Calculate the tax liability for 2021-22 of a husband and wife (both born in 1933), using the

Question:

Calculate the tax liability for 2021-22 of a husband and wife (both born in 1933), using the information below. No elections have been made in relation to the MCA and none of the income is derived from savings or dividends.

In each case, the stated income figure is the taxpayer's net income (i.e. total income less tax reliefs), MCA is claimed and adjusted net income is the same as net income.

Transcribed Image Text:

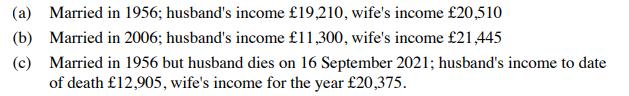

(a) Married in 1956; husband's income 19,210, wife's income 20,510 (b) Married in 2006; husband's income 11,300, wife's income 21,445 (c) Married in 1956 but husband dies on 16 September 2021; husband's income to date of death 12,905, wife's income for the year 20,375.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

To calculate the tax liability for a husband and wife for each of the scenarios presented it is necessary to have knowledge of the tax rates and allowances for the 202122 tax year in the relevant juri...View the full answer

Answered By

Sandhya Sharma

I hold M.Sc and M.Phil degrees in mathematics from CCS University, India and also have a MS degree in information management from Asian institute of technology, Bangkok, Thailand. I have worked at a international school in Bangkok as a IT teacher. Presently, I am working from home as a online Math/Statistics tutor. I have more than 10 years of online tutoring experience. My students have always excelled in their studies.

4.90+

119+ Reviews

214+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Which form of business organization is limited by the Internal Revenue Code (IC) concerning the number and type of shareholders? A partnership An S corporation A C corporation A sole proprietorship...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Which statement about the Java variable and literal is NOT true? a. A global variablewill be initalised by the complier automatically. b. Literals can also be used as the lvalue in an express. c. An...

-

A coin has an unknown bias p that is assumed to be uniformly distributed between 0 and 1. The coin is tossed n times and heads turns up j times and tails turns up k times. We have seen that the...

-

What four dates can exist in an importing or exporting foreign currency transaction?

-

The mean annual salary of employees at a company is $36,000 with a variance of 15,202,201.At the end of the year, each employee receives a $2000 bonus and a 4% raise (based on salary).What is the...

-

Assume the following financial data for Rembrandt Paint Co. and Picasso Art Supplies: a. If all the shares of Rembrandt Paint Co. are exchanged for those of Picasso Art Supplies on a share-for-share...

-

On January 1, Montgomery Inc. issued $200,000 of 12% 5-year bonds when the market interest rate was 10%. The bonds pay interest semiannually on June 30th and December 31. Proceeds received were...

-

Toby is a widower. He was born in August 1933. His wife was born in June 1934 but she died in March 2021. Toby's income for 2021-22 is as follows: 11,550 912 Retirement pension Income from purchased...

-

Calculate the married couple's allowance available to the following couples in 2021-22, assuming that they were married before 5 December 2005 and that they have not elected for MCA to be claimed by...

-

On January 1, 2016, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable...

-

According to a recent study, 21% of American college students graduate with no student loan debt. Suppose we obtain a random sample of 106 American college students and record whether or not they...

-

Differentiate the following with respect to x: a. y=5x+2x + x + 15 b. y=4x+3x - 4x - 10 c. y = 3Sin(5x) d. y = 3Cos(3x) e. y=10e -25x f. y = log(6x)

-

Question 2. The rate of drug destruction by the kidneys is proportional to the amount of the drug in the body. The constant of proportionality is denoted by K. At time t the quantity of the drug in...

-

5. 6. -1 (4a) U u X2 1 X2 -2 x -1 -2 12 (4b) U -2 2 Y y 16 x2 X2 3 1 (4c) U u - x 2 Y y -8 Y y -20 5 x X2 2 Find the state space models of the three systems shown in Fig. 4a, Fig. 4b, and Fig. 4c,...

-

Given the following data for Mehring Company, compute total manufacturing costs, prepare a cost of goods manufactured statement, and compute cost of goods sold. Direct materials used $230,000...

-

An article discussed radiation therapy and new cures from the therapy, along with the harm that could be done if mistakes were made. The following tables represent the results of the types of...

-

Find the work done in pumping all the oil (density S = 50 pounds per cubic foot) over the edge of a cylindrical tank that stands on one of its bases. Assume that the radius of the base is 4 feet, the...

-

(a) Distinguish between current tax and deferred tax. (b) Distinguish between permanent differences and temporary differences. (c) Explain how temporary differences between accounting profits and...

-

Otlay Ltd prepares accounts to 31 July each year. The company's financial statements for the year to 31 July 2018 showed a liability for current tax of 120,000. This was an estimate of the current...

-

The following trial balance relates to Quincy as at 30 September 2019: The following notes are relevant: 1. On 1 October 2018, Quincy sold one of its products for 10 million (included in revenue in...

-

thumbs up if correct A stock paying no dividends is priced at $154. Over the next 3-months you expect the stock torpeither be up 10% or down 10%. The risk-free rate is 1% per annum compounded...

-

Question 17 2 pts Activities between affiliated entities, such as a company and its management, must be disclosed in the financial statements of a corporation as O significant relationships O segment...

-

Marchetti Company, a U.S.-based importer of wines and spirits, placed an order with a French supplier for 1,000 cases of wine at a price of 200 euros per case. The total purchase price is 200,000...

Study smarter with the SolutionInn App