T Ltd has owned 90% of the ordinary share capital of B Ltd for many years. Both

Question:

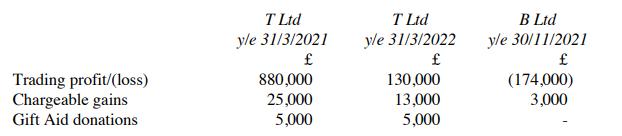

T Ltd has owned 90% of the ordinary share capital of B Ltd for many years. Both are UK resident. Recent results for the two companies are as follows:

No dividends have been received by either company in any of these years and maximum group relief is claimed. Calculate the corporation tax which is payable by each company for each accounting period and state the due date (or dates) of payment.

Transcribed Image Text:

Trading profit/(loss) Chargeable gains Gift Aid donations T Ltd yle 31/3/2021 880,000 25,000 5,000 T Ltd y/e 31/3/2022 130,000 13,000 5,000 B Ltd yle 30/11/2021 (174,000) 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 42% (7 reviews)

To calculate the corporation tax payable by each company we need to consider their trading profits chargeable gains and any available reliefs or deductions such as those for Gift Aid donations Additio...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The person working on task C tells the project manager he can't start work until one day after the scheduled starting date. What impact would this have on the completion date of the project? Why? 2....

-

Jess is an e-learning specialist working for an Australian company that works for government agencies in the defence field. As part of signing her employment contract, she signed a Non-Disclosure...

-

Farnsworth Television makes and sells portable television sets. Each television regularly sells for $200 and has the following costs. Direct materials, Direct labor. Manufacturing overhead 75%...

-

Raider Company manufactures and sells multiple products. The traditional costing system allocates overhead costs based on direct labor hours, while the company is considering transitioning to an...

-

A 3-m3 tank contains saturated air at 25C and 97 kPa. Determine (a) The mass of the dry air, (b) The specific humidity, and (c) The enthalpy of the air per unit mass of the dry air.

-

What is meant by a document?

-

Web-based exercise. Oddsmakers often list the odds for certain sporting events on the Web. For example, one can find the current odds of winning the next Super Bowl for each NFL team. We found a list...

-

Suppose in problem 5 that because of currency risk, Viacom would prefer to have dollar debt, and Gaz de France would prefer to have euro debt. How could an investment bank structure a currency swap...

-

An investment is expected to generate the following cash flows: Year 0 -$1,000,000 Year 1 $300,000 Year 2 $0 Year 3 $300,000 Year 4 $200,000 Year 5 $500,000 The discount rate is 10% per year. a....

-

Erin Smith sells gourmet chocolate chip cookies. The results of her last month of operations are as follows: Sales revenue. . . . . . . . . . . . . . . . . . . . . . . $50,000 Cost of goods sold (all...

-

Classify each of the following supplies as either taxable at the standard rate, taxable at the reduced rate, taxable at the zero rate or exempt: (a) (c) a theatre ticket bank charges (e) a taxi ride...

-

The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35% by RR Ltd and 23% by SS Ltd. The remaining 10% is owned by various individuals, none of whom own more than 1%. All...

-

A level platform vibrates horizontally with simple harmonic motion with a period of 0.8 s. (a) A box on the platform starts to slide when the amplitude of vibration reaches 40 cm; what is the...

-

Carla Vista Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2025, the following balances relate to this plan Plan assets $489,900 Projected benefit obligation 616,700...

-

Question 2 of 8 Shirts were purchased for $12.50 each and were marked up by $18.75. During Christmas, they were discounted by $6.85 per shirt. a. What was the rate of markdown? % Round to two decimal...

-

The cost versus quality decision is one that only few companies get right. What is the cost of quality? It is very high for some companies such as Ford and Bridgestone/Firestone, whose reputations...

-

Find the absolute maximum and absolute minimum values of the function f(x) (x-2)(x-5)+7 = on each of the indicated intervals. Enter 'NONE' for any absolute extrema that does not exist. (A) Interval =...

-

4. Roll one 10-sided die 12 times. The probability of getting exactly 4 eights in those 12 rolls is given by (a) 10 9 4 10 10 (b) HA 9 -HAA (c) 1 (d) 9 (c) 10 9 () 10

-

What four processes make up the ideal Otto cycle?

-

How do network effects help Facebook fend off smaller social-networking rivals? Could an online retailer doing half as much business compete on an equal footing with Amazon in terms of costs? Explain.

-

(a) Define the term "borrowing costs" and explain the accounting treatment of such costs which is required by international standard IAS23.(b) During the year to 31 December 2022, a company started...

-

Whilst preparing financial statements for the year to 30 June 2023, a company discovers that (owing to an accounting error) the sales figure for the year to 30 June 2022 had been understated by...

-

The statement of financial position of Urbax plc at 31 July 2024 (with comparatives for the previous year) is shown below:Statement of financial position at 31 July 2024 (i) Equipment which had cost...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App