You have been assigned to compute the income tax provision for Tulip City Flowers, Inc. (TCF) as

Question:

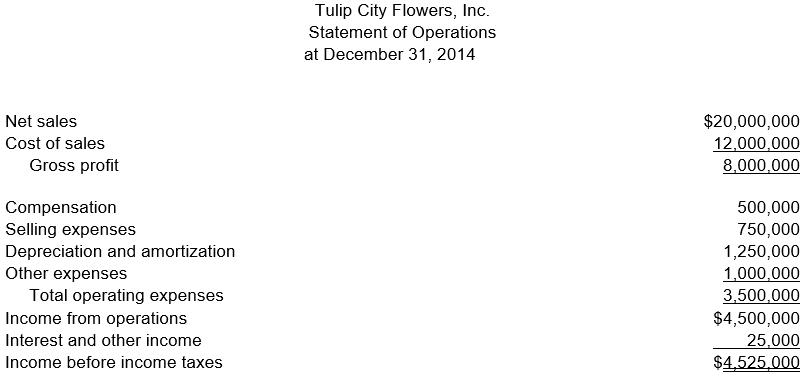

You have been assigned to compute the income tax provision for Tulip City Flowers, Inc. (TCF) as of December 31, 2014. The Company’s federal income tax rate is 34%. The Company’s Income Statement for 2014 is provided below:

You have identified the following permanent differences:

Interest income from municipal bonds: $10,000

Nondeductible stock compensation: $5,000

Domestic production activities deduction (DPAD): $8,000

Nondeductible fines: $1,000

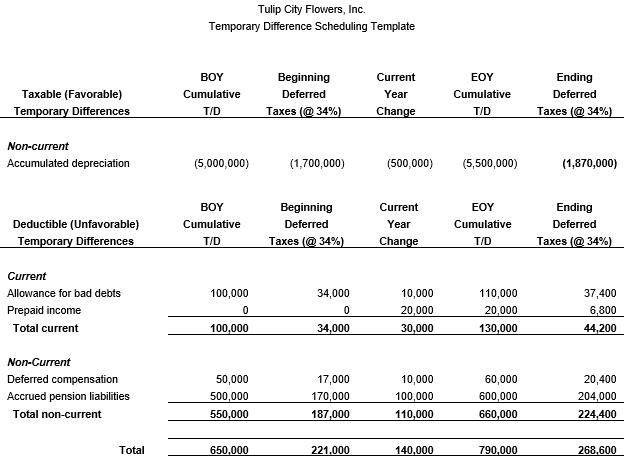

TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year:

a. Compute TCF’s current income tax expense or benefit for 2014.

b. Compute TCF’s deferred income tax expense or benefit for 2014.

c. Prepare a reconciliation of TCF’s total income tax provision with its hypothetical income tax expense in both dollars and rates.

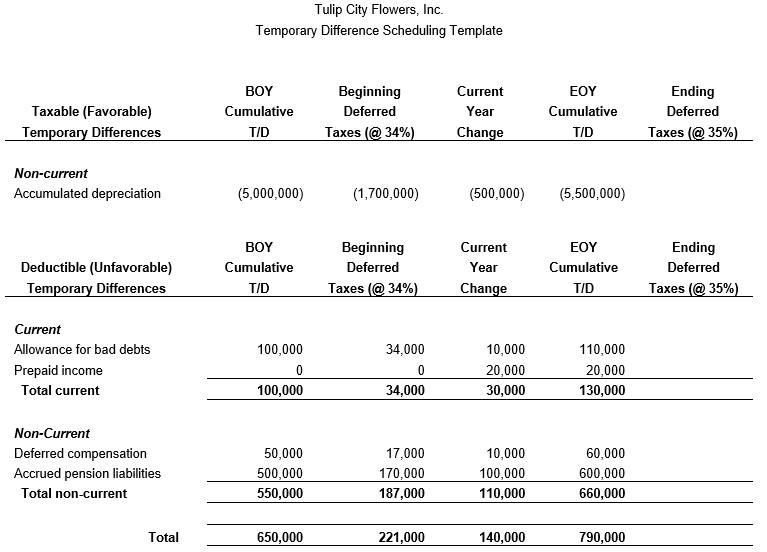

d. Assume TCF’s tax rate increased to 35% in 2014. Recompute TCF’s deferred income tax expense or benefit for 2014 using the following template:

Step by Step Answer:

Taxation Of Individuals And Business Entities 2015

ISBN: 9780077862367

6th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver