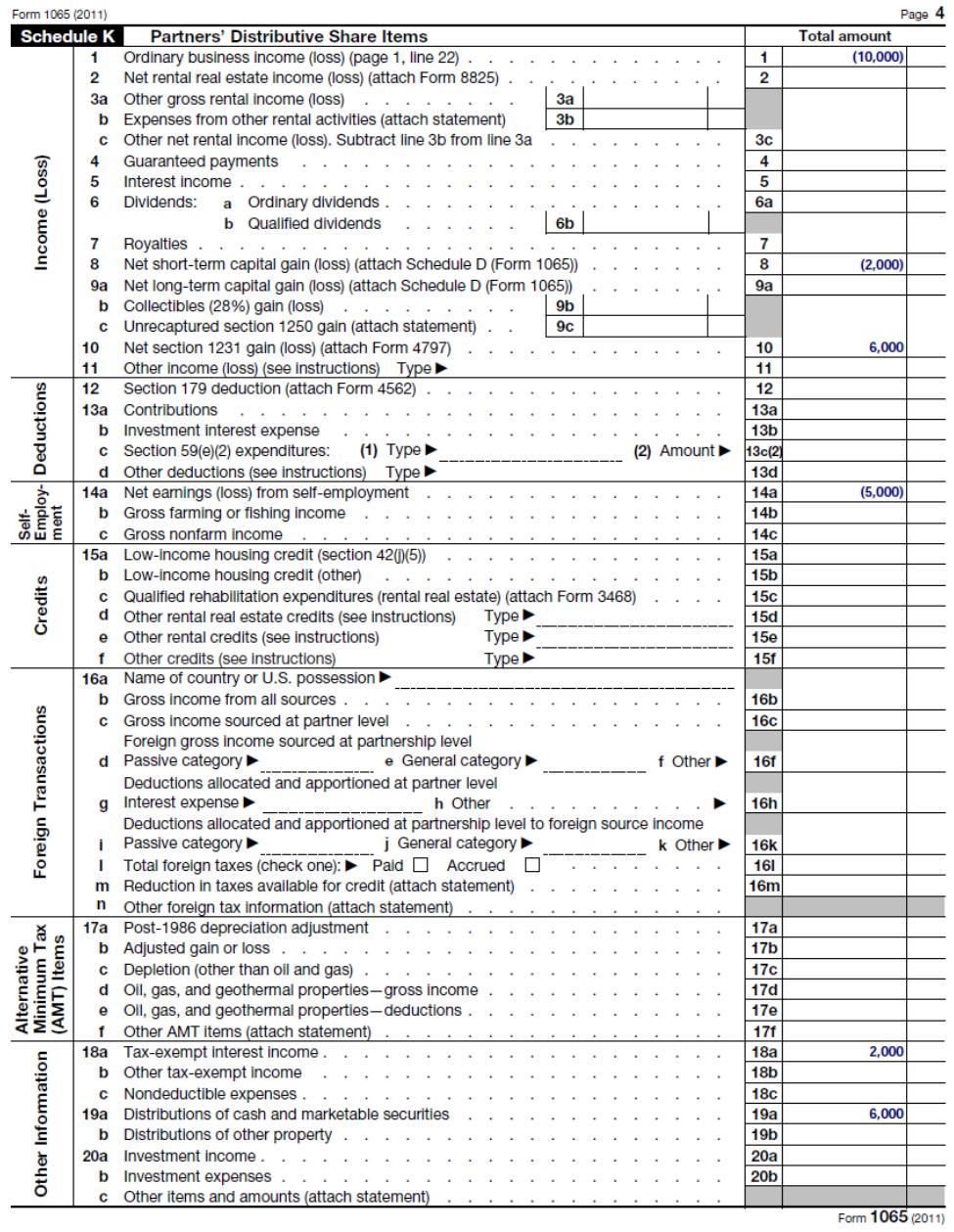

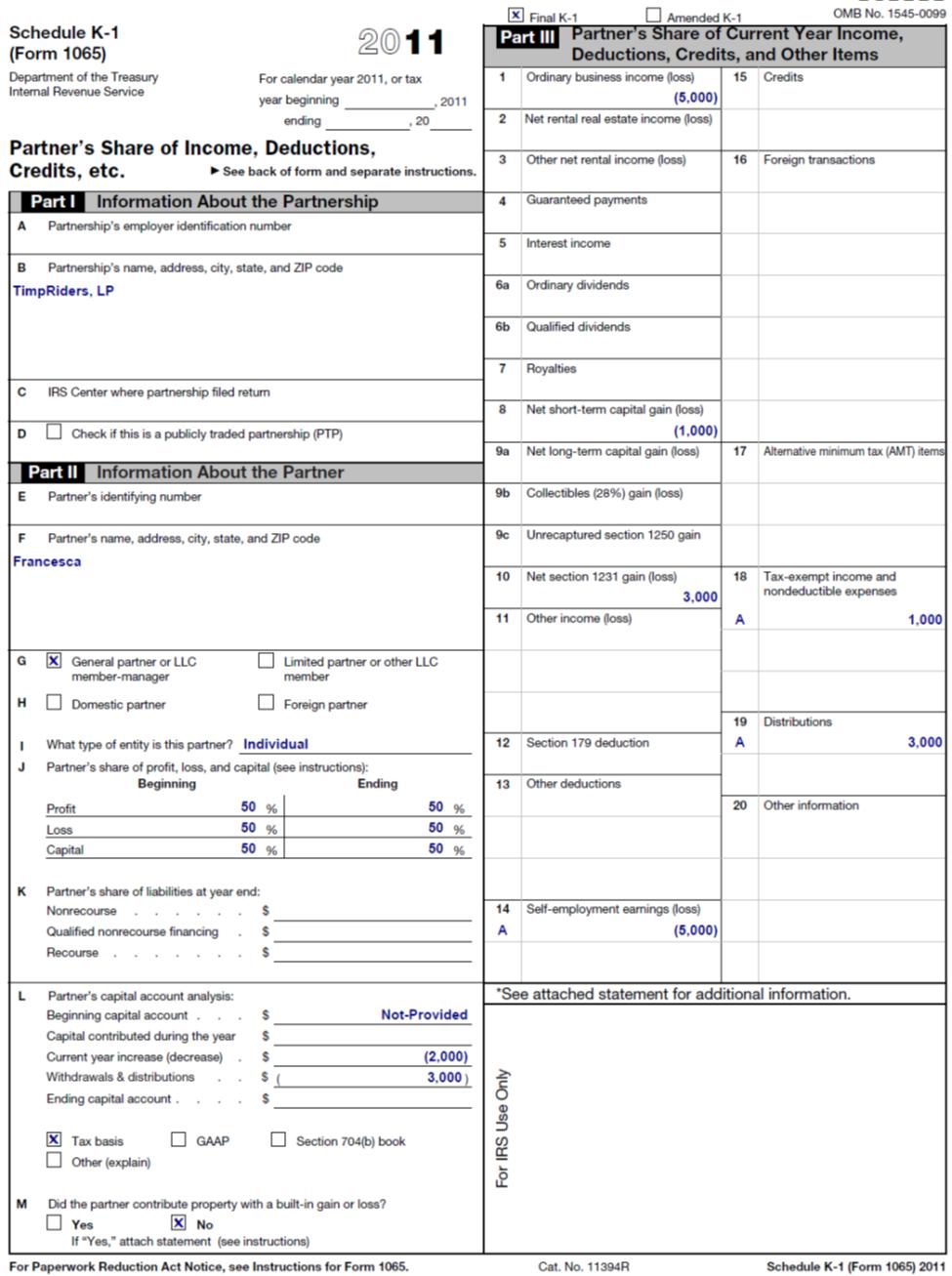

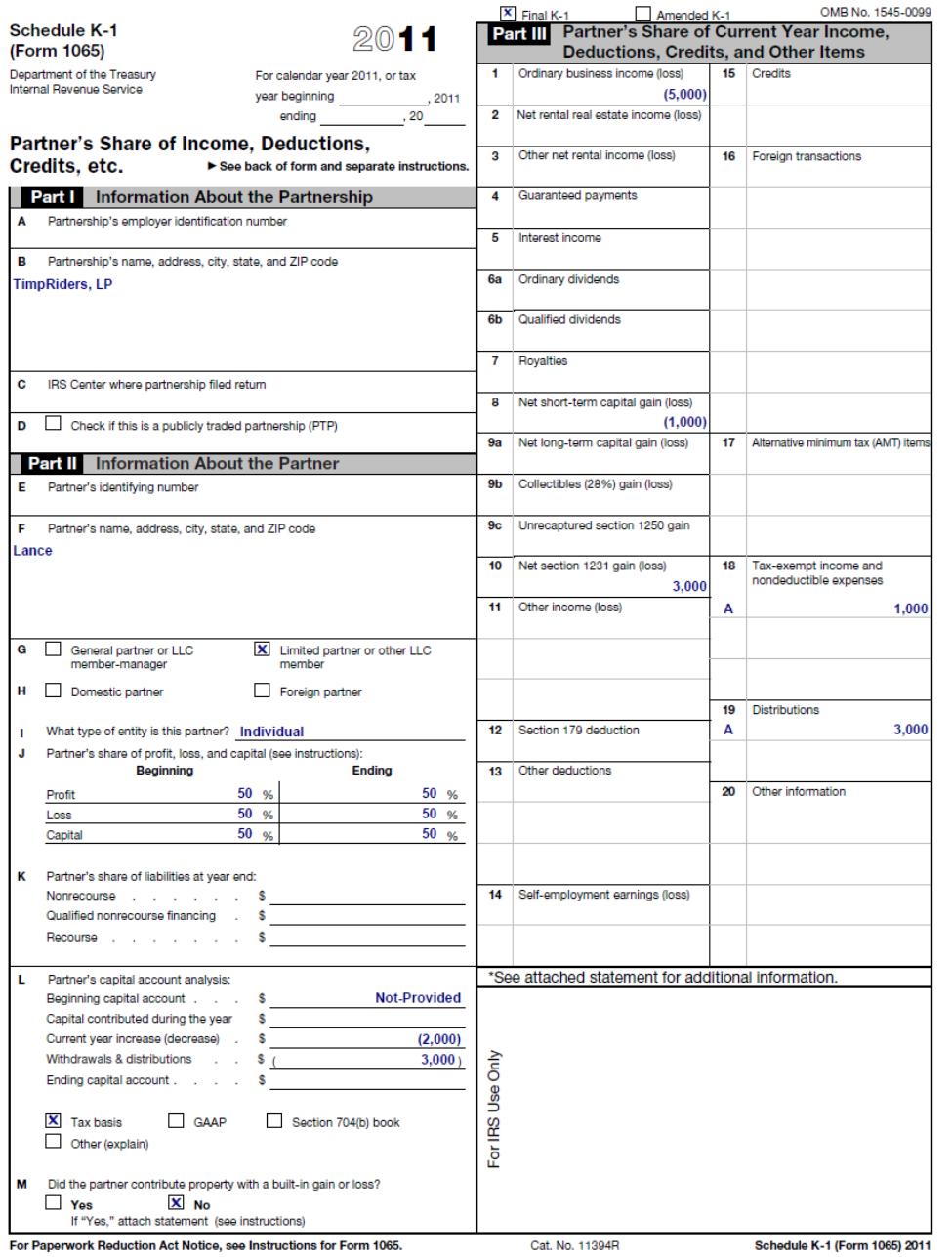

The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited partner, Francesca is the general partner, and they share capital and profits equally. Francesca works full-time managing the partnership. Both the partnership and the partners report on a calendar-year basis. At the start of the current year, Lance and Francesca had bases of $10,000 and $3,000 respectively, and the partnership did not carry any debt. During the current year, the partnership reported the following results from operations:

On the last day of the year, the partnership distributed $3,000 each to Lance and Francesca.

a. What outside basis do Lance and Francesca have in their partnership interests at the end of the year?

b. How much of their losses are currently not deductible by Lance and Francesca because of the tax basis limitation?

c. To what extent does the passive activity loss limitation apply in restricting their deductible losses for the year?

d. Using the information provided, prepare TimpRiders’ page 1 and Schedule K to be included with its Form 1065 for the current year. Also, prepare a Schedule K-1 for Lance and Francesca.

Form 1065:

Step by Step Answer:

Taxation Of Individuals And Business Entities 2015

ISBN: 9780077862367

6th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver