Question

Farnsworth Television makes and sells portable television sets. Each television regularly sells for $200 and has the following costs. Direct materials, Direct labor. Manufacturing

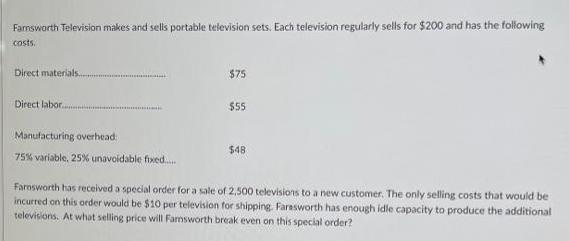

Farnsworth Television makes and sells portable television sets. Each television regularly sells for $200 and has the following costs. Direct materials, Direct labor. Manufacturing overhead 75% variable, 25% unavoidable fixed...... $75 $55 $48 Farnsworth has received a special order for a sale of 2,500 televisions to a new customer. The only selling costs that would be incurred on this order would be $10 per television for shipping. Farasworth has enough idle capacity to produce the additional televisions. At what selling price will Famsworth break even on this special order?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the selling price at which Farnsworth will break even on the spe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

16th edition

0077664078, 978-0077664077, 78111048, 978-0078111044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App